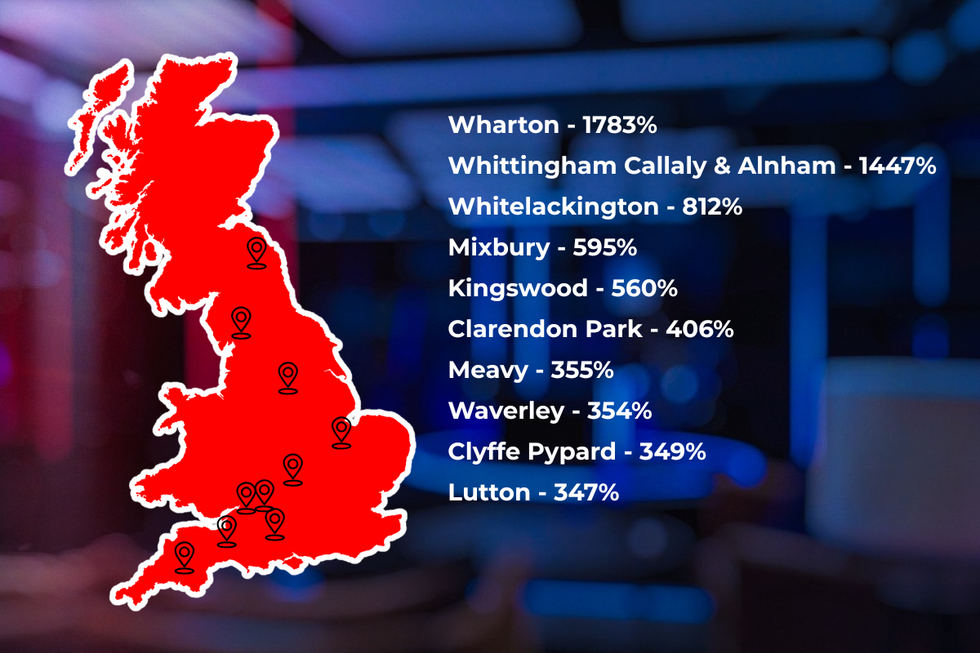

MAPPED: The 10 councils hitting residents with a 'local stealth tax' as levies rise more than 300% overnight

Householders across the country face massive increases

Don't Miss

Most Read

Trending on GB News

Residents living in rural areas are being hit with a "local stealth tax" as parish councils have been forced to step in to provide vital services.

Cash-strapped borough and district councils are scrapping and pulling funding from services aimed at helping neighbours in small towns and villages.

While there is a cap on the amount district councils can increase their tax, there is no such limit for parish councils, meaning some areas have seen massive increases.

In April, a total of 11 parishes increased their council tax precepts by more than 300 per cent, reports The Telegraph.

The ten parish councils where levies have risen by over 300 per cent

|GB NEWS

The worst impacted area was Wharton in Westmorland, Cumbria where the precept went up by 1,783 per cent from £1.67 to £31.45. Meanwhile, Whittingham Callaly & Alnham Parish Council in Northumberland went up 1,447 per cent.

In Somerset, the county council said it has been forced into devolving funding into town and parish council as it is staring down the barrel of a £35million budget cut.

Some of the services cut include funding for maintenance for public toilets, CCTV, visitor centres and other local amenities.

This includes Whitelackington Parish Council, which saw an 812 per cent jump from £7 to £64.

Elsewhere, Yeovil Parish Council precept rose 90 per cent from £145 to £276, and Taunton’s by 173 per cent from £110 to £299 in 2024-25.

Wharton Parish - Westmorland and Furness Council

Wharton Parish

|GOOGLE MAPS

- 2023-2024 levels: £1.67

- 2024-2025 levels: £31.45.

- Nominal increase: 1,783 per cent

Whittingham Callaly & Alnham Parish - Northumberland County Council

- 2023-2024 levels: £2

- 2024-2025 levels: £31

- Nominal increase: 1,447 per cent

Whitelackington Parish - Somerset Council

St Mary's Church

|WIKICOMMONS

- 2023-2024 levels: £7

- 2024-2025 levels: £64

- Nominal increase: 812 per cent

Mixbury Parish - Cherwell District Council/Oxfordshire County Council

- 2023-2024 levels: £4

- 2024-2025 levels: £25

- Nominal increase: 595 per cent

Kingswood Parish- South Gloucestershire Council

- 2023-2024 levels: £15

- 2024-2025 levels: £99

- Nominal increase: 560 per cent

Clarendon Park Parish - Wiltshire County Council

- 2023-2024 levels: £7

- 2024-2025 levels: £37

- Nominal increase: 406 per cent

Meavy Parish - West Devon Council

The Royal Oak, Meavy

|WIKICOMMONS

- 2023-2024 levels: £8

- 2024-2025 levels: £38

- Nominal increase: 355 per cent

Waverley Parish - Rotherham Metropolitan Borough Council

- 2023-2024 levels: £63

- 2024-2025 levels: £288

- Nominal increase: 354 per cent

Clyffe Pypard Parish - Wiltshire Council

- 2023-2024 levels: £6

- 2024-2025 levels: £29

- Nominal increase: 349 per cent

Lutton Parish - North Northamptonshire Council

St Thomas' Church in Lutton

|GOOGLE MAPS

- 2023-2024 levels: £15

- 2024-2025 levels: £67

- Nominal increase: 347 per cent

Shadow communities secretary Kevin Hollinrake said: "The Labour Government is forcing up council tax across the board through their fiddled funding.

"Parish councils have had no compensation at all from Rachel Reeves’s job tax, leading to a double whammy of soaring council tax on top.

"Labour’s flawed plans for top-down unitary restructuring also threaten to lead to cost shunting from the old councils down to parish level, cooked up in Whitehall but with town and parish councils to take the blame."

A spokesman for the Wharton parish council told The Telegraph its increase was so high because of an administrative error the year before.

More From GB News