Martin Lewis urges drivers to renew car insurance on specific day to halve costs - 'Sweet spot!'

Separate research shows that drivers could save up to £499 by shopping around for their car insurance

Don't Miss

Most Read

Latest

Martin Lewis has called on drivers to take matters into their own hands and take steps to slash their car insurance costs, which could save them hundreds of pounds.

While average car insurance prices have fallen from their peak a few years ago, many drivers are still struggling with the high costs.

Young people are still expected to spend more than £2,000 on average for their coverage, with the average driver expecting to pay £726.

Money Saving Expert Martin Lewis has now urged motorists to renew their car insurance policy at one specific time, as it could save them hundreds of pounds.

TRENDING

Stories

Videos

Your Say

Speaking on ITV's The Martin Lewis Money Show Live, the financial expert said that people often miss out on huge savings by allowing their car insurance policy to automatically roll over.

He explained that the "sweet spot" is around 26 days before they get their new policy, which can deliver the largest savings.

Mr Lewis said: "The price you're quoted [at 26 days] can be nearly half what would happen if you got a quote the day of your renewal. Bonkers, isn't it?

"All of insurance pricing is based on actuarial risk. Risk charts. Who's a good and who's a bad risk?

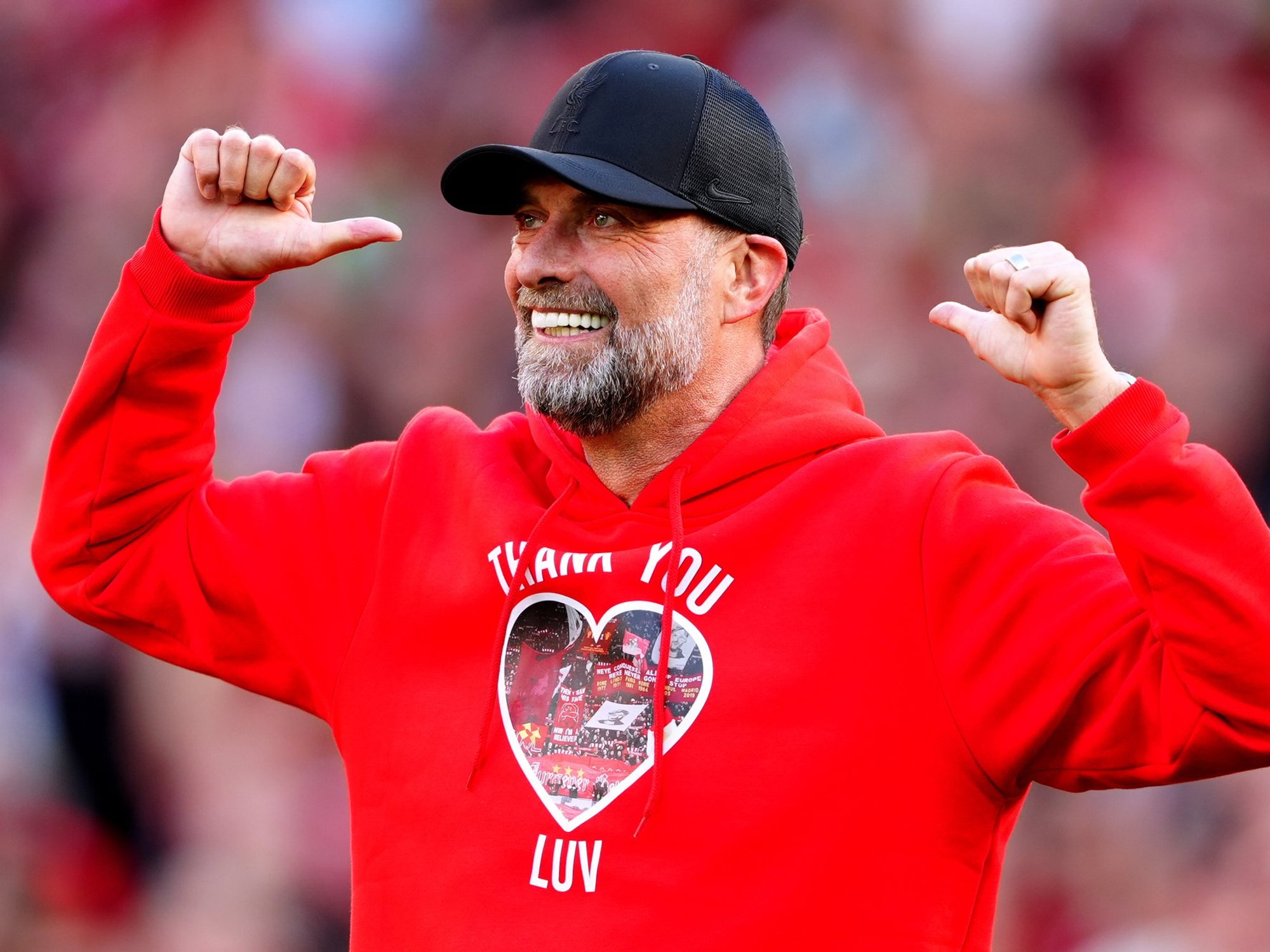

Martin Lewis has urged motorists to renew their car insurance on a specific day to slash their costs

|GETTY/PA

"The type of people who leave it to the last minute are deemed to be a higher risk than the people who go and get their insurance earlier."

Mr Lewis prefaced to say that the timing may not work for everyone, but it can and already has worked for many people.

One driver who had used the method managed to cut their car insurance costs from £913 to just £445, representing a huge 49 per cent saving.

Another was quoted £555 for car insurance, which plummeted to £222 when they checked 25 days in advance.

LATEST DEVELOPMENTS

Between April and June, drivers could see car insurance premiums spike for EVs and automatic vehicles | GETTY

Between April and June, drivers could see car insurance premiums spike for EVs and automatic vehicles | GETTYThis could deliver massive savings, especially for younger drivers who are routinely charged around £2,000 as they are deemed to be more of a risk when they have just received their licence.

Data from Confused.com found that drivers in the 17 to 20 age bracket are facing costs of £1,980 for coverage, which falls to £1,304 for 20-29-year-olds.

On the other end of the spectrum, elderly drivers between 60 and 69 face costs of just £452, having fallen from £520 year-on-year.

Sam Wilson, expert at Compare the Market, said Martin Lewis' advice was valuable for motorists so they can better understand their policy and make significant savings.

Young motorists are still paying around £2,000 for their car insurance

| PAHowever, the expert urged drivers to check their policies to ensure they are not underinsured, regardless of a much lower price.

Mr Wilson added: "Our data shows you can save up to £499 annually by shopping around ahead of your renewal date.

"It's worth checking comprehensive cover, reviewing multi-policy and multi-car options each year, and making sure details like job title and named drivers are accurate, as small changes could have a big impact on price."

Drivers can also make large savings when shopping around between different insurance providers, rather than sticking with their insurer every year.