Fuel duty rises as petrol and diesel drivers avoid electric cars after Rachel Reeves' Budget

The latest HMRC data showed an uptick in fuel duty receipts due to more drivers sticking with petrol and diesel cars

Don't Miss

Most Read

Latest

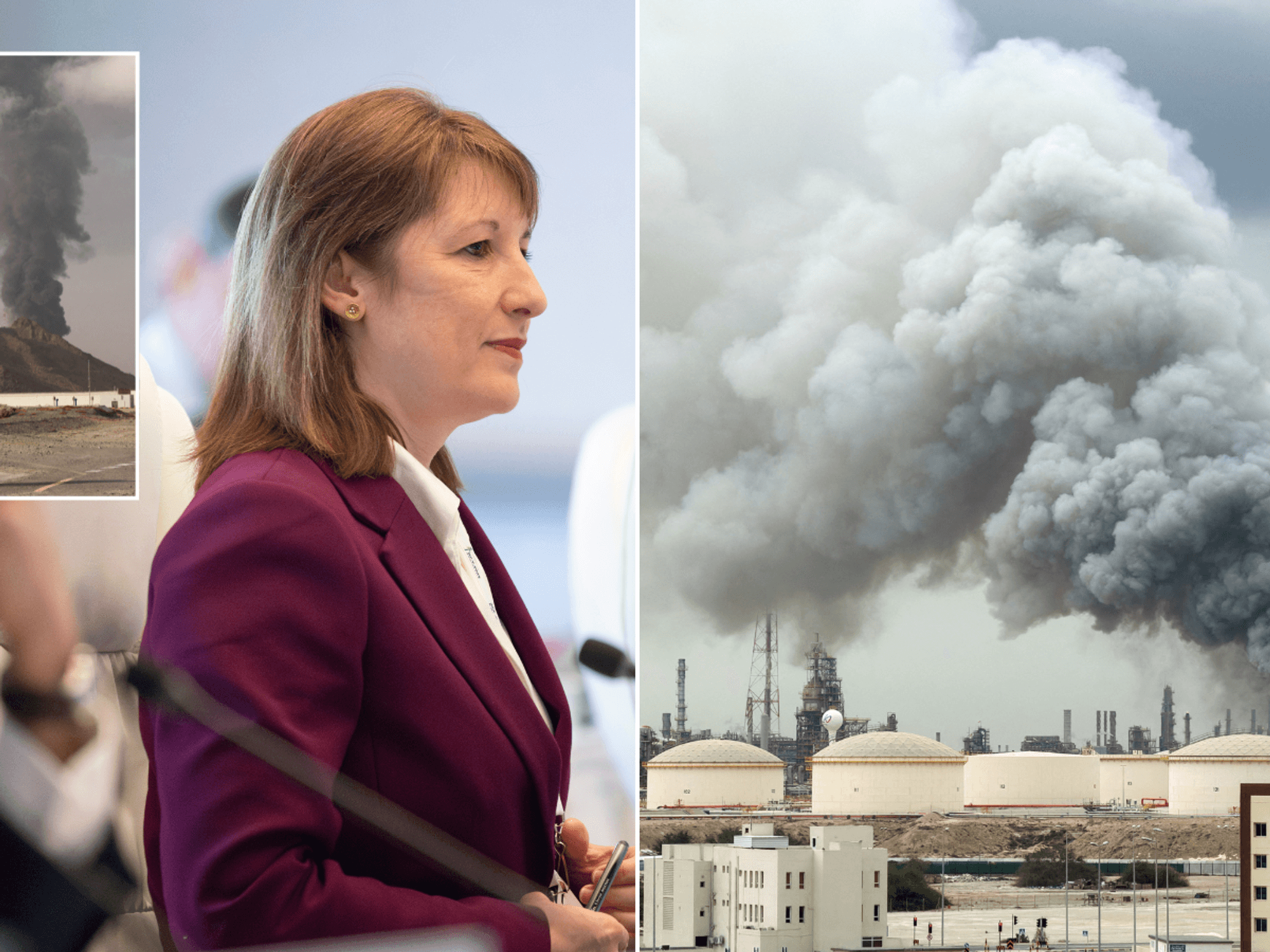

Revenue from fuel duty has risen for the first time in two years, as drivers appear to turn away from electric cars following Rachel Reeves' Autumn Budget and new taxes on motorists.

New figures from HMRC showed fuel duty receipts reached £18.5billion between April and December 2025, marking a £100million difference compared to the same period one year earlier.

Fuel duty has fallen in recent years as drivers from petrol and diesel cars to electric and hybrid vehicles.

Tax experts stated the change may be an early sign that the shift to electric cars is slowing as a result of higher costs, fewer incentives and new pay-per-mile taxes announced in the Budget, which will launch in 2028.

TRENDING

Stories

Videos

Your Say

Sheena McGuinness, co-head of energy and natural resources at RSM UK, said the figures could reflect a reaction from drivers following the Budget.

She said: "Fuel duty rising for the first time in two years could be a worrying sign. It may suggest demand for electric and hybrid cars is starting to slow."

In recent years, electric vehicle sales have been growing steadily, with almost one in four buyers choosing an electric or hybrid car, despite concerns over charging points, battery range and higher upfront costs.

However, many of the financial benefits that encouraged drivers to switch are now being removed, such as exemptions from Vehicle Excise Duty and the Congestion Charge.

Fuel duty receipts increased following the Budget announcement of new pay-per-mile taxes for electric cars

| PA"All of this makes electric and hybrid cars less attractive to consumers,” Ms McGuinness said. "As costs rise, some drivers may decide the switch is no longer worth it."

Electric vehicle owners will pay three pence per mile, while hybrid owners face a charge of 1.5p per mile. Hybrid drivers will also pay fuel duty when buying petrol and diesel.

The expert highlighted that some drivers could delay the purchase of an electric car due to the new taxes, while others will stick with petrol vehicles.

Ms McGuinness said: "If drivers move back towards petrol vehicles, fuel duty revenues could continue to rise."

LATEST DEVELOPMENTS

The timing of the fuel duty increase may also be affecting behaviour. The Chancellor announced in November intentions to end the fuel duty freeze and increase it by 1p in September.

Meanwhile, the falling rate of inflation could also soften the impact of fuel duty increases later in the year, but many households remain under pressure from high living costs, the expert stated.

Despite years of Government support, the tax expert warned the UK was still well below its target for electric vehicle sales.

The 5p fuel duty cut was introduced in the aftermath of Russia's invasion of Ukraine in 2022 | PA

The 5p fuel duty cut was introduced in the aftermath of Russia's invasion of Ukraine in 2022 | PAUnder the Zero Emission Vehicle mandate, at least 33 per cent of new cars need to be electric by this year, followed by an 80 per cent target in 2030.

However, some experts have warned that registrations remain far short of the level required to meet the ZEV mandate targets.

"This reversal in fuel duty trends could widen the gap between Government targets and what drivers actually choose to buy," Ms McGuinness warned.