Rachel Reeves blasted for handing out 'huge public sector pay rises' in stark economy warning

The Chancellor could also be considering a significant reduction to tax-free pension withdrawals

Don't Miss

Most Read

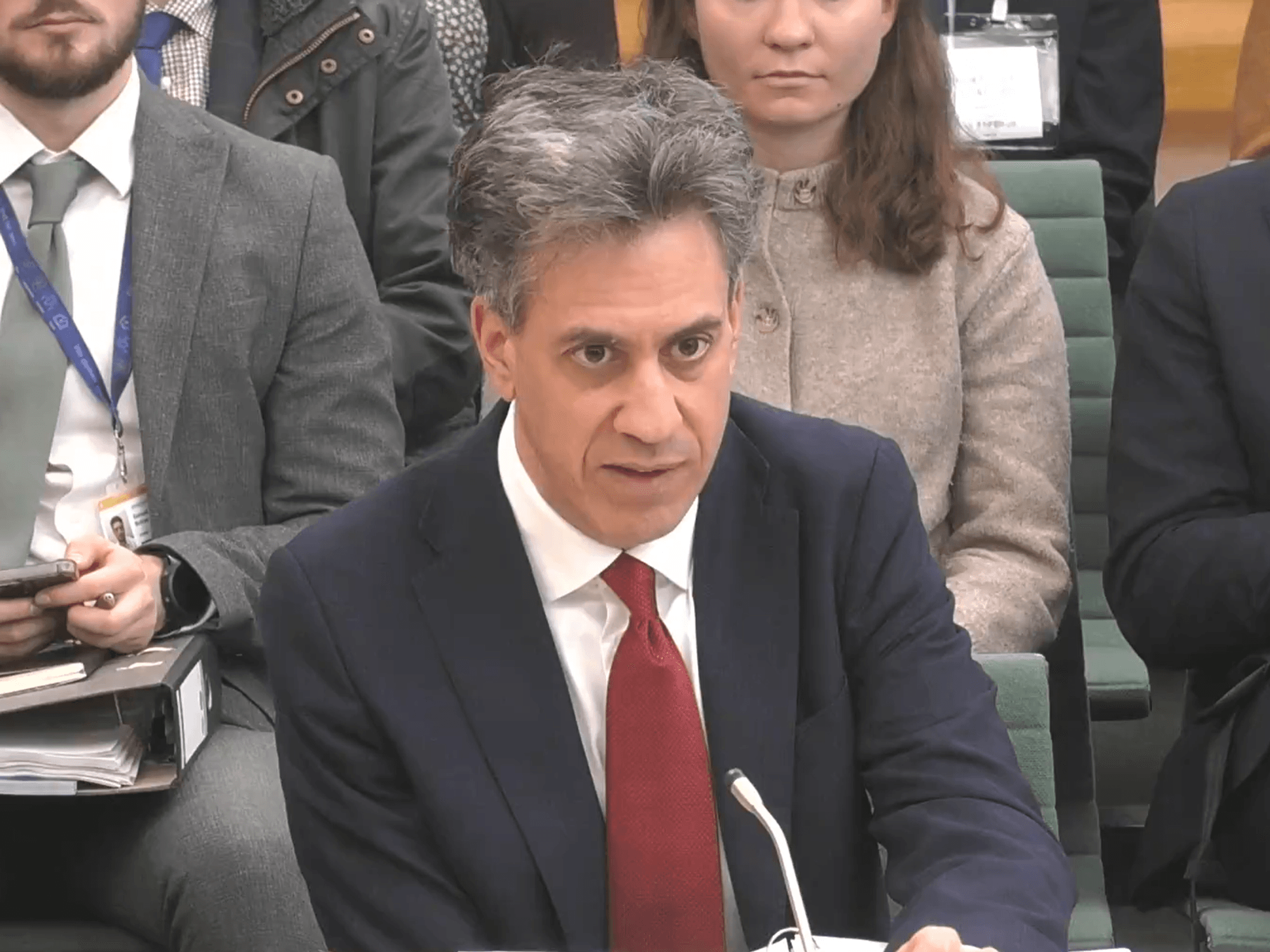

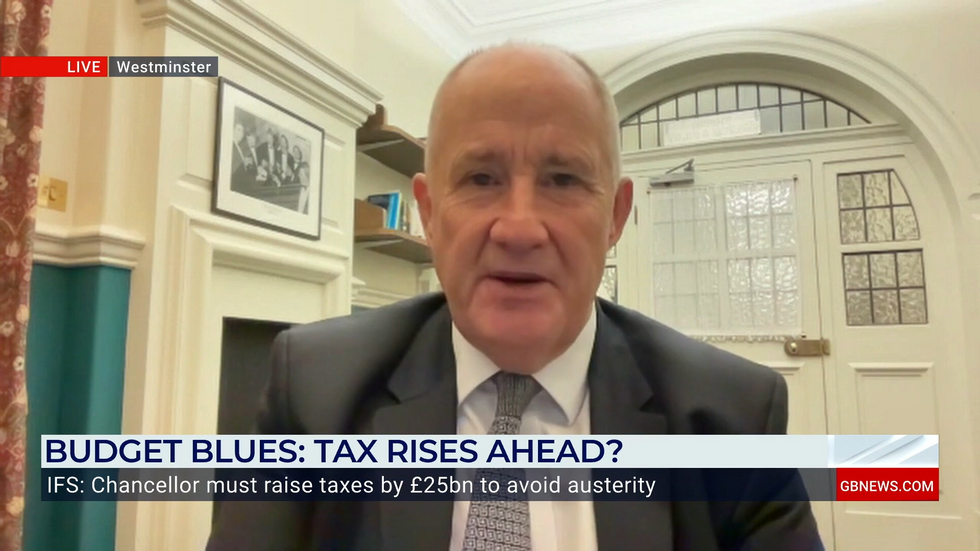

Shadow Business Secretary Kevin Hollinrake has issued a stark warning about Labour's economic plans, cautioning that large public sector pay rises without productivity gains and potential tax hikes could stifle economic growth.

Speaking on GB News, Hollinrake criticised Labour Chancellor Rachel Reeves's approach to public sector remuneration and welfare reform.

The Institute for Fiscal Studies (IFS) released a report suggesting Reeves may need to implement a £25billion tax increase to balance the books, ahead of the party's looming Budget.

The warning highlights growing concerns about Labour's fiscal strategy, with Hollinrake arguing that the party's policies could lead to "more tax increases, more spending" in the next budget.

Rachel Reeves has been criticised for paying public sector workers more ahead of Labour's Budget

|PA / GB News

Hollinrake's criticism of Labour's approach was pointed. He said: "They also decided simply to hand over huge public sector pay rises and pay rises to train drivers without asking for any productivity gains in return."

The Shadow Business Secretary argued that these increases could have been funded through productivity improvements, but Labour had not attached any conditions.

He expressed concern about potential tax increases, particularly on businesses, noting that Labour had refused to rule out raising National Insurance contributions from employers.

Hollinrake warned that such measures, combined with proposed workplace reforms, could damage business confidence and economic growth.

LATEST DEVELOPMENTS:

- Kemi Badenoch tipped to win Tory leadership election after shock Cleverly exit

- Businesses slam Rayner's workers rights revolution which will be 'bad for jobs'

- Pensioner blasts Labour’s ‘utter cruelty’ over winter fuel cuts as she fears for excess deaths

