UK’s cheapest supermarket unveiled as inflation pushes food prices up by 5.1 per cent

MARKSANDSPENCER-BEST-SUPERMARKET

|GBNEWS

The rate of food and drink inflation rose to 5.1 per cent in August as shoppers continue to face higher prices for items at the till

Don't Miss

Most Read

Shoppers are being warned to brace for higher grocery bills even as one retailer comes out on top for value.

A fresh comparison by Which? shows the gap between Britain's cheapest and priciest supermarkets is widening.

Aldi has secured its spot as the nation’s most affordable supermarket, with a typical basket of 75 everyday items costing £127.92 in August. The German discounter narrowly beat rival Lidl, where the same shop came in at £128.35.

Among the traditional chains, Asda offered the best value at £139.42, despite not relying on loyalty schemes to bring prices down.

At the other end of the scale, upmarket retailer Waitrose charged £172.61 for the same basket of goods, a 35 per cent premium compared with Aldi.

Loyalty schemes offered only modest relief. Lidl Plus members saw their basket reduced slightly to £128.30, while Tesco Clubcard holders saved around £2.65.

The analysis included both branded products and retailers' own-label alternatives, providing a comprehensive view of grocery costs across the sector.

British shoppers face mounting pressure as food and drink inflation climbed to 5.1 per cent in August, up from 4.9 per cent the previous month. This marks the fifth consecutive monthly rise in grocery costs, according to Office for National Statistics data.

Essential supermarket staples such as vegetables, dairy products, fish and beef have all risen sharply in price, piling further pressure on household budgets.

inflation pushes food prices up by 5.1 per cent

| PAShoppers have seen only limited relief from falling costs of items like pasta, rice and olive oil, with the overall trend still pointing upward.

The British Retail Consortium said higher shelf prices were being driven by rising employment costs and poor harvests that have disrupted supplies. Food manufacturers also warn they are under strain from new regulations and extra taxes, according to the Food and Drink Federation.

Its chief executive, Karen Betts, pointed to particular difficulties in global coffee, cocoa, olive oil and dairy markets, while noting the wider cost pressures facing producers.

Treasury Chief Secretary James Murray rejected claims that government policy is to blame, arguing that international commodity markets remain the main factor.

