‘That’s her life savings’ - Building society customers left heartbroken over £138m Philips Trust Scandal

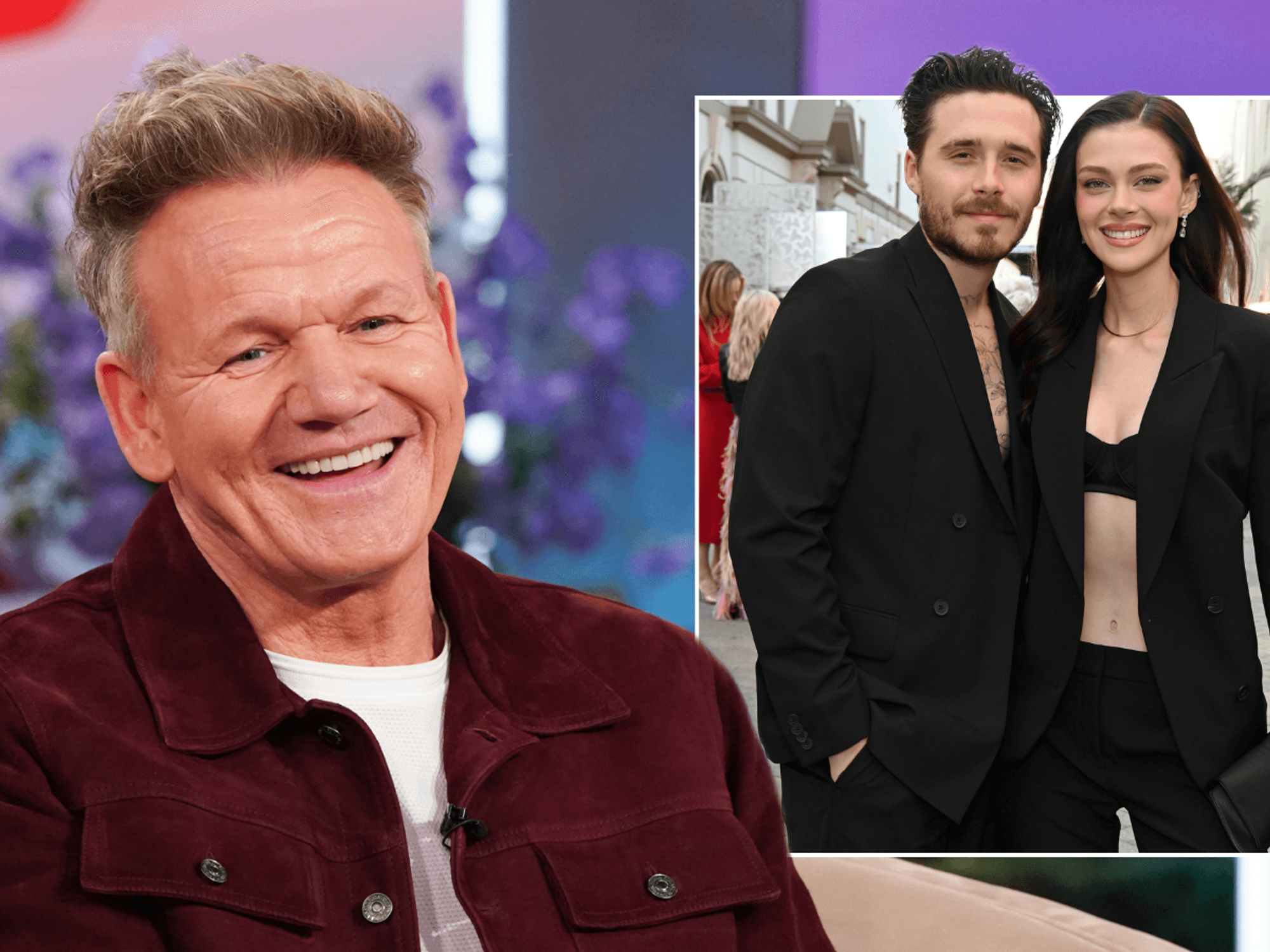

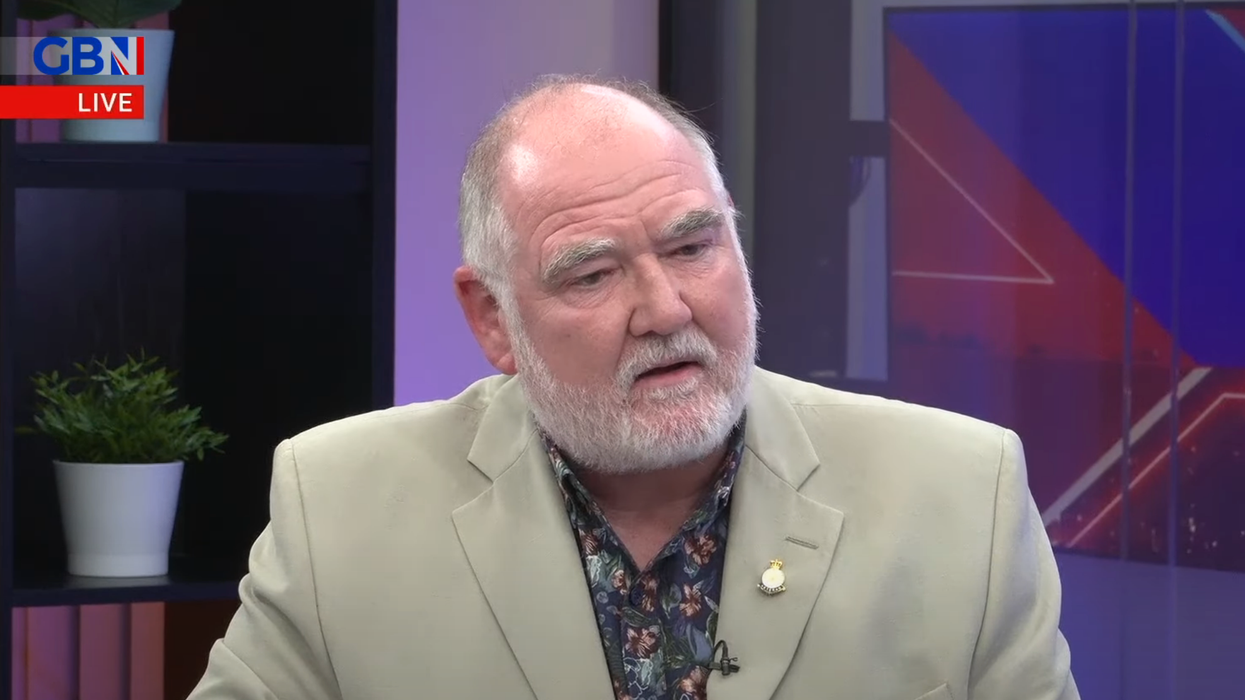

Gordon Crosthwaite speaks about his troubles over the Philips Trust scandal

|GB NEWS

They were introduced to third parties to get help writing their wills

Don't Miss

Most Read

Thousands of building society customers are owed more than £138 million after being duped into putting their money into trust funds.

They were introduced to third parties to get help writing their wills and investing pensions into trust funds.

Philips Trust Corporation took over the firms when they went bust and last year it entered administration.

One victim says his mother-in-law is owed £117,000 after handing over cash her late husband had saved.

She was told by Newcastle Building Society (NBS) to give money to Will Writing Company despite already having a will organised.

As a result of this arrangement, NBS received commission.

Gordon Crosthwaite told GB News: “Her savings were set up in a way that would take care of her disabled son when she passes.

“The impact on her is that she doesn’t have the money to take care of him.

“That’s her life savings. That’s what her husband worked overseas for.”

He added: “There were three transactions made that NBS facilitated. On each occasion, they took a commission.”

Gordon Crosthwaite speaks to Nigel Farage

|GB NEWS

Gordon’s mother-in-law is one of 2,345 victims of the scandal which involve customers of other building societies around the country including Leeds and Nottingham.

Administrators at Kroll Advisory begun investigating Philips Trust last May shortly after it too went bust.

Campaigners have slammed an investigation by the Financial Conduct Authority which wrote to the building societies for an account of events, which it then accepted without asking for consumers' experience and evidence.

The All-Party Parliamentary Group on Personal Banking and Fairer Financial Services says the regulatory body was “complacent”. It gathered its own evidence, which it has supplied to the FCA, and has called for another review.

