Drivers handed three-year deadline for 'car tax advantages' before facing '100%' cost hike

'We would advise fleet managers to begin reducing the choice of plug-in hybrids on their car policies before the start of the 2028/29 tax year'

Don't Miss

Most Read

Latest

Experts are urging drivers to make use of low-tax loopholes over the coming years after Labour announced it would be changing the terms of the Zero Emission Vehicle (ZEV) mandate.

Prime Minister Keir Starmer recently confirmed that the ZEV mandate would be relaxed to allow plug-in hybrid vehicles to remain on sale until 2035.

The move has been backed by experts who argue that drivers will be able to benefit from "favourable" Benefit-in-Kind tax charges.

People who use company cars, especially those living in rural areas or who rack up thousands of miles a year, a plug-in hybrid model could act as a stopgap if they are hesitant about switching to an electric vehicle.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

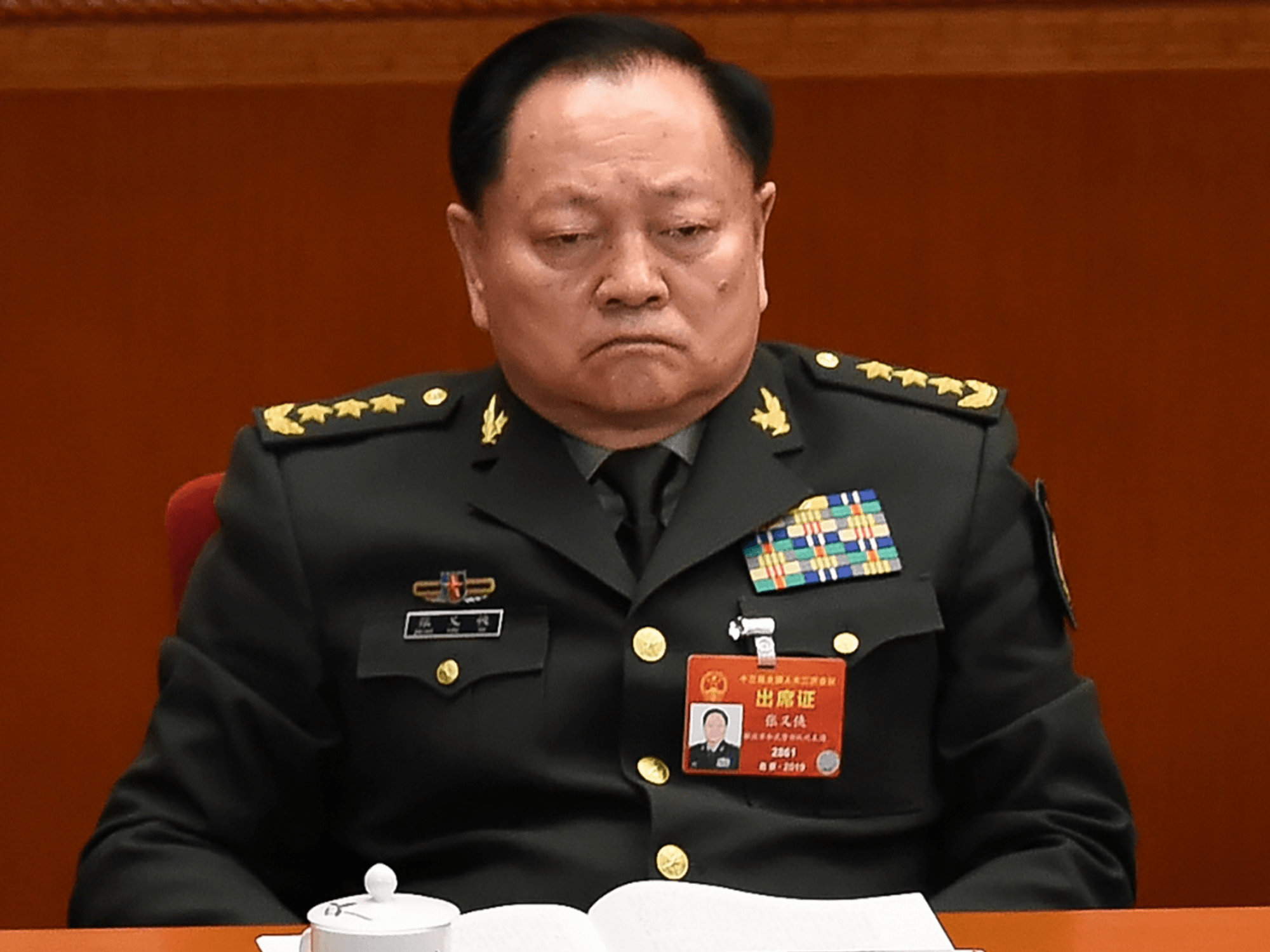

Experts are warning that drivers could see their car tax bills increase dramatically in the coming years

|GETTY

However, industry experts from fleet management specialist Grosvenor warned that the BiK rate for some plug-in hybrid models could more than double from the start of 2028/29.

