Winter Fuel Payment U-turn branded 'chaotic' as it could tax dead pensioners' families

Keir Starmer opens door to U-turn on Winter Fuel Payments |

GBNEWS

Families may be chased for Winter Fuel Payments if pensioners die before tax recouped

Don't Miss

Most Read

The Treasury is thought to be exploring a system that could see bereaved families taxed in a bid to recoup costs for wealthy pensioners' Winter Fuel Payments.

Under the proposed approach, the Government would restore Winter Fuel Payments as a universal benefit but then claw back up to £300 from wealthier pensioners through their tax returns.

However, Government insiders have raised concerns about the implications of the time lag between payment and recovery.

Insiders have described the process of reinstating the payment as chaotic, with concerns about the "dire optics" of a plan to reclaim the money from wealthier pensioners through the tax system, especially if they die before it can be recovered, according to the Guardian.

With at least six months between the benefit being paid and HMRC recouping it through the tax system, thousands of pensioners could die during this period.

This would potentially leave grieving families responsible for settling the tax bill on behalf of their deceased relatives.

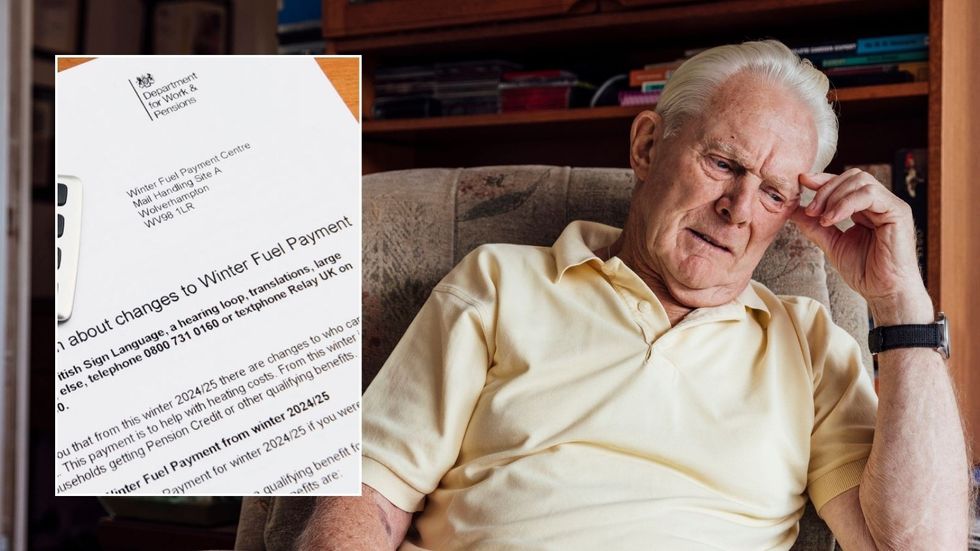

The Winter Fuel Allowance is intended to help people who have reached state pension age with the cost of heating in the winter | GETTY

The Winter Fuel Allowance is intended to help people who have reached state pension age with the cost of heating in the winter | GETTYJonathan Athow, a senior HMRC official, told the Treasury select committee on Wednesday that implementing changes through the tax system would create significant delays.

"We'd have to get to April next year before we knew somebody's income, before we could then make any decisions about how [recouping the payment] would then be implemented," he told MPs.

This timeline confirms that payments made this winter could not be clawed back until at least April 2026, creating a minimum six-month gap.

One Government source expressed alarm at the potential consequences: "We should never have scrapped the Winter Fuel Payments in the first place, but the whole process of reinstating it has been completely chaotic.

"The optics of us demanding the money back from grieving families are dire."

Chancellor Rachel Reeves confirmed on Wednesday that changes to the Winter Fuel Payments means test will be implemented in time for this winter's payments.

Speaking to reporters after a speech in Rochdale, Reeves said: "We have listened to the concerns that people had about the level of the means test, and so we will be making changes to that; they will be in place so that pensioners are paid this coming winter."

The Chancellor indicated that the income threshold, currently set at £11,500, will be raised to allow more pensioners to qualify for the benefit.

Rachel reeves has confirmed she will not alter her fiscal rules | Parliament TV

Rachel reeves has confirmed she will not alter her fiscal rules | Parliament TV"We'll announce the detail of that and the level of that as soon as we possibly can. But people should be in no doubt that the means test will increase and more people will get a Winter Fuel Payments this winter," she said.

The Government is considering restoring Winter Fuel Payments as a universal benefit before recouping money from higher-income pensioners through the tax system, similar to the approach taken with child benefit.

This mirrors the system introduced by former Conservative chancellor George Osborne, who reduced child benefit eligibility for better-off parents through tax clawbacks rather than creating a new means test.

Pensioners are distressed about recent changes to the Winter Fuel Payment allowance | GETTY

Pensioners are distressed about recent changes to the Winter Fuel Payment allowance | GETTY Ministers are exploring this option because establishing an entirely new means test would be highly complex to implement.

The approach would see all pensioners receive the payment initially, with wealthier recipients required to repay the benefit when filing their tax returns.

However, the significant time lag between payment and clawback remains a key concern, particularly regarding the potential impact on bereaved families.

More From GB News