Inheritance Tax poised to be SCRAPPED as part of three huge tax changes for Britons

The Prime Minister is said to have demanded a 'gear change' on tax

Don't Miss

Most Read

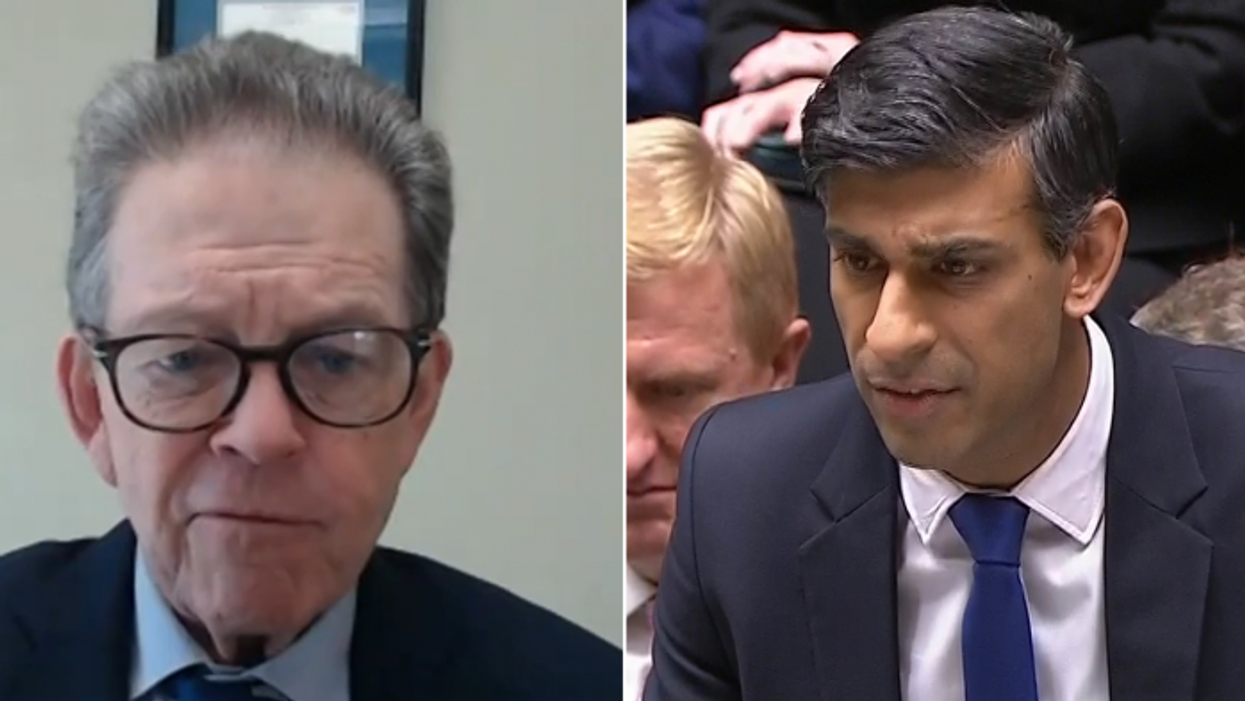

Rishi Sunak is looking at scrapping inheritance tax and making two major changes to income tax in just a matter of weeks as part of a pre-election handout to boost the Conservative Party's position in the polls.

Number 10 is said to be discussing introducing the cuts in three months time.

Sources told the Telegraph the PM has demanded a "gear change" on tax, after making inflation his main priority, over cutting the tax burden.

In addition to axeing inheritance tax, the Treasury is also considering increasing the threshold at which people start paying the 40 per cent rate of income tax and reducing the basic 20 per cent rate.

Rishi Sunak is looking at cutting inheritance tax and making two major changes to income tax in just a matter of weeks

|PA

Inheritance tax is paid on estates worth over £325,000.

Former Conservative minister David Jones welcomed the reports, telling GB News that the tax is "hated".

He said: "If true, it will be very welcome.

"Inheritance Tax is arguably the most hated of all personal taxes.

"It is a tax on assets that have often been accrued out of savings after income tax has already been paid.

"Because of fiscal drag, it is affecting an increasing number of people of moderate means. It is iniquitous and should be scrapped."

Earlier this year, figures from the Institute of Fiscal Studies showed that Inheritance Tax will raise £15 billion per year by 2032.

Analysis of the latest HMRC figures showed fewer than four per cent of estates paid inheritance tax between 2020 and 2021.

The number is expected to rise to more than seven per cent across the next ten years, as a result of the growth in wealth of older adults.

Inheritance tax is paid on estates worth over £325,000.

The IFS report said this year, the cost of abolishing Inheritance Tax would be £7 billion, but this would rise to £15 billion per year by 2032.

The report warned: "The 90 per cent or so of estates not paying inheritance tax would not be directly affected by such a reform."

Earlier this year, Defence Secretary Grant Shapps this week described inheritance tax as "deeply unfair" and "punitive".

He said: "I think it’s a question, for many people, of aspiration, and people know that there’s something deeply unfair about being taxed all their lives and then being taxed in death as well."

LATEST DEVELOPMENTS:

Responding to reported plans to cut Inheritance Tax, James Murray MP, Labour’s Shadow Financial Secretary to the Treasury, said: “This is a desperate briefing from a desperate prime minister who is spending his Christmas break trying to keep Tory MPs on side.

"There have been 25 Tory tax rises since the last election. Now at a time when families across Britain are struggling with the cost of living and our NHS is on its knees, Rishi Sunak is trying to buy off his backbenchers with an unfunded tax cut for millionaires.

"The Conservatives are out of touch and out of time. It’s time for change with Labour.”