Scrapping stamp duty just handed one of our party leaders a massive advantage. But which one? - Miriam Cates

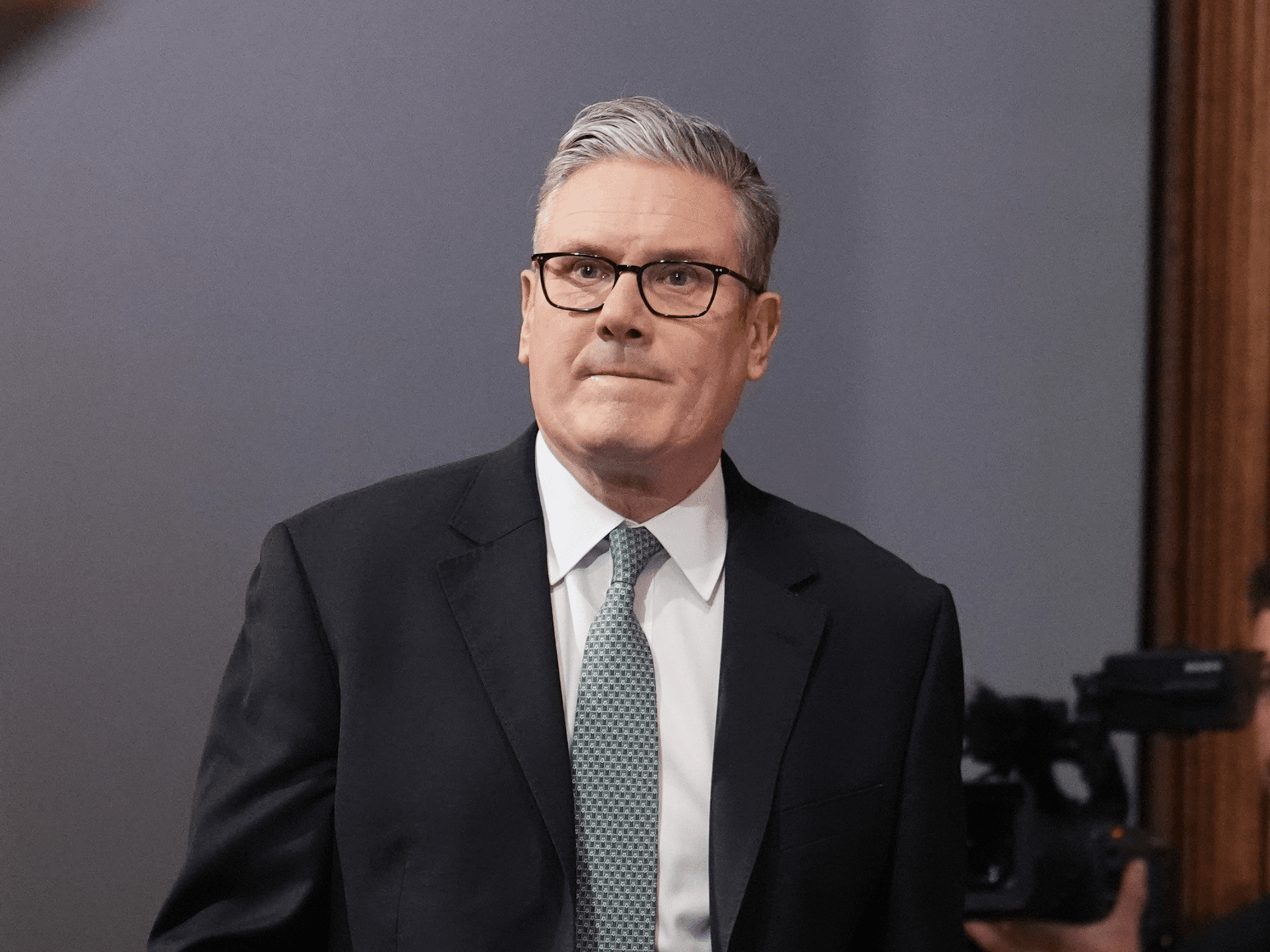

Kemi Badenoch unveils Conservative's plans to scrap stamp duty |

GB

Scrapping stamp duty will stimulate the economy - but we must boost housing supply as well as demand, writes GB News Presenter Miriam Cates

Don't Miss

Most Read

Trending on GB News

Well, she certainly saved the best until last. Throughout this week’s party conference, Conservative leader Kemi Badenoch and her front bench team have issued a slew of new policy announcements.

From a commitment to leaving the ECHR to scrapping the Climate Change Act, Badenoch has sought to put an end to the criticism that she has been too slow to come up with new policies after being elected Tory leader just under a year ago.

