UK mortgage rates: Nearly 800 mortgage deals SCRAPPED over interest rate fears

Nearly 800 residential and buy-to-let deals have been taken off the market since last week over interest rate fears

|PA

Nearly 10 per cent of UK mortgage deals have been taken off the market amid uncertainty over rates

Don't Miss

Most Read

Latest

Nearly 800 residential and buy-to-let mortgage deals have been taken off the market since last week amid concerns about how high interest rates will go.

Uncertainty over rates has meant deals had been pulled as lenders were reassessing their offers.

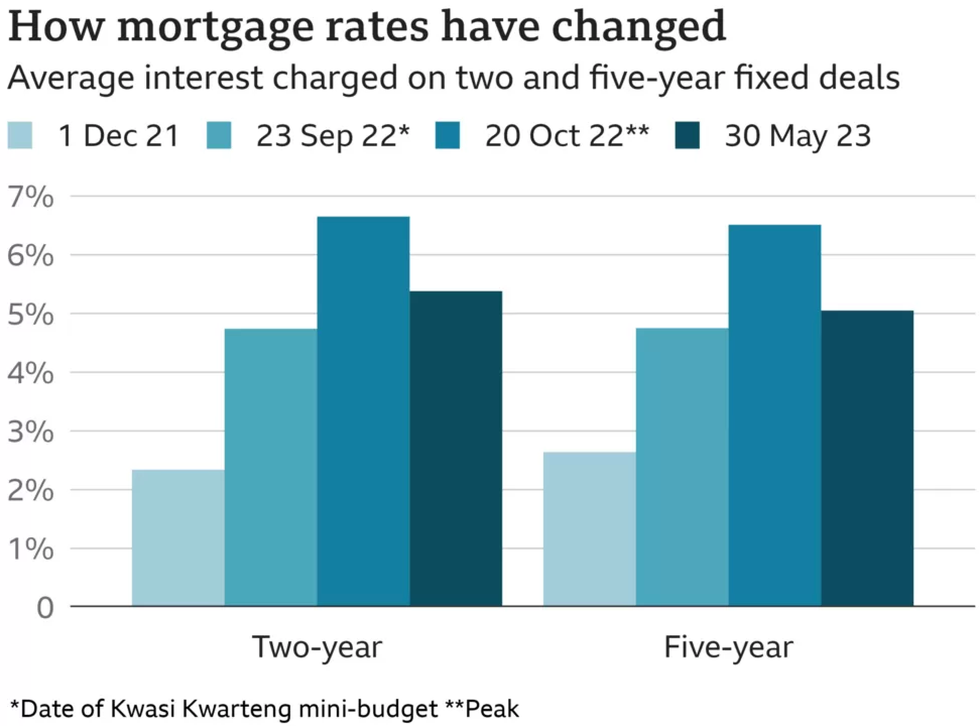

Average rates on two-year and five-year fixed mortgage deals have also risen.

It comes after inflation figures, which were higher-than-expected, raised predictions of how much UK interest rates will rise.

Average rates on two-year and five-year fixed mortgage deals have risen

|Moneyfacts.co.uk

Official figures last week showed that the UK inflation rate – displaying rising prices - slowed in April to 8.7 per cent.

That led to a strong reaction in the markets, with investors now predicting the Bank of England will have to raise interest rates above their current level of 4.5 per cent to as high as 5.5 per cent to try to slow price rises.

The change in inflation rate expectations has led to big changes in prices and interest rates in the bond markets, having a knock-on effect on mortgages. As a result, ‘swap rates’ which lenders use to price home loans, have increased.

According to the finance website Moneyfacts, since the start of last week the number of residential mortgages on the UK market has fallen by 373 - from 5,385 deals to 5,012. The number of buy-to-let mortgages has fallen by 405 to 2,343.

Mortgage rates have gone up, with the average rate on a two-year fixed deal rising to 5.38 per cent

|PA

Mortgage rates have also gone up, with the average rate on a two-year fixed deal rising to 5.38 per cent, and the average rate on a five-year fixed now standing at 5.05 per cent.

They are far higher than they were last May, when two- and five-year fixed rates stood at 3.03 per cent and 3.17 per cent respectively.

But they are still some way off the levels seen last October, just after the mini-budget spooked markets and drove up borrowing costs.

The impact of this budget, passed in September, saw lenders initially withdrew from the market due to the high level of uncertainty.

Rachel Springall, a finance expert at Moneyfacts, said: "Borrowers searching for a new deal may well be concerned about the latest developments in the mortgage market.

"Over the past few days, we have seen a few lenders withdraw selected fixed products, with some pulling out of the market, at least temporarily. Product choice has started to fall, and as may be expected, average fixed mortgage rates are on the rise."

Property prices have been falling over the last six months as borrowing costs creep up, limiting people's buying power.

But earlier on Tuesday the property website Zoopla said buyer confidence appeared to be improving, with sales reaching their highest point of the year so far in April.