Andrew Mountbatten-Windsor closely linked to firm that planned £550m bid to seize control of Telegraph

A fresh investigation claims that Andrew attempted to exploit his relationships with Gulf rulers to advance his commercial interests in the region

Don't Miss

Most Read

Andrew Mountbatten-Windsor sought to leverage his royal connections in the Middle East for commercial gain, contacting Bahrain's Crown Prince and an adviser to the Omani government to arrange visits for his business associates, a new report has claimed.

Messages appear to show the former Duke of York reaching out to Crown Prince Salman bin Hamad al-Khalifa in June last year, while also drafting correspondence to Pankaj Khimji, a foreign trade adviser in Oman.

The Times investigation claims that Andrew attempted to exploit his relationships with Gulf rulers to advance his commercial interests in the region.

A linked investment vehicle, Waterberg Stirling, developed proposals to establish a bank in Bahrain and prepared a potential £550million offer for The Daily Telegraph.

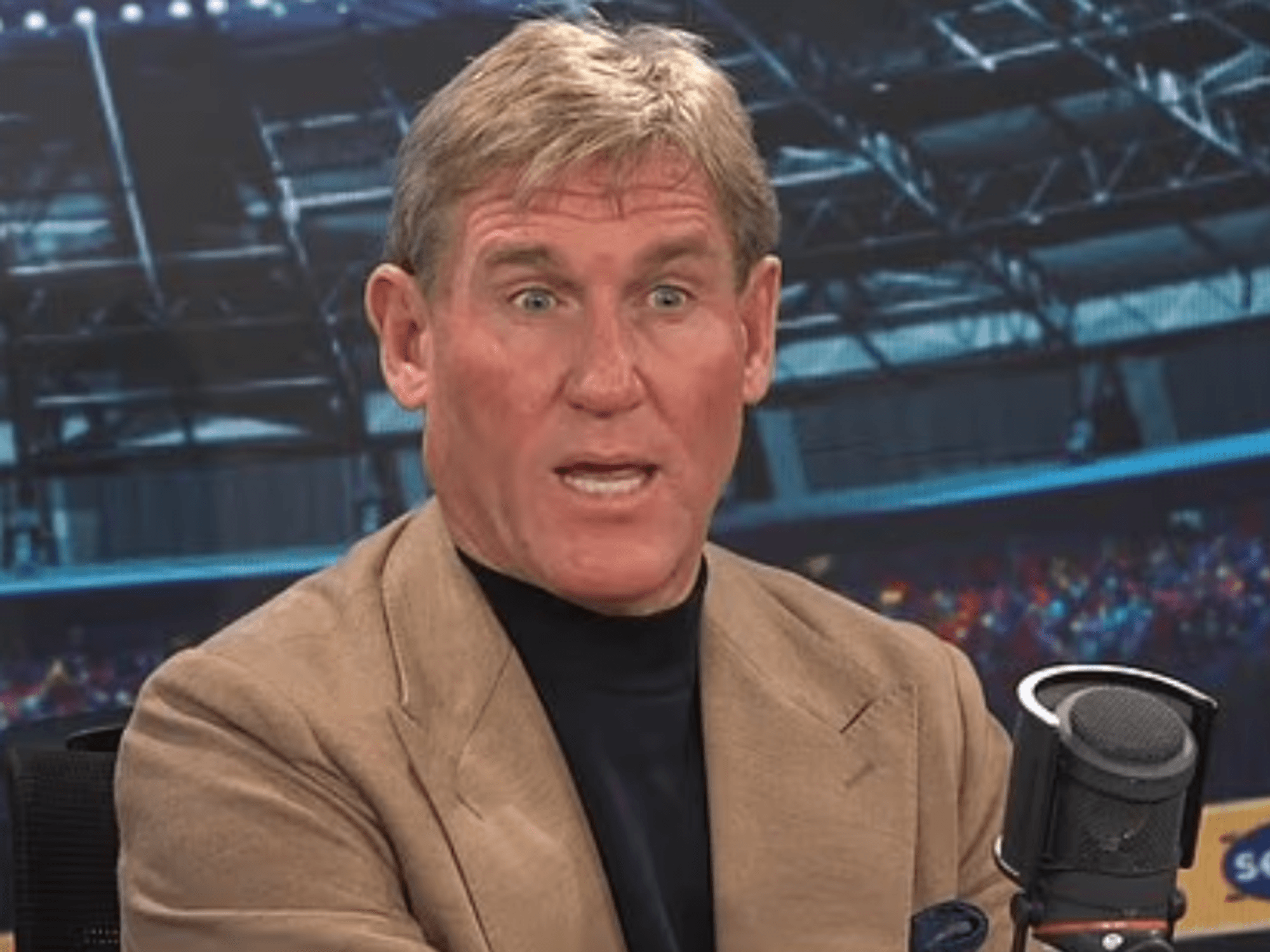

Andrew Mountbatten-Windsor sought to use his royal connections in the Middle East for commercial gain, The Times has claimed

| GETTYAndrew's message to the Crown Prince, addressed "Dear S", declared that he had not been "idle recently" and had encountered "fantastic serendipity" through an introduction to Startupbootcamp, a Dutch company pursuing the acquisition of his Pitch@Palace venture.

The disgraced former royal informed the Bahraini ruler that his partnership with Startupbootcamp had received "the support and blessing of the palace" and outlined ambitions to expand the business network into new territories.

"The goal is to invest and accelerate local start-ups and scale-ups and create economic impact and business development," Andrew wrote, requesting permission to bring his partners to Bahrain to "invigorate your entrepreneurial ecosystem".

His correspondence to Mr Khimji in Oman followed a similar pattern, seeking guidance on reinvigorating his entrepreneurial activities and asking whether his associates might visit the Gulf state.

The proposed Pitch@Palace sale had progressed to discussions at Buckingham Palace in June last year, with Sir Michael Stevens, then keeper of the privy purse, among those present alongside representatives from Startupbootcamp.

Stevens did not scrutinise the transaction but indicated the King would approve it proceeding through legitimate channels.