In her speech to a packed auditorium in the final session of the conference this morning, Badenoch made a few more additions to her new policy platform, including pledging to reverse Labour’s VAT raid on schools and abandon ‘Net Zero’ should she become Prime Minister at the next general election.

Many of these policy interventions had been trailed in advance and widely reported in the press. But in the final minutes of her speech, Badenoch stunned her audience with a commitment that few had seen coming; the Leader of the Opposition pledged that a Conservative government would scrap stamp duty in a move she said would help “achieve the dream of homeownership for millions”.

Stamp duty – or Stamp Duty Land Tax (SDLT) to give it its full name – is a deeply unpopular levy. It is the tax that must be paid whenever a property over the value of £ 250,000 is purchased.

The amount of SDLT due depends on the price of the house; buyers owe five per cent of the purchase price above £250,000 and below £925,000, 10 per cent on the next £575,000 (up to a value of £1.5 million) and 12 per cent after that.

So, a house bought for £200,000 will incur no SDLT, someone buying a property priced at £400,000 will owe £7,500, and a house costing £600,000 incurs a charge of £17,500.

A property worth £1million will attract a tax bill of an eye-watering £41,250. This tax must be paid on every property purchase, and the rates are even higher for those buying a second home.

Scrapping stamp duty just gave one of our party leaders a massive advantage. But who? - Miriam Cates

|Getty Images

More often than not, the cost of the SDLT is added to the borrower’s mortgage, which means that, once interest is priced in, homeowners end up paying even more.

If you borrow an extra £10,000 to pay your stamp duty bill at an interest rate of five per cent over a term of 30 years, you will end up paying your mortgage company an additional £15,000 of interest on top of the £10,000 handed over to HMRC.

Although stamp duty doesn’t apply to the lowest value homes, most house purchases involve a chain of buyers and sellers; if those at the ‘top’ of the chain can’t afford to move, the whole housing market stagnates.

Stamp duty doesn’t just stop individuals from relocating, downsizing and upsizing when they need to; it has also put the brakes on Britain’s economic growth more generally.

When people move house, the local economy gets a boost, with plumbers, decorators, electricians, kitchen fitters, furniture suppliers and others often called in to help with refurbishments.

When former Chancellor Rishi Sunak announced a stamp duty ‘holiday’ in his March 2021budget to help restart the economy after the pandemic, house sales soared from an average of around 100,000 per month to 184,000 transactions in June 2021.

Scrapping Stamp Duty may cost the Treasury in the short term – last year, just under £12billion was paid into government coffers – but it is reasonable to expect that the longer-term benefits to the economy from trade and construction activity will outweigh the lost revenue.

Scrapping SDLT will certainly help hard-pressed homeowners. But for young people, the most important question will be whether or not the new Tory policy will help them get on the housing ladder in the first place.

One of the greatest challenges facing our young generation is that house price inflation over the last 30 years has made it almost impossible to even dream about owning their own home.

In the 1980s, the average house cost around three and a half times the average salary; now that ratio has doubled, with the average property priced at seven times the average full-time wage.

The average cost of a first property in the UK is now £ 311,000, but with huge regional variations. First-time buyers in the northeast can expect to pay £ 180,000 for their first property (which is below the current stamp duty threshold), whereas Londoners need to find an astonishing £ 511,000.

Scrapping stamp duty should, in theory, make housing cheaper and therefore help more young people buy their first home.

But there’s a catch. While scrapping SDLT will certainly stimulate the housing market, it is what economists call a ‘demand-side’ reform.

Abolishing tax on property transactions will, in the short term at least, reduce the upfront cost of moving house and therefore increase demand for property. But in and of itself, binning stamp duty won’t increase the supply of houses.

With such a shortage of homes – the UK has one of the lowest numbers of dwellings per inhabitant in the whole of Europe – any increase in demand could just push prices up further, counteracting the impact of the tax cut.

In the long term, therefore, this reform must be accompanied by supply-side reforms – measures to increase the number of houses being built – otherwise its only impact will be to further benefit mortgage lenders as house prices continue to rise.

Kemi Badenoch’s stamp duty announcement is a welcome one and will be popular with many. Whether or not it will be enough to give her party a boost in the polls remains to be seen, and there is every possibility that Reform UK, the Conservatives’ main rivals, will adopt the same policy, erasing any political advantage.

Whether it turns out to be an election-winning pledge or not, the Tories have started an important conversation about the role of the housing market in boosting our economy.

But if this policy is going to achieve Badenoch’s aim of helping young people onto the first rung of the property ladder, it must also be accompanied by radical measures to boost the supply of housing, such as planning reforms, land supply, and an increase in social housing construction.

The Conservatives have correctly identified the first piece in the puzzle; let’s hope they can find the rest.

More From GB News