Reeves could be considering a significant reduction to tax-free pension withdrawals | Getty

Reeves could be considering a significant reduction to tax-free pension withdrawals | GettyHe emphasised the need for efficiency and productivity gains, especially in the public sector, to balance budgets without resorting to austerity or excessive taxation.

The IFS report, released today, paints a grim picture of the fiscal challenges facing Labour. It suggests that Chancellor Rachel Reeves may need to implement a £25billion tax increase to meet pledges and balance the books by 2028/29. This would be nearly double the size of the coalition's austerity measures after the credit crunch.

Potential targets for tax hikes include national insurance, pension pots, inheritance tax, and capital gains.

The report states that ensuring all departments see their day-to-day budgets rise at least in line with national income would require a further top-up of £17billion.

IFS director Paul Johnson described Reeves' upcoming Budget as potentially "the most consequential since at least 2010".

He noted that the Chancellor is constrained by Labour's pledges not to raise main rates of income tax, corporation tax, National Insurance, or VAT.

Hollinrake offered alternative approaches to economic growth and efficiency, particularly in the NHS and public sector.

He emphasised the need for productivity improvements, stating: "We need to get more efficient, productivity has stalled, particularly in the public sector."

Kevin Hollinrake said 'confidence is dropping' in Labour ahead of the announcement

|GB News

The Shadow Business Secretary highlighted Conservative plans to reduce the number of managers in the NHS and improve its productivity.

He criticised Labour's focus on union-dictated policies, warning that proposed workplace reforms could be "massively damaging" to the economy.

Hollinrake cited concerns from the Federation of Small Businesses, suggesting these reforms could lead to job losses and economic inactivity.

He concluded: "This is what we're heading towards and it's not good news," underscoring his view that Labour's approach could hinder economic growth and job opportunities.