Horseracing exempt from gambling tax raid as Labour hikes betting duty in 2027

Rachel Reeves asked if she is 'the Grinch' as she prepares to deliver Budget statement |

GB NEWS

The tax changes are estimated to raise £1.1billion by 2029/30

Don't Miss

Most Read

Horseracing will be exempt from Rachel Reeves' gambling tax raid as the Chancellor hikes betting duty in her second Budget.

The changes are set to come into force in April 2027, Ms Reeves confirmed in the Commons today.

A new rate of general betting duty (GBD) for remote betting will be introduced at 25 per cent in 2027, "excluding self-service betting terminals, spread betting, pool bets, and horse racing".

Remote gaming duty is to rise to 40 per cent from 21 per cent from April 2026, according to the OBR, which did not mention any changes to machine games duty (MGD).

TRENDING

Stories

Videos

Your Say

The Office for Budget Responsbility's leaked report also revealed the abolition of bingo duty at its current 10 per cent rate and a freeze on casino gaming duty bands.

The tax changes are estimated to raise £1.1billion by 2029/30, the OBR said.

Betting shop operators have warned that thousands of betting shops would close if the rate of MGD were increased.

Shadow sports minister Louie French had his say on X, saying: "Labour's gambling tax hike is reckless.

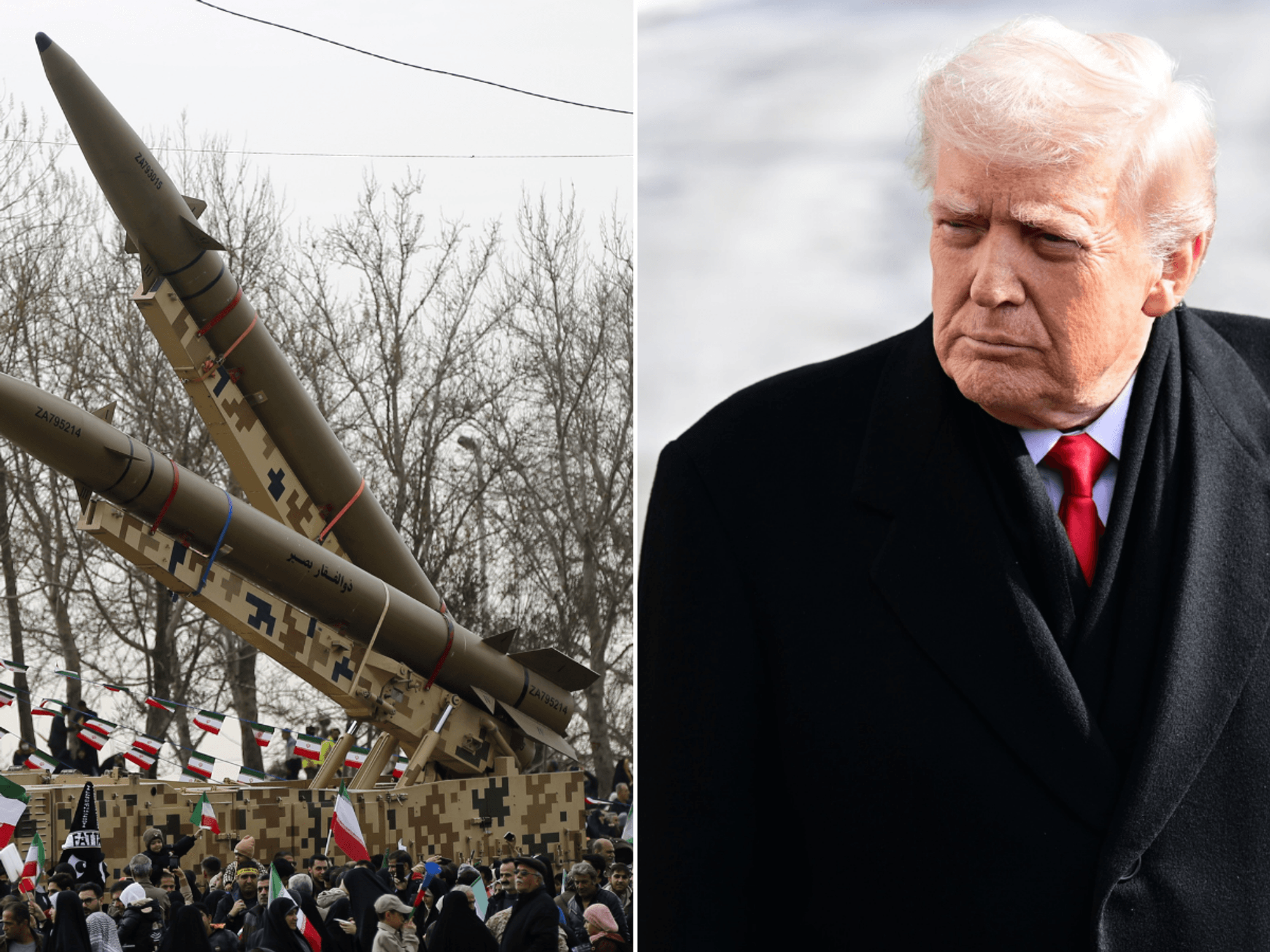

The tax changes are estimated to raise £1.1billion by 2029-30

| GETTY"It will push people onto the unsafe black market and cost thousands of jobs across Britain.

"This is just another stealth tax on working people having fun, and it will hurt our economy.

"Labour's hostility to people having a bet could cost our country billions in tax revenues, see businesses close and jobs lost, and jeopardise funding for British sport and charities.

"Rachel Reeves is gambling with lives and livelihoods."

LATEST SPORT NEWS

Labour confirmed they were making no change to taxes on in-person gambling or on horse racing

|GETTY

In the Commons, Ms Reeves elaborated on her plans.

She said: "I will also reform gambling taxes in response to the rise in online gambling."

"Remote gaming is associated with the highest levels of harm so I'm increasing remote gaming duty from 21 per cent to 40 per cent, with duty on online betting duty increasing from 15 per cent to 25 per cent.

"I'm making no change to taxes on in-person gambling or on horse racing."

Labour reformed gambling taxes in response to the rise in online gambling

|GETTY

The Chancellor added: "Taken together my reforms to gambling tax will raise more than £1billion per year by 2031."

According to the OBR, the tax increases revealed today are expected to cost the industry £1.6billion from 2027/28, when the general betting duty change is introduced.

One betting industry source said: "This is an early Christmas present for the black market, even the Treasury admit huge amounts of tax will be lost to illicit operators. No one wins today apart from criminal gangs.”

Our Standards: The GB News Editorial Charter