REVEALED: Reform’s plan to end taxpayer waste and save £35 BILLION a year

Economist EJ Antoni warns Bank of England 'should be worried' over exit of gold to US

|GB News

With the savings, Reform would use the excess cash to pay for an increase in the tax-free personal allowance

Don't Miss

Most Read

Trending on GB News

Reform UK has a plan to end major amounts of taxpayer cash being wasted by the Bank of England and potentially save £35billion a year.

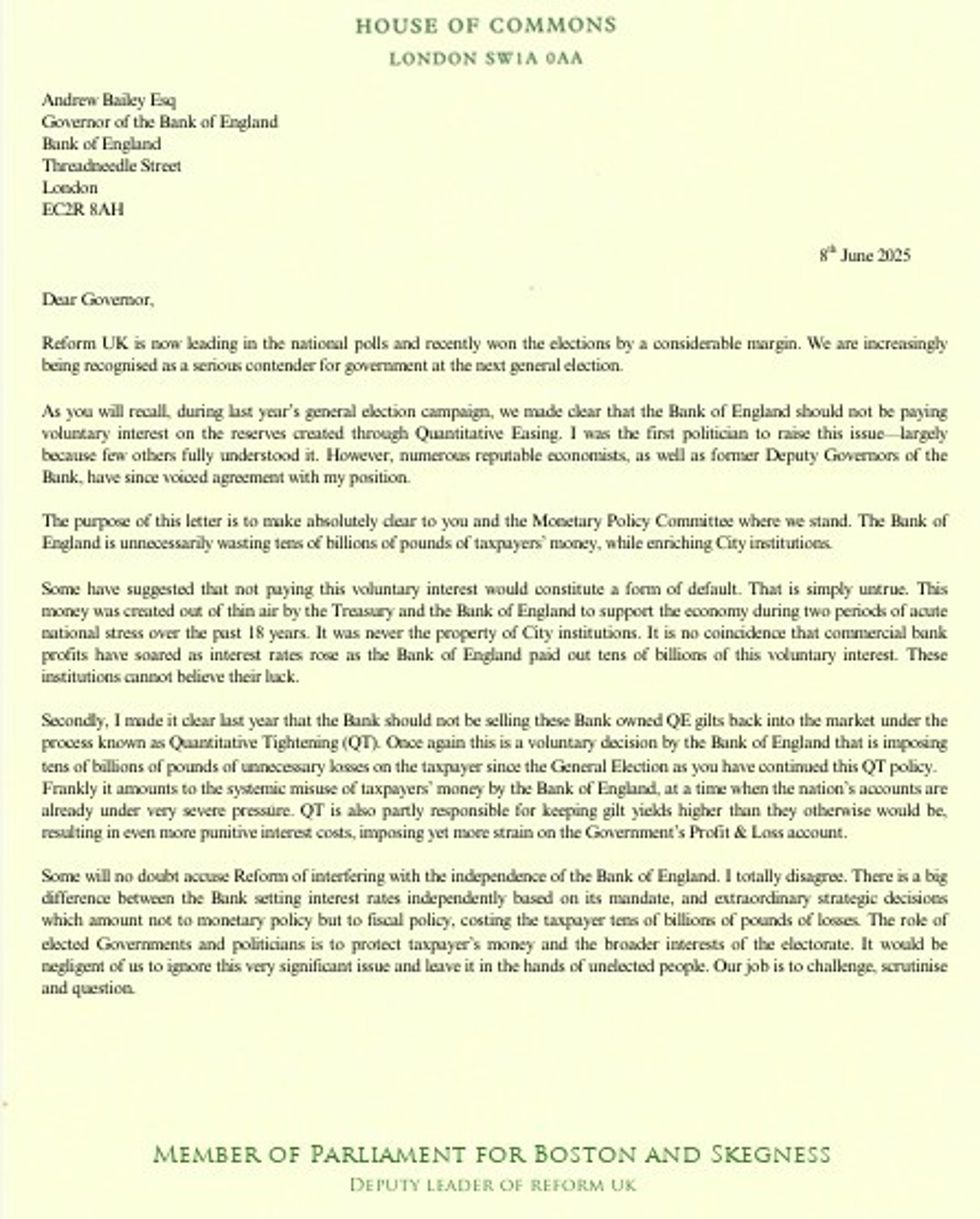

Deputy leader Richard Tice launched a devastating attack on Threadneedle Street, accusing the institution of prioritising bank profits over the interests of working people.

In a letter to Bank of England Governor Andrew Bailey, Tice accused the institution of a “systemic misuse of taxpayers’ money” by paying voluntary interest on its reserves and selling gilts back into the market.

According to Tice, these two factors are costing “tens of billions of pounds of taxpayers’ money, while enriching City institutions”.

Reform has previously claimed scrapping interest on central bank reserves could save as much as £35billion.

