HGVs slapped with new daily road charges and higher taxes as Rachel Reeves targets larger vehicles

HGVs will see new road rates come into effect from Wednesday, April 1

Don't Miss

Most Read

Drivers of popular vehicles have been warned they will soon face tougher daily road charges under new tax rules that will make travel more expensive.

The amendment to the HGV Road User Levy Act 2013 was announced by Rachel Reeves in the Autumn Budget, with the new rates set to increase prices for larger vehicles on April 1.

Official documents show the revised levy structure introduces tiered daily rates based on vehicle weight and emissions compliance.

Lorries meeting Euro 6 standards will soon pay between £3.22 and £9.67 per day, depending on their weight band, while older vehicles failing to meet these emissions requirements face higher charges ranging from £4.18 to £10.74 daily.

The changes form part of the Finance (No. 2) Bill, which amends Schedule 1 to the existing levy legislation.

Vehicles weighing 12,000kg or more must pay the levy for any day they travel on A-roads or motorways across England, Scotland, Wales and Northern Ireland.

The levy increases affect all three weight categories for HGVs. For Band A vehicles weighing between 12,000kg and 31,000kg, Euro 6 compliant lorries will pay £3.22 daily, rising to £8.05 weekly and £161 annually.

Older Euro 5 vehicles in the same weight bracket face £4.18 per day, £10.45 weekly and £209 yearly.

Mid-range Band B vehicles between 31,001kg and 38,000kg see daily rates of £7.74 for cleaner lorries and £10.06 for those not meeting Euro 6 standards.

