Car insurance prices plummet to two-year low - but drivers could miss out on 'substantial savings'

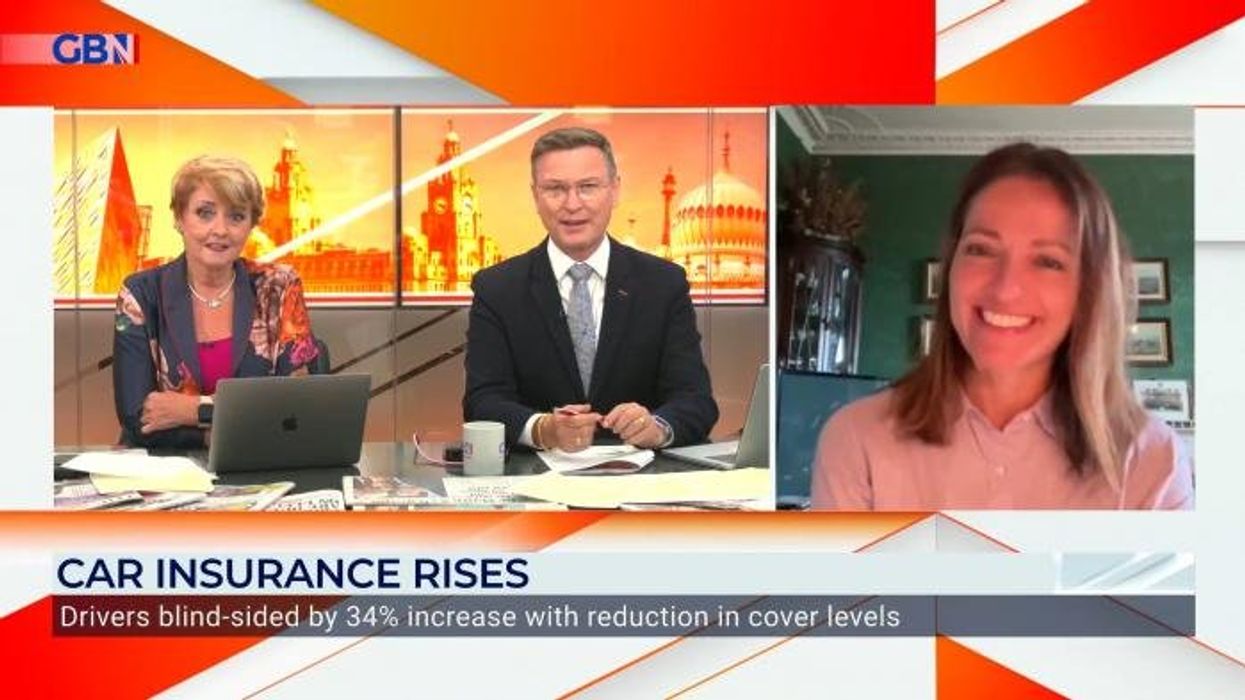

WATCH: Motoring expert Amanda Stretton on expensive car insurance costs

|GB NEWS

Car insurance prices peaked in November 2023, with the average driver paying £951

Don't Miss

Most Read

Drivers can breathe a sigh of relief as new research shows that car insurance prices have dropped to their lowest price in almost three years.

The average motor insurance premium has dropped by 22 per cent year-on-year to just £600, compared to a staggering £762 in August last year.

Data shows that this is the lowest car insurance premiums have been since October 2022, when premiums were £589.

This appears to be a continuing trend, with the average price of a premium falling by £53 over the last four months, compared to the price in May earlier this year.

TRENDING

Stories

Videos

Your Say

Experts from Compare the Market have suggested that the drop in costs could be down to lower inflation levels, putting pressure on insurers.

Compared to the peak in prices seen in November 2023, when the average premium was £951, drivers are now saving around £351.

All age ranges are seeing significant savings, with motorists under the age of 25 seeing premiums fall from £1,761 last August to £1,336.

While the cost is still the highest premium of any age range, more young drivers could join the road as a further barrier is removed.

Drivers are now paying significantly less for their car insurance than they were last year

|GETTY

Elderly drivers between the ages of 65 and 79 pay the least for their insurance, with average premiums costing just £325, although they see the smallest discounts year-on-year.

Amy Rootham, insurance expert at Compare the Market, called on motorists to act soon to ensure they make savings.

She commented, saying: "Many motorists will be delighted that the cost of car insurance is continuing to fall.

"Drivers should look to take advantage of this by shopping around for a cheaper deal when their policy ends.

Drivers in the South West of England and Wales pay the least for their car insurance policies

| GETTYLATEST DEVELOPMENTS:

- Motorists handed huge electric car charging lifeline as 500,000 could slash costs - 'Removes a big barrier!'

- Drivers urged to learn recent Highway Code changes or face consequences as council issues warning

- Diesel prices prompt violent protests as furious drivers throw stones at President - 'We will not allow this'

"Choosing to auto-renew a policy may lead to motorists missing out on substantial savings."

The data from the Premium Drivers research shows that drivers in the South West of England pay the least for their car insurance.

On average, road users are paying just £463 for their coverage, followed by Wales (£499), the South East of England (£528) and the North East of England (£529).

However, millions of drivers will still be paying more than £1,000 for their car insurance policy, with a surprise region claiming top spot.

Motorists are encouraged to shop around before they renew their car insurance, as they could save hundreds of pounds

| GETTYMotorists in Yorkshire and the Humber are paying £1,221, despite a huge £361 price drop over the last year.

This is almost £200 more than drivers in the capital, London, who pay £1,035, a decrease of £232 compared to August, when they were forking out an average of £1,267.

Experts from Compare the Market have called on drivers to make the best savings they can by shopping around before they renew their policy.

Research has shown that motorists could save as much as £473 if they shop around before they renew, offering major savings.