Andrew's relationship with Bahrain stretches back years, with the crown prince hosting him in 2014 and again in 2022 during his first overseas trip following the disastrous BBC Newsnight interview about his association with the convicted paedophile Jeffrey Epstein.

Andrew Mountbatten-Windsor had his royal titles removed earlier this year

| GETTYBahrain's ruling family faced accusations of deploying brutal force and torture against pro-democracy demonstrators in February 2011, resulting in more than 40 deaths.

The crown prince declined his invitation to the 2011 royal wedding following public outcry.

The Pitch@Palace transaction ultimately collapsed, but by October last year Andrew's senior adviser Dominic Hampshire had become sole shareholder of five Bahraini companies bearing the Waterberg Stirling name.

Sources familiar with the operation described Waterberg Stirling as an £8 billion investment fund registered in Bahrain, intended to consolidate the business interests of Saudi-based businessman Adnan Sawadi.

Promotional material seen by The Times characterised the company as "a global investment company" created as "a vehicle for HRH's current and future engagement", referring to Andrew, though those connected to Waterberg Stirling contest this description and insist he held no formal position.

Documentation revealed plans to launch a fully regulated Bahraini bank offering virtual asset services including trading and payment solutions.

A separate proposal outlined a potential £550 million bid for The Daily Telegraph.

Horizon Global Capital, described as a Waterberg Stirling company and formerly known as the Eurasia Fund, proposed creating a £7.5 billion "fund of funds" with investment areas linked to China's belt and road initiative.

Andrew Mountbatten Windsor has kept out of the public eye in recent months

| GETTYAhmed al-Mazrouei, head of Mubadala Investment Company's London office, was photographed with Hampshire and Andrew's former PR adviser Lucy Goodwin in Saudi Arabia during an October meeting to promote Waterberg Stirling.

Mazrouei was also pictured alongside Sawadi and Yang Tengbo, the suspected Chinese spy, during a visit to a Chinese art museum, though he denied any board or advisory role with Waterberg Stirling.

Andrew was stripped of his titles in October after revelations he had maintained contact with Epstein longer than previously acknowledged.

He also agreed to vacate Royal Lodge after The Times established he had not paid rent for 22 years.

GB News has approached Buckingham Palace for comment.

Our Standards: The GB News Editorial Charter