British drivers can finally expect compensation for car finance scandal that has been 'brewing for years' - analysis by Felix Reeves

WATCH: Dr Roger Gewolb on the car finance repayment scandal

|GB NEWS

£850million has already been set aside to deal with repayments from the scandal

Don't Miss

Most Read

Latest

Drivers have likely already been made aware that they could be owed thousands of pounds in compensation for dodgy car finance deals between 2007 and 2021.

Experts like Martin Lewis have predicted that the average payout could be £1,100 per person, a significant amount of money amid the soaring cost of living and motoring.

The money saving expert has been instrumental in helping more than one million motorists lodge a complaint against lenders thanks to his MSE complaints tool and his advocacy for drivers to take action on TV and radio.

Two of the largest car finance lenders in the UK have already set aside a staggering £850million in preparation for a damning judgement statement, which is expected to be released in September.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

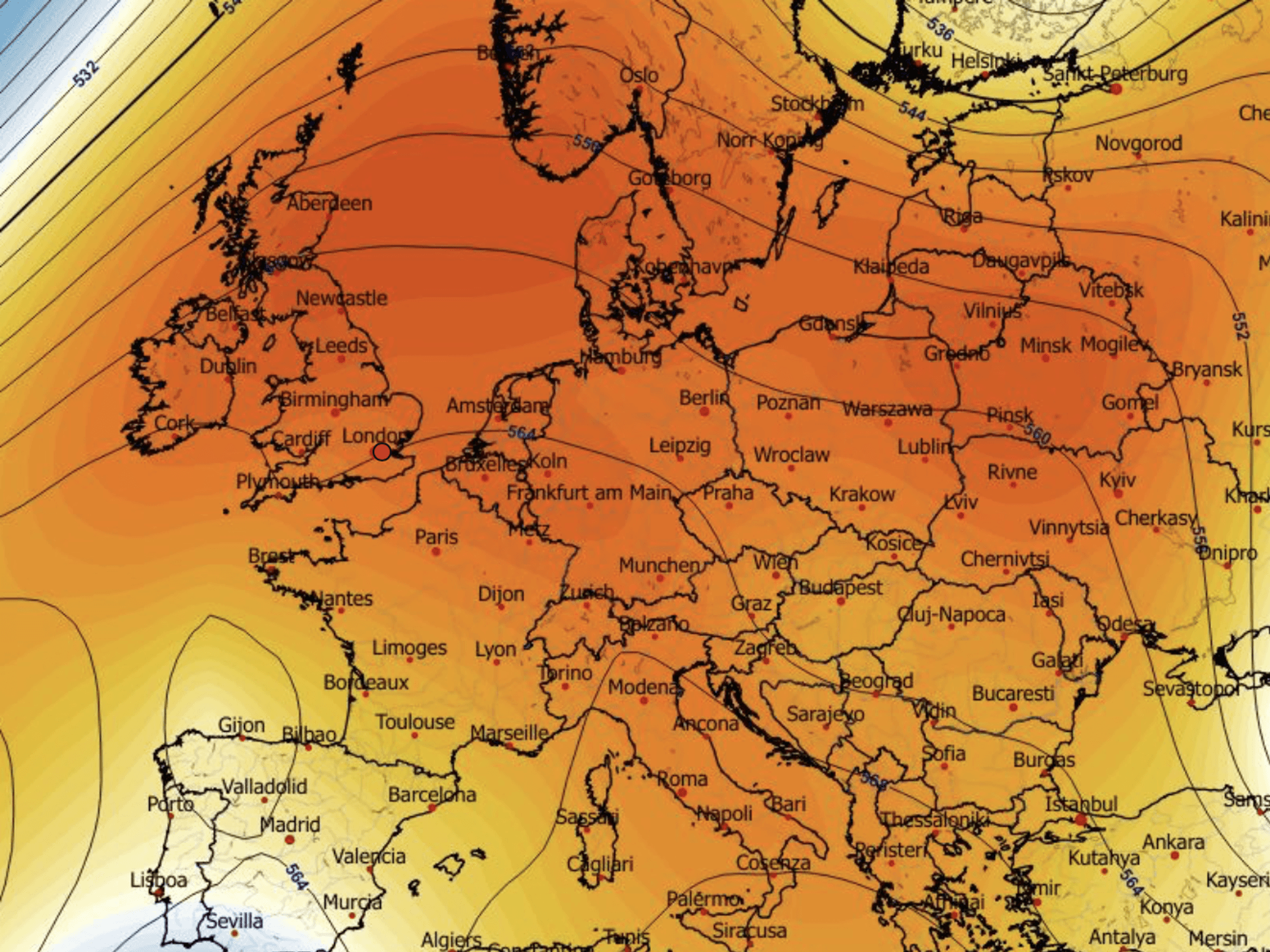

Experts have predicted that the 'next steps' of the car finance scandal will be outlined in September

|GETTY

Speaking exclusively to GB News, finance expert Dr Roger Gewolb said drivers across the UK should be aware of the incident and look into ways of claiming it if they believe they are affected.

He said the incident had been “brewing for years”, comparing it to a “monster” and a “tsunami”, adding that he had been consulted on the issue for around a year.

The consumer champion explained: “Some lenders, mainly the big banks, allowed what's called a Discretionary Commission Arrangement system.

“This meant that the person, the agent, who sold their finance for them, either a car dealer or a car finance broker, could adjust the amount of interest that the car buyer would pay with different levels of commission.

“So they could raise the interest rate and earn a higher commission because they were making more money for the bank. And the banks are said not to have policed this very well and a lot of people were treated unfairly.

“Now at the same time, of course, a car dealer or broker could reduce the rate of interest and give up some of his commission in order to close the sale, which he wouldn't otherwise make.”