An FCA spokesperson said: “This is a very complex issue involving the provision of unregulated services by unregulated firms.

“Where concerns about regulated firms have been raised, we have asked the firms for more information which we have scrutinised. We have also recently been sent information from consumers affected by this issue and are reviewing this currently.

“We always review information and correspondence sent to us and ensure that the most appropriate person provides a response, understandably this will not always be the Chief Executive or the Chair.”

On Friday, the FCA said it had asked a number of building societies for further information about customer referrals to trust service providers.

A Newcastle Building Society spokesman said: “Newcastle Building Society previously acted only as an introducer to The Will Writing Company Limited (TWWC) who provided estate planning advice to our customers. TWWC ceased trading In November 2017 and subsequently entered administration in February 2018.

"The Society’s relationship with TWWC ended at this point.

“In the months following the collapse of TWWC, it became clear that The Family Trust Corporation (FTC) were introducing some customers to The Philips Trust Corporation (PTC) who, in turn, were suggesting that customers now agree to appoint PTC as trustees.

“At no point have Newcastle Building Society had any involvement with the Philips Trust Corporation.

"Any allegation which states that we have consented to, supported or been involved in any transfer from TWWC or FTC to Philips Trust Corporation is untrue.

“We know this series of events has been a source of distress for a number of people.

"When TWWC ceased trading we arranged for a heavily discounted trustee reassignment service to be provided by an independent third party which gave customers an option to move away from corporate trustees and appoint alternative trustees, such as family members, in their place.

"A number of our customers took up this service. We continue to respond to all related queries on a case-by-case basis.”