Labour doubles down on pay-per-mile car taxes as Rachel Reeves backs 'difficult decision'

The Chancellor plans to introduce road charges for electric vehicles in 2028

Don't Miss

Most Read

Labour has stood firmly behind its new pay-per-mile taxation scheme for electric vehicles, despite hitting millions with new road charges.

The Government said the new tax presented a fairer approach to funding the UK road network despite criticism that millions of motorists will face additional costs.

The Government unveiled Electric Vehicle Excise Duty (eVED) in the Budget, introducing a mileage-based charge for electric and plug-in hybrid cars from April 2028.

But earlier this week, Financial Secretary to the Treasury Lord Livermore defended the policy during a House of Lords debate, stating the Government is "ensuring that motoring taxes cover electric vehicles via a new per-mile levy."

TRENDING

Stories

Videos

Your Say

The Treasury argued all vehicles contribute to road congestion and wear regardless of fuel type, yet EV drivers currently make no equivalent contribution to the fuel duty paid by petrol and diesel motorists.

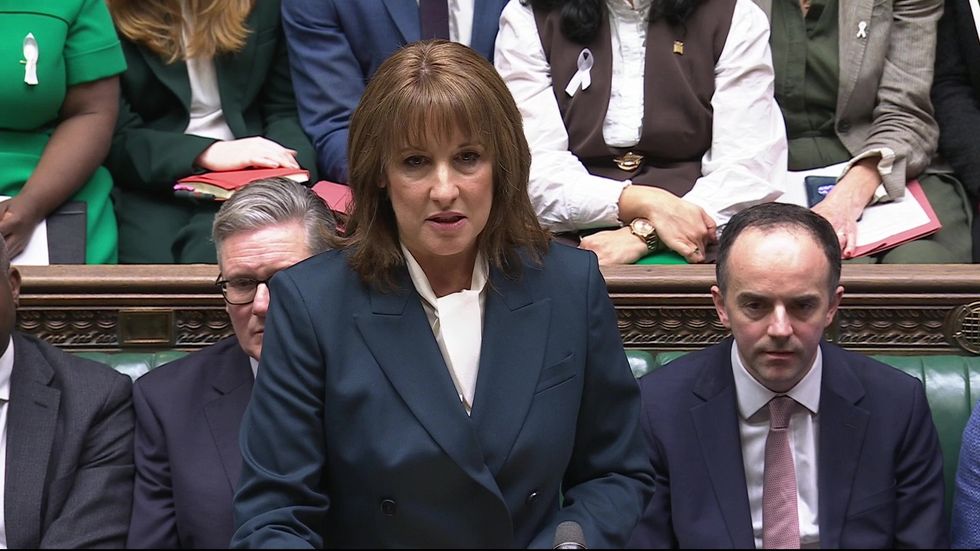

Treasury Minister James Murray told MPs the policy addresses a challenge previous Governments avoided tackling.

"This is a decision that people have talked about for many years," Mr Murray said. "The honourable gentleman's party ducked it, alongside many other difficult decisions, but we are taking them head-on to ensure that we are fit and stable for the future."

The minister emphasised electric vehicle owners benefit from road investment and maintenance just as conventional car drivers do, regardless of where in the country they travel.

Chancellor Rachel Reeves introduced new pay-per-mile car tax changes

| PA/GETTYMr Murray argued the changes ensure the taxation system remains sustainable as more motorists switch to cleaner vehicles, with the Office for Budget Responsibility forecasting fuel duty receipts will halve during the 2030s before approaching zero by 2050.

The Government's consultation document outlines eVED will safeguard driver privacy, with no obligation to report journey times or locations, and no requirement for vehicle tracking devices.

When the charge takes effect in April 2028, typical electric car owners can expect to pay approximately £240 annually, equivalent to roughly £20 monthly.

But notably, the Treasury has set the rate at around half what average petrol and diesel drivers pay through fuel duty, with plug-in hybrid owners facing a reduced rate.

LATEST DEVELOPMENTS

Vans, buses, motorcycles, coaches and Heavy Goods Vehicles fall outside the initial scope of eVED, with the Government acknowledging the transition to electric power for these vehicle categories remains less developed than for passenger cars.

Chancellor Rachel Reeves positioned the electric vehicle levy as part of broader tax reforms necessary for long-term fiscal sustainability.

"We need to reform the tax system so that it works for the future," Ms Reeves told the Commons, linking the eVED announcement to measures on high-value properties.

The Chancellor expressed deep respect for the Office for Budget Responsibility while acknowledging the need for modernisation of revenue collection as traditional income streams decline.

Rachel Reeves delivered her Budget at the end of November | PA

Rachel Reeves delivered her Budget at the end of November | PARevenue generated from the new charge will support road maintenance investment, with the Government pledging over £2billion annually by 2029-30 for local authorities to repair roads and fill potholes.

The Treasury said the money represents a doubling of funding since Labour took office, sufficient to address millions of potholes each year.

Conservative MP Richard Fuller challenged the Government over the policy's impact on rural communities, noting countryside residents and businesses already face higher fuel costs than their urban counterparts while having fewer public transport options available.

Fuller questioned Ministers about what assessment had been conducted regarding the relative burden on rural versus urban areas when introducing the new road pricing system.

The Government has faced broader criticism during parliamentary debates, with opponents arguing the measure represents yet another tax hitting millions of drivers who made environmentally conscious vehicle choices.

Lord Young of Cookham, a former Financial Secretary to the Treasury and EV owner himself, expressed surprise at the announcement, noting he had asked the minister about road pricing plans just weeks before the Budget and been told repeatedly there were none.