Dr Gewolb highlighted the comparisons between the ongoing car finance scandal with that of the PPI scandal, which has seen almost £40billion handed back to Britons who were mis-sold personal protection loans.

He even suggested that it could spell the end of the car finance industry with some lenders potentially having to pay hundreds of millions of pounds to motorists who overpaid for their cars between 2007 and 2021.

Complaints normally need to be lodged within a certain timeframe, although given the magnitude of the case, this has been extended. The Financial Ombudsman has confirmed that car dealers or finance providers do not have to respond to the complaint until after September 24, at the earliest.

While it is not guaranteed that car lenders will have to pay out hundreds of millions, or even billions, of pounds, the threat is present and drivers could be in for a serious payday after being overcharged for their finance deal.

September will also be a big month for drivers, with the Financial Conduct Authority expected to release its long-awaited report on the scandal and lay out the “next steps”.

Consumer experts, like Martin Lewis and Dr Roger Gewolb, will have a keen interest in the coming months, especially in how drivers will be able to receive long-awaited compensation and whether lenders will try to drag the scandal out as much as possible to delay giving drivers what they deserve.

LATEST DEVELOPMENTS:

- Drivers warned of nationwide crackdown on reckless motorists who 'fail to comply with safety rules'

- M4 closure: Britons risk traffic havoc after 'multi-vehicle collision' causes long delays by Heathrow Airport

- Older motorists face driving and fitness assessments which could lead to people losing their licence

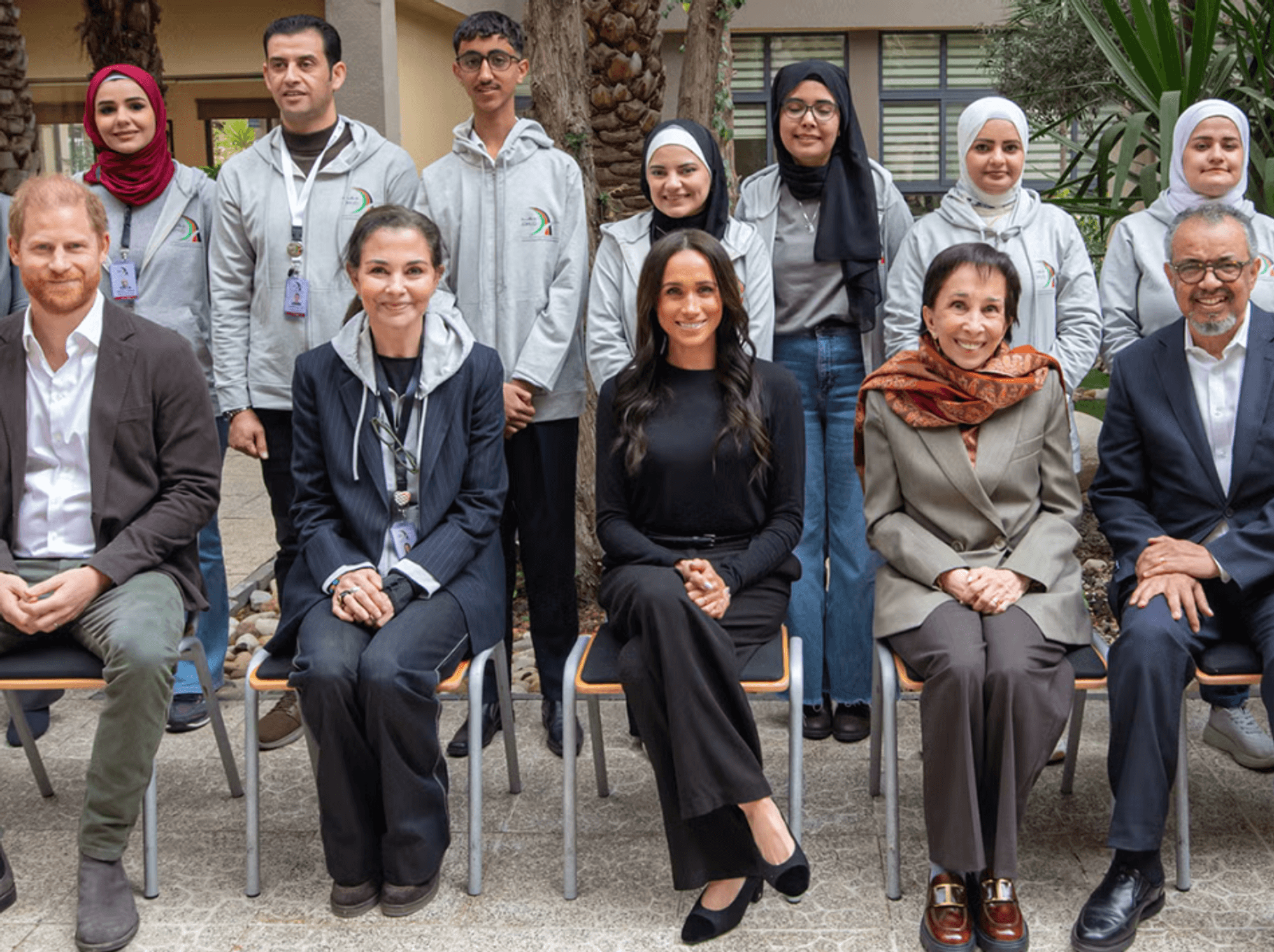

Martin Lewis said more than 1.1 million people have used the MSE complaints tool

| PAThe £850million set aside by car lenders is significant, although some of the major players in the industry have admitted that there is no guarantee of how much they will be charged as the total amount could be higher or lower than what has already been set aside.

Many are confident that hard-pressed motorists will receive some relief from the car finance scandal, even drivers will likely have more questions than answers before the end of the year.