At present, the BMW 330e plug-in hybrid attracts a BiK tax of nine per cent, meaning a 40 per cent taxpayer will be charged £1,734 per year.

Since BiK rates are only locked in until 2028/29, drivers could see prices spiral after the deadline as the Government pushed more motorists towards zero emission vehicles.

In the coming years, the BMW 330e will rise by one per cent each year to 11 per cent, costing someone £2,120.

Despite this, in the 2028/29 tax year, it will soar to 18 per cent, meaning a 40 per cent taxpayer with a company car would be charged £3,468 - equivalent to a 100 per cent increase.

Lee Brown, managing director of Grosvenor, warned that company car drivers should not be "lulled into a false sense of security" with plug-in hybrids as they could be stung with expensive costs in just three years.

He added: "There may be drivers who are still not ready for a fully electric car in three years' time and for these drivers, despite the escalation in rates, a plug-in hybrid will continue to attract lower BIK tax than many have been accustomed to paying over the years for petrol and diesel models.

"Also, the choice of fully petrol or diesel models will have declined so significantly due to the ZEV mandate that PHEVs will be the primary alternative to a BEV until they are removed from sale."

In the last month, the Society of Motor Manufacturers and Traders (SMMT) reported that plug-in hybrid models retained an 11.7 per cent share of the market, with more than 14,000 registrations.

This represents an impressive 34.1 per cent hike compared to the same time last year, while new petrol, diesel and pure hybrids all saw a decline in sales.

When announcing the new ZEV mandate rules, Keir Starmer praised the changes, saying they would boost British brilliance and help UK businesses.

The changes were also backed by Transport Secretary Heidi Alexander, Chancellor Rachel Reeves, Energy Secretary Ed Miliband and Business Secretary Jonathan Reynolds.

LATEST DEVELOPMENTS:

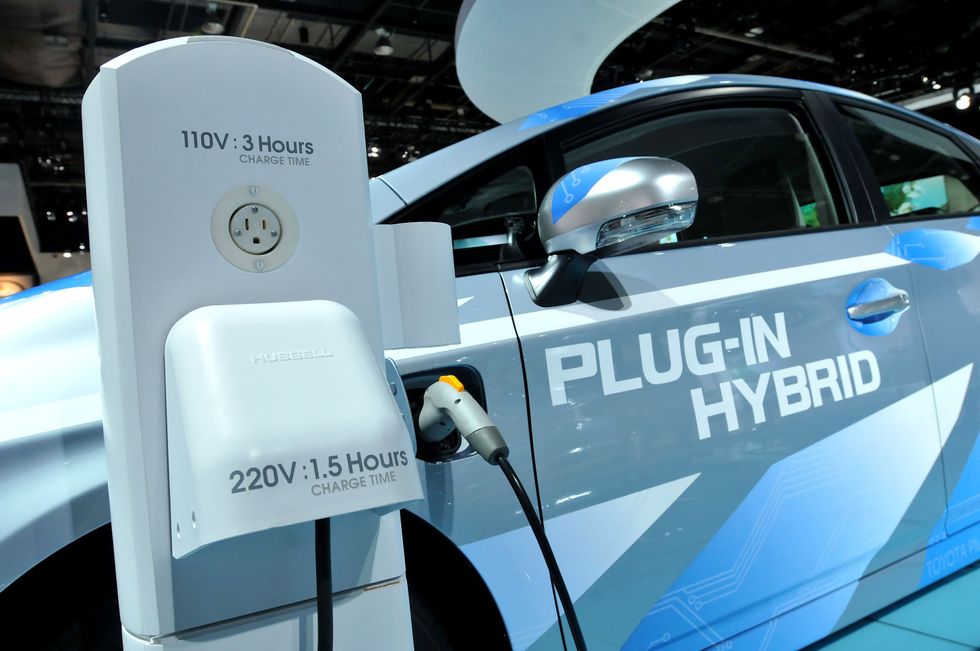

The sale of hybrid vehicles will be allowed until 2035 under new rules | GETTY

The sale of hybrid vehicles will be allowed until 2035 under new rules | GETTYBrown concluded, saying: "However, we would advise fleet managers to begin reducing the choice of plug-in hybrids on their car policies before the start of the 2028/29 tax year in anticipation of these changes, and start moving towards a fully electric choice list, wherever possible.

"This is because, while plug-in hybrids play a useful role in helping fleets to decarbonise, and currently provide a better Benefit-in-Kind tax than traditional petrol and diesel cars, they really have a limited window before fleets should move fully to electric cars.

"Of course, they will continue to be on sale until 2035 and will provide a better Benefit-in-Kind choice than a conventional petrol or diesel car, but the real tax advantages are time-limited."