Car tax changes could see thousands of drivers receive '50% reduction' - Would you benefit?

The petition is quickly approaching 10,000 signatures, which would require a response from the Government

Don't Miss

Most Read

Latest

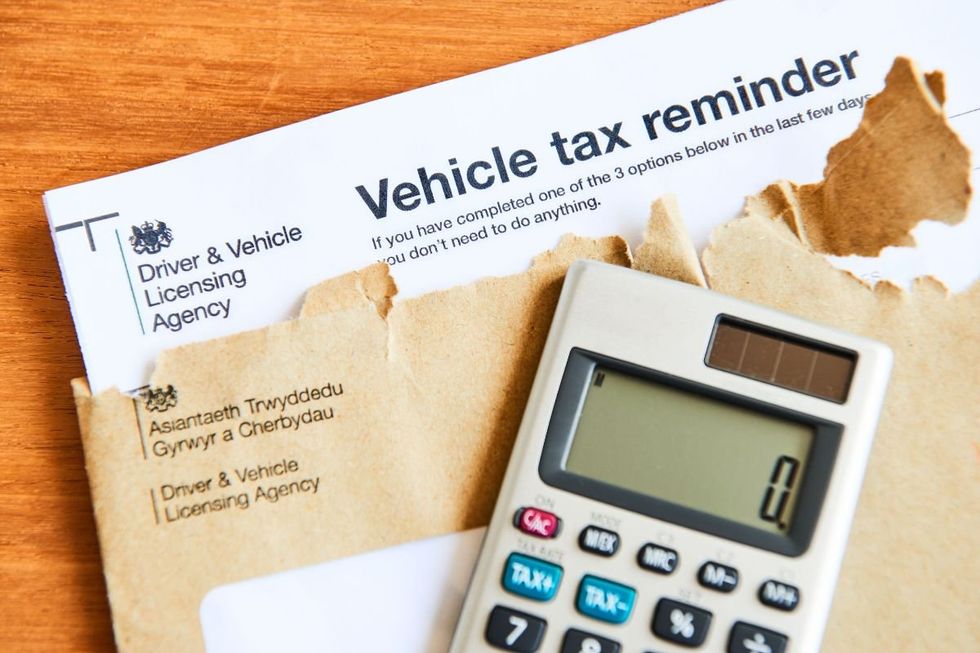

Campaigners are calling for new car tax changes to be introduced to support hundreds of thousands of historic vehicle owners with massive discounts.

A new petition has suggested that Vehicle Excise Duty be halved for cars between 20 and 39 years old for a number of reasons.

It suggests that a 50 per cent reduction in VED should be introduced for medium-aged vehicles in a bid to dispel a "disposable" culture which has been created by "high taxes" which force working vehicles to be scrapped.

The creator, Heitor Mazzotti, suggested that keeping existing vehicles on the road is more environmentally friendly than building new ones.

TRENDING

Stories

Videos

Your Say

Classic cars currently benefit from a Vehicle Excise Duty exemption if the vehicle was first built before January 1, 1985.

While drivers do not need to pay any tax on the vehicle, it must still be registered and taxed if it is over 40 years old.

If someone does not know when their vehicle was built, they will not need to pay vehicle tax if it was registered before January 8, 1985.

However, vehicles will not be exempt from vehicle tax if they are used for hire or reward, or if they are used commercially for a trade or business.

