Mortgage payments expected to increase for millions after Bank of England raises interest rate

More than a quarter of mortgage borrowers, about 2.2 million, are on home loans linked to the base rate, meaning that their bills will increase from next month.

Don't Miss

Most Read

Latest

Millions of mortgage borrowers face higher monthly repayments after the Bank of England put up its base rate by 0.15 percentage points in response to inflation of more than 5 per cent.

Members of the Monetary Policy Committee (MPC) voted eight to one to raise rates from the historic low of 0.1% in a move to tackle rampant rises in the cost of living.

Over a quarter of mortgage borrowers, about 2.2 million, are on home loans linked to the base rate, meaning that their bills will increase from next month. Banks have tended to pass on past base rate rises in full to these borrowers.m

In minutes of the decision to rase interest rates, the Bank cautioned that inflation would peak at 6% in April – the highest since March 1992 and three times its 2% target.

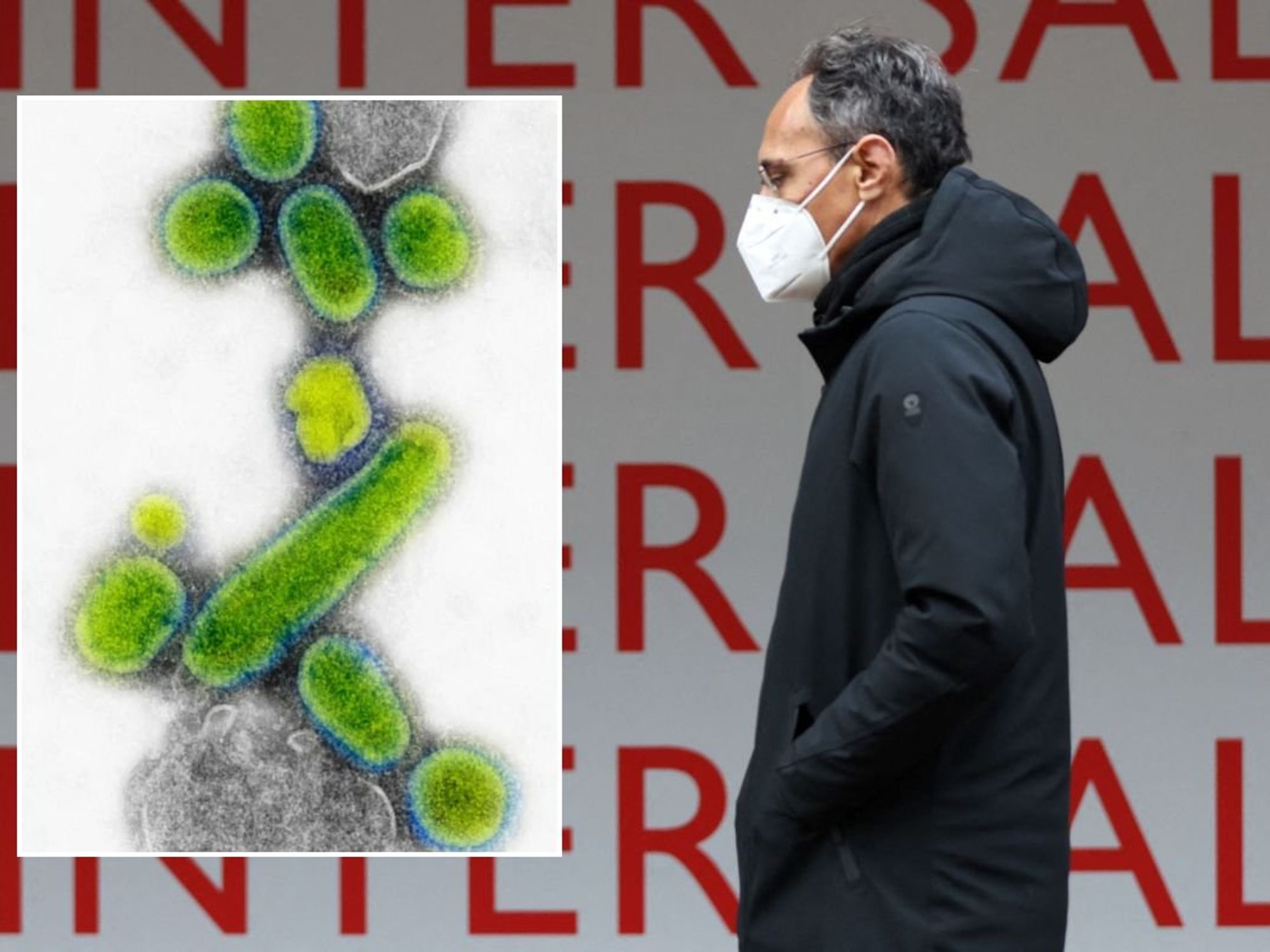

The hike comes despite mounting fears over the impact of the Omicron variant of coronavirus on the economy, with the Bank flagging signs that it is already slowing growth.

It downgraded the growth outlook to 0.6% in the fourth quarter from a previous forecast of 1%.

Pressure has been building on the Bank to bring rocketing inflation under control, with official figures this week showing the Consumer Prices Index jumped to 5.1% – the highest level for more than a decade.

The Bank said: “Most members of the committee judged that an immediate, small increase in Bank rate was warranted.”

But it said the decision was “finely balanced”, noting that Omicron is “spreading rapidly within the United Kingdom and around the world”.

It said there was “some value in waiting for further information on the degree to which Omicron was likely to escape the protection of current vaccines and on the initial economic effects of this new wave”.

“There was, however, also a strong case for tightening monetary policy now,” it said.

Rates had been at 0.1% since March last year, when the Bank moved to prop up the economy in the early days of the pandemic.

It is the first increase since August 2018 and sees the Bank become the first of the major central banks to raise rates since the start of the pandemic.

The pound rose strongly after the decision, which caught financial markets by surprise after many thought Omicron had put paid to any action.

The Bank said the spread of the new variant and restrictions to control it were set to impact economic growth in December and the first quarter of next year.

But it warned that the economic impact of the new variant could also lead to even higher inflation.

The Bank added that the knock to UK growth was lessening with each wave of the pandemic, although it stressed there was “uncertainty around the extent to which that would prove to be the case on this occasion”.

The British Chambers of Commerce (BCC) called the Bank’s decision to hike interest rates “surprising” in light of the sharp rise of Covid cases.

Alpesh Paleja, lead economist at the CBI business group, said: “The decision to raise interest rates signals that the MPC wants to get off on the front foot in tackling rising inflation.”

Economist Samuel Tombs, at Pantheon Macroeconomics, said the move “underlines how worried it is about the outlook for inflation”.

He believes further rate increases are still on the cards, but that the Bank will wait until May to deliver another rise, to 0.5%.