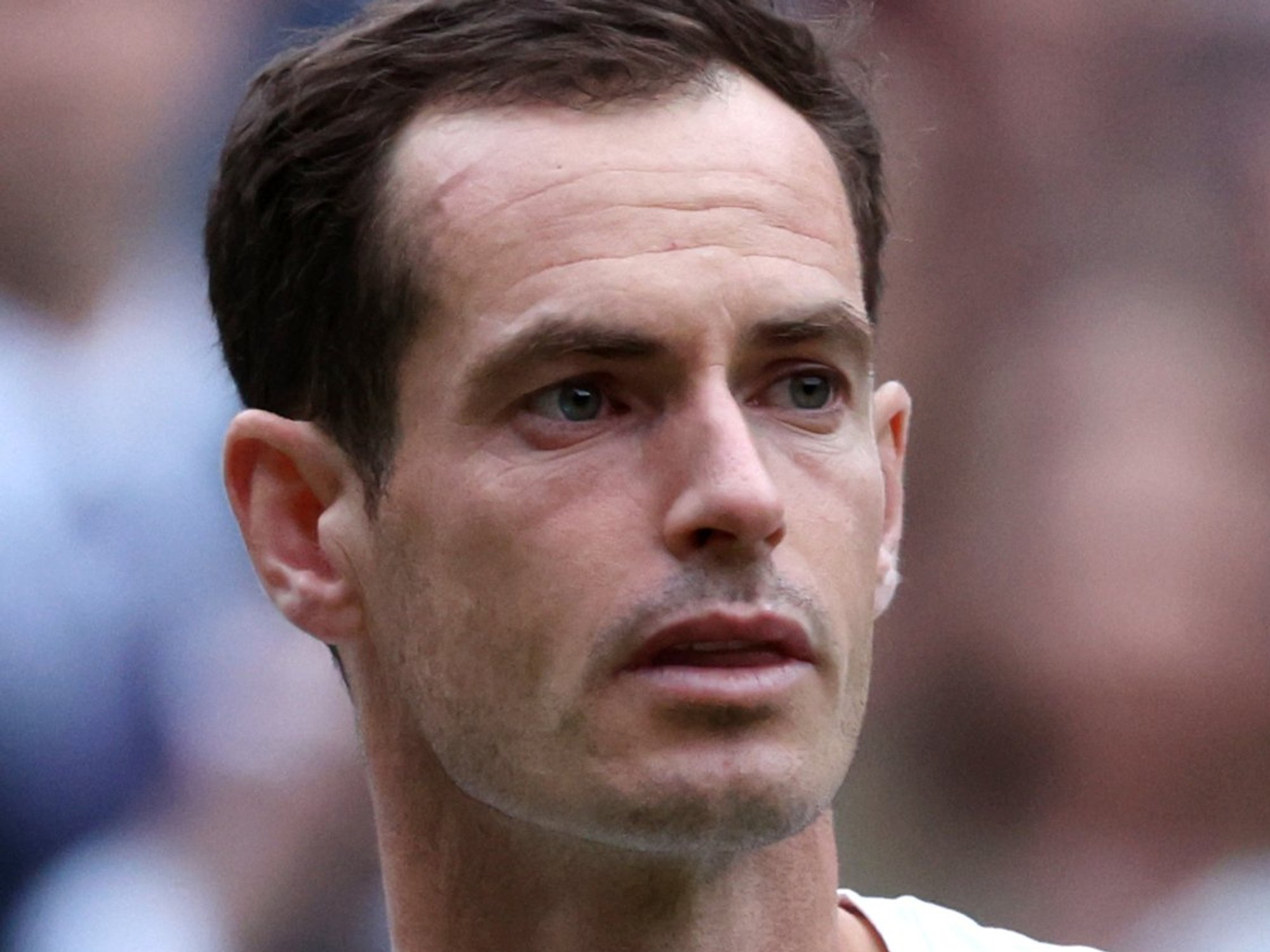

Drivers of larger vehicles will see daily charges increase in April, depending on car emissions

|GETTY/PA

The heaviest vehicles exceeding 38,000kg fall into Band C, where Euro 6 trucks pay £9.67 daily, while non-compliant vehicles will be charged £10.74. Annual rates for this category reach £619 and £804, respectively.

Alongside the road user levy, Vehicle Excise Duty rates for goods vehicles are also being revised from April 1. Rigid lorries exceeding 3,500kg will see annual duty ranging from £102 to £601, depending on weight and axle configuration.

Meanwhile, two-axle rigid vehicles weighing between 27,000kg and 44,000kg face the highest rate at £601 annually. Tractive units with two axles pulling semi-trailers will pay between £86 and £913 yearly based on their revenue weight.

Vehicles carrying exceptional loads or those exceeding 44,000kg will see their annual duty rise from £1,643 to £1,703. Haulage vehicles other than showman's vehicles face an increase from £365 to £380.

LATEST DEVELOPMENTS

The daily charge rate for HGVs will rise in line with inflation from April

| PAEnforcement measures for non-compliance remain stringent under the revised framework. Drivers caught operating without a valid levy face an immediate £300 roadside penalty plus the outstanding daily charge.

Failure to pay this fine on the spot can result in the vehicle being immobilised and seized until full payment is received, according to the Treasury, while additional storage costs also apply for impounded lorries.

Both operators and drivers bear responsibility for ensuring correct levy payments are made before entering UK roads. Using an HGV without the appropriate licence constitutes a criminal offence, the Treasury document detailed.

Drivers paying the lower Euro 6 rate will also be required to carry documentation proving their vehicle meets the required emissions standard. UK police and enforcement officers can access the levy payment database to verify compliance instantly, meaning no physical proof of purchase needs to be displayed in vehicles.

HGVs will see new rates for Vehicle Excise Duty come into effect in April

| GETTYZero emission HGVs, including fully electric and hydrogen fuel cell lorries, will still pay nothing, although hybrid powertrains and hydrogen combustion vehicles remain liable.

Showman's vehicles, which display trade plates for repair journeys, and lorries used exclusively for driver training, also avoid the charge. Island goods vehicles operating solely on small islands away from mainland roads are similarly exempt.

The levy system operates differently for UK and foreign-registered lorries. British HGVs pay their levy alongside car taxes on an annual or six-monthly basis.

But non-UK vehicles must settle charges before entering the country, with payment available daily, weekly, monthly or annually through the Government's online service or telephone contact centre.