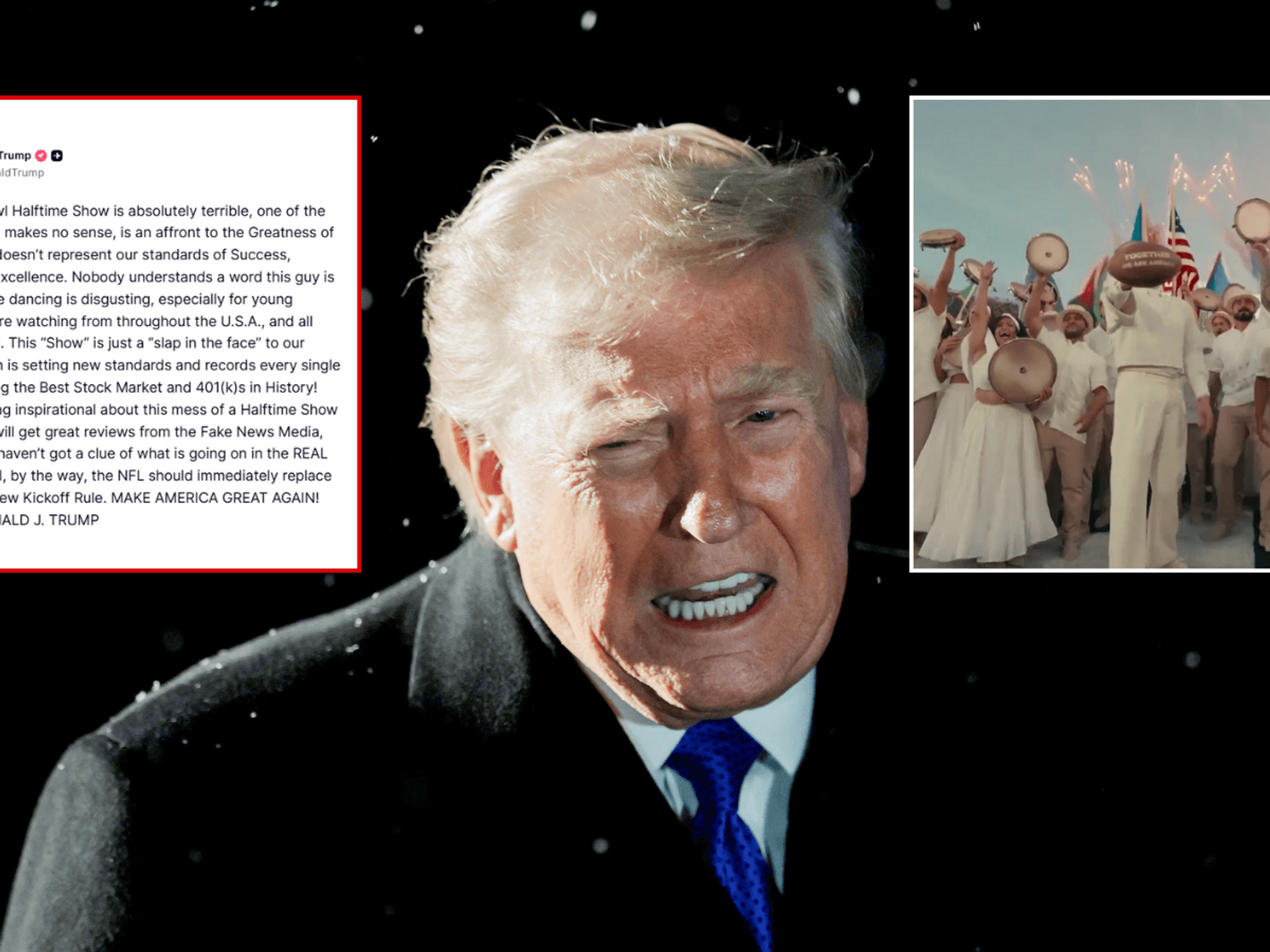

Drivers are calling for new car tax changes to be introduced for vehicles built between 20 and 39 years ago

|GETTY

Eligible vehicles include cars, vans, motorcycles, tricycles, large vehicles and buses, and specialist vehicles, such as snowploughs or agricultural machines.

The petition, which has already secured more than 8,250 signatures, said the 20 to 39-year-old range could be designated as the "young-timer" bracket.

By introducing such measures, the creator claims it would support the circular economy and reinforce the UK's classic car industry.

They added: "Keeping a functional 20-year-old car on the road is often greener than building a new one, as it preserves the embedded carbon already spent.

LATEST DEVELOPMENTS

Historic vehicles do not have to pay car tax if they were built more than 40 years ago

| CAR AND CLASSIC"Current VED rates force many well-maintained cars to be scrapped prematurely."

It calls for a 50 per cent "transition to historic" tax discount to encourage repairs to older vehicles and support the valuable classic car sector.

The newly launched petition will remain active until August 6, 2026. If it receives 10,000 signatures, the Government will respond to the terms of the consultation.

In the event that 100,000 people add their signature to the consultation, it will be considered for a debate in Parliament.

The classic car industry provides billions of pounds to the UK economy every year

| GETTYUnder current rules, drivers need to apply for a vehicle tax exemption, although they do not need to apply to stop getting an MOT for the vehicle each year.

Despite this, drivers can be fined up to £2,500 and get three penalty points for using a vehicle in a dangerous condition.

Data from the Federation of British Historic Vehicle Clubs (FBHVC) shows that 22.7 million people across the UK see historic vehicles as an important part of Britain's heritage.

The classic car sector supports 34,500 jobs around the country, with 2,700 specialist organisations across restoration, maintenance, parts supply, and more.