Universal Credit to increase by 6.7 per cent next year - 5.5 million to get £470 boost on average

The DWP has confirmed the new rates for Universal Credit from April 2024

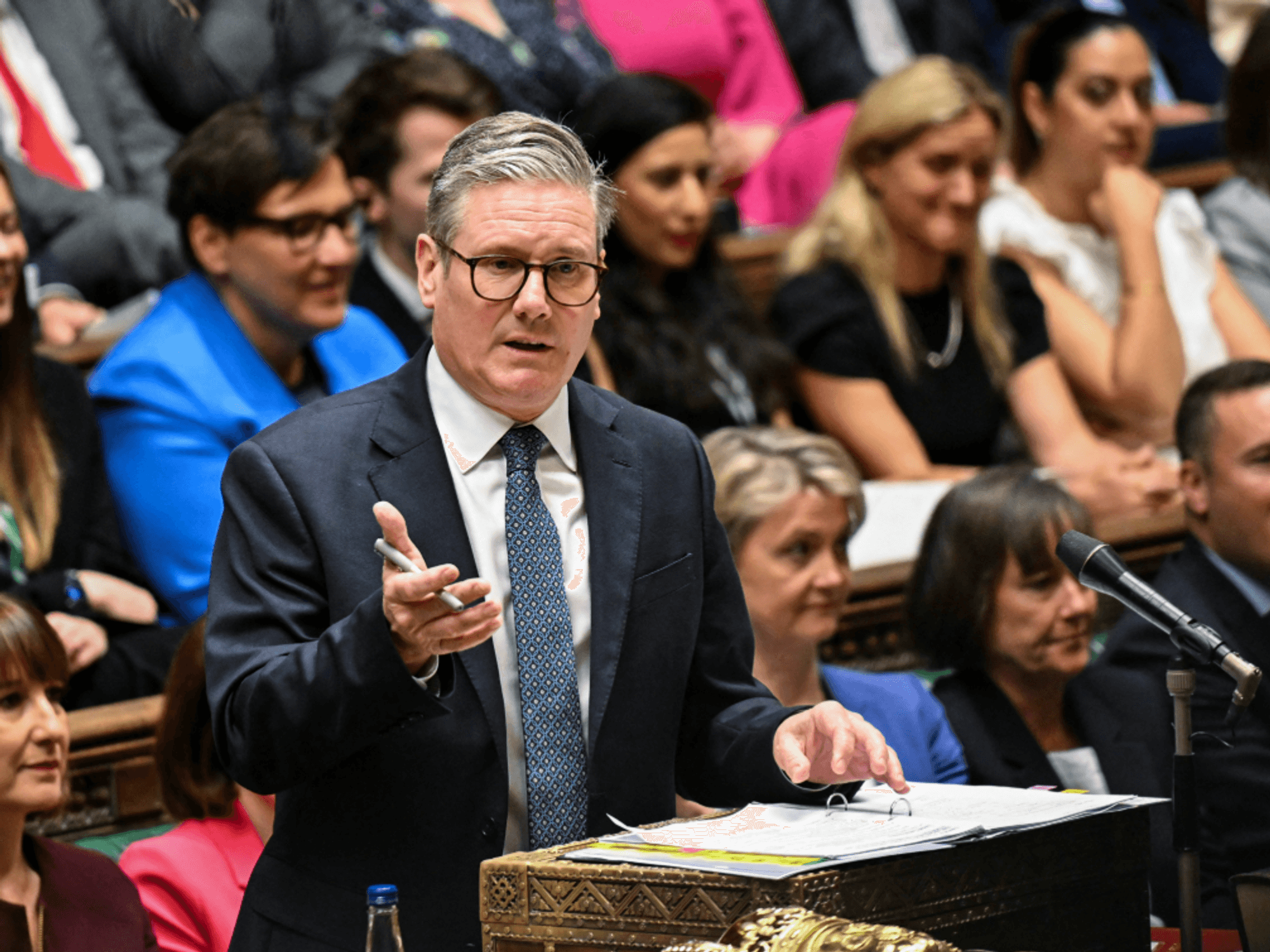

|PA

The Department for Work and Pensions (DWP) has confirmed the new rates for Universal Credit today

Don't Miss

Most Read

Universal Credit will increase by 6.7 per cent, in line with September's inflation figure, from April 2024, Jeremy Hunt has announced.

It will see 5.5 million households on Universal Credit gaining £470 on average in 2024/25, according to the Treasury.

Universal Credit is made up of a standard allowance, with the amount depending on circumstances, and some people may get more money on top of this if they meet the eligibility criteria.

For example, people who have a health condition or disability, cares for someone with a health or disability-related benefit, or those with children can qualify for additional monthly amounts.

WATCH NOW: Jeremy Hunt confirms Universal Credit will rise by 6.7% next year

Universal Credit, Personal Independence Payment, Carer's Allowance, Income Support, Housing Benefit, and Jobseeker's Allowance increased by 10.1 per cent in April this year, in line with the inflation rate used for uprating benefits.

The state pension was also uprated by 10.1 per cent. From April 2024, the state pension will rise by 8.5 per cent under the triple lock.

Universal Credit standard allowance: 2024/25

Universal Credit will increase by 6.7 per cent in April 2024.

The standard allowance a person gets depends on their circumstances.

According to GB News calculations, from April 2024, the monthly Universal Credit standard allowance would be as follows:

- Single and under 25 - £311.68

- Single and over 25 - £393.45

- Couple both under 25 - £489.23

- Couple with at least one partner over 25 - £617.60

People may get additional amounts on top of the standard allowance, depending on their circumstances.

Universal Credit standard allowance: 2023/24

People who are single and under 25 currently get £292.11 a month.

A single person who is 25 or older can get £368.74.

Those who live with a partner and both people are under 25 can get £458.51 (for you both).

If a person lives with their partner and one person in the couple is over 25, they can get £578.82 (for you both).

People might find their payments are reduced for various reasons.

LATEST DEVELOPMENTS:

Universal Credit payments will reduce as a person earns more

|PA

The government states Universal Credit payments may be reduced if:

- “You are paying back an advance on a Universal Credit payment

- “You have more than £6,000 in money, savings and investments

- “You would get above the amount limited by the benefit cap

- “You’ve been overpaid benefits in the past

- “You owe money for Council Tax, court fines, electricity, gas, water or Child Maintenance

- “You pay your gas or electricity bill directly from your Universal Credit payment

- “You have a paid job

- “You have other income – for example, money from pensions or certain other benefits.”

There is no limit as to how many hours a person can work on Universal Credit.

Universal Credit payments will reduce as a person earns more.

For each £1 a person or their partner earns, their payment will reduce by 55p.

Some people may qualify for a work allowance – meaning they can earn that much of monthly income before their Universal Credit reduces.

The work allowance may apply if a person or their partner are either:

- Responsible for a child or young person

- Living with a disability or health condition that affects their ability to work

In 2023/24, the monthly work allowance is £379 for eligible people who get help with housing costs.

For those who don’t get help with housing costs, the monthly work allowance is £631.

It’s important to be aware that how often a person is paid can affect their Universal Credit. There is more information available on the Gov.uk website.