Why aligning closer with the EU would doom Britain - explained by just one chart

Katherine Forster delivers 'bad news for Britain' in shocking IMF warning |

GB NEWS

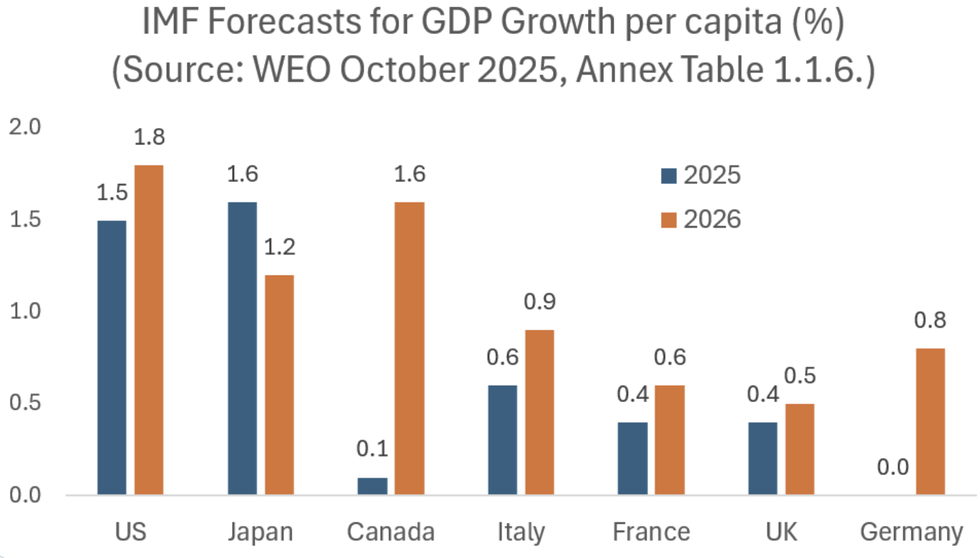

The chart from the IMF reveals the GDP growth forecast per capita in 2025 and 2026

Don't Miss

Most Read

Trending on GB News

A bombshell new chart has suggested Britain would be economically doomed if it alligned itself closer to the EU.

The chart comes from the International Monetary Fund (IMF) forecasts for GDP growth per capita in 2025 and 2026.

Economist Julian Jessop suggested the chart "is a better measure of changes in living standards than the headline numbers."

The chart has the forecast for growth per capita for the UK to be 0.5 per cent in 2026, up from 0.5 per cent this year.

TRENDING

Stories

Videos

Your Say

The US is forecast for 1.8 per cent in 2026, up from 1.5 per cent thus year, according to the IMF report.

Japan is forecast to see a decrease between the years, from 1.6 per cent to 1.2 per cent.

However, among the other EU countries, Germany saw the highest growth, going to 0.8 per cent between 2025 and 2026.

There was minimal growth for Italy and France, going from 0.6 to 0.9 per cent and 0.4 to 0.6 per cent respectively.

The chart from the IMF reveals the growth figures

|X/@JULIANHJESSOP

Mr Jessop said: "It's still a mystery to me why anyone thinks the solution to the UK's problems is to copy the other underperformers, notably France and Germany, or even to tie us more closely to them again."

Shadow Chancellor Mel Stride responded to the growth figures, telling GB News: "It's totally flat.

"The figure for July was a contraction of 0.1 per cent, with the IMF saying that we have lowest growth of GDP per capita in the G7.

"The Chancellor will blame everybody but herself."

LATEST DEVELOPMENTS

Rachel Reeves has been encouraged to find a tonic and quickly

|PA

Lindsay James, investment strategist at wealth management firm Quilter, said: "In the week that the International Monetary Fund gave the UK’s economic growth forecasts a small bump up, today’s GDP figures paint a picture of an economy stumbling to the end of the year after a strong start.

"Monthly GDP grew just 0.1 per cent, giving a three-month rate of 0.3 per cent, not exactly exciting figures.

"Markets will have been hoping for signs that the UK can maintain it’s early-year momentum but it appears that has now dissipated just as we approach a crunch Budget statement from the Chancellor.

"Rachel Reeves will need to find a tonic and quickly if she is to extricate the economy from its current malaise."

Services output is estimated to have experienced no growth in August 2025. This is the second consecutive month in which services has shown no growth, after also doing so in July 2025 (revised down from 0.1 per cent growth in our previous bulletin).

The largest positive contribution to services growth in August 2025 came from administrative and support service activities which grew by one per cent.

This was mainly caused by a 5.3 per cent increase in rental and leasing activities.

This subsector saw its largest period of growth since July 2020, and has now grown for the last nine consecutive months, in line with widespread growth in this industry.

The Institute for Fiscal Studies (IFS) said it expected Chancellor Rachel Reeves to find at least £22billion next month, thanks to rising borrowing costs, weaker growth forecasts and spending commitments made since the spring.

That figure would restore the £10billion of headroom Ms Reeves previously left herself against her self-imposed debt rules, although it does not include the cost of widely expected announcements on abolishing the two-child benefit cap and maintaining the freeze on fuel duty.

But the IFS said there was a "strong case" for the Chancellor to go further, arguing that a £10billion buffer was not enough to ensure stability and would leave her "limping from one forecast to the next".

IFS director Helen Miller said: "For Rachel Reeves, the Budget will feel like groundhog day."

More From GB News