The interest is paid on reserves created through Quantitative Easing (QE) - a tool used by the Bank of England to lower long-term borrowing costs and support the economy.

“I was the first politician to raise this issue—largely because few others fully understood it,” Tice wrote.

“However, numerous reputable economists, as well as former Deputy Governors of the Bank, have since voiced agreement with my position.”

LATEST DEVELOPMENTS:

Richard Tice sent an open letter to the Bank of England this weekend

|PA

Quantitative Easing was first established in 2009 following the Global Financial Crisis when the central bank needed to lower interest rates and encourage spending in the economy.

According to the BoE, “QE involves us buying bonds to push up their prices and bring down long-term interest rates.

“In turn, that increases how much people spend overall which puts upward pressure on the prices of goods and services.”

Since the financial crash, the Bank of England has purchased £895billion in bonds.

Richard Tice's letter to the Bank of England (part 1)

|Supplied

Richard Tice's letter to the Bank of England (part 2)

|Supplied

Tice continued: “Some have suggested that not paying this voluntary interest would constitute a form of default.

“That is simply untrue. This money was created out of thin air by the Treasury and the Bank of England to support the economy during two periods of acute national stress over the past 18 years.

“It was never the property of City institutions. It is no coincidence that commercial bank profits have soared as interest rates rose as the Bank of England paid out tens of billions of this voluntary interest.

“These institutions cannot believe their luck.”

If the interest is eliminated, Reform would use the excess cash to pay for an increase in the tax-free personal allowance, moving the figure from £12,570 to £20,000 and cut corporation tax.

This in turn, would put more cash in taxpayers’ pockets and ease the cost of living crisis.

Tice accused Andrew Bailey's institution of a 'systemic misuse of taxpayers’ money'

|PA

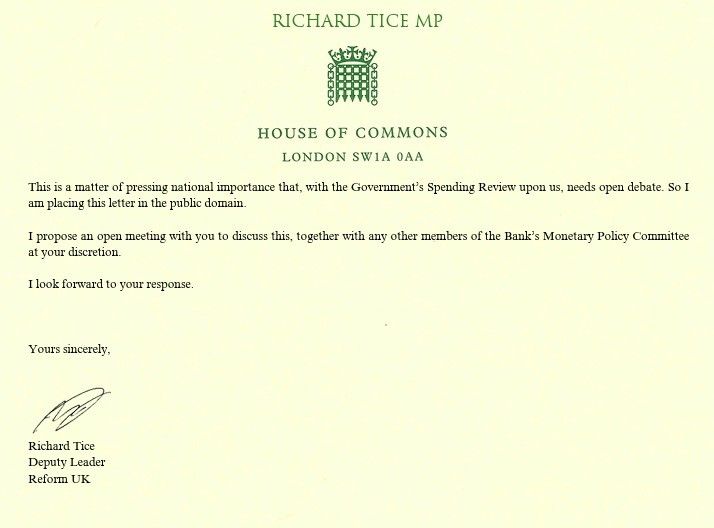

Tice continued: “Secondly, I made it clear last year that the Bank should not be selling these Bank-owned QE gilts back into the market under the process known as Quantitative Tightening (QT).

“Once again this is a voluntary decision by the Bank of England that is imposing tens of billions of pounds of unnecessary losses on the taxpayer since the General Election as you have continued this QT policy.

“Frankly, it amounts to the systemic misuse of taxpayers’ money by the Bank of England, at a time when the nation’s accounts are already under very severe pressure.

“QT is also partly responsible for keeping gilt yields higher than they otherwise would be, resulting in even more punitive interest costs, imposing yet more strain on the Government’s Profit & Loss account.”

Threadneedle Street made huge profits from QE because the returns on Government bonds were far higher than the rate it had to pay on interest on those reserves.

When interest rates were at record lows of 0.1 per cent, the Bank of England generated a total of £123.9billion and sent it to the Treasury.

However, when borrowing costs again began to rise, the Treasury was forced to transfer back around £85.9billion.

NatWest, Barclays, Lloyds and Santander received more than £9billion in interest on Bank of England reserves in 2023.

The Bank of England generated a total of £123.9billion when interest rates were at rock bottom

|GETTY

Tice continued: “Some will no doubt accuse Reform of interfering with the independence of the Bank of England. I totally disagree.

“There is a big difference between the Bank setting interest rates independently based on its mandate, and extraordinary strategic decisions which amount not to monetary policy but to fiscal policy, costing the taxpayer tens of billions of pounds of losses.

“The role of elected Governments and politicians is to protect taxpayers’ money and the broader interests of the electorate.

“It would be negligent of us to ignore this very significant issue and leave it in the hands of unelected people. Our job is to challenge, scrutinise and question.”

A Bank of England spokesman said: “The Governor set out the Bank’s views on the matter in a letter to the Treasury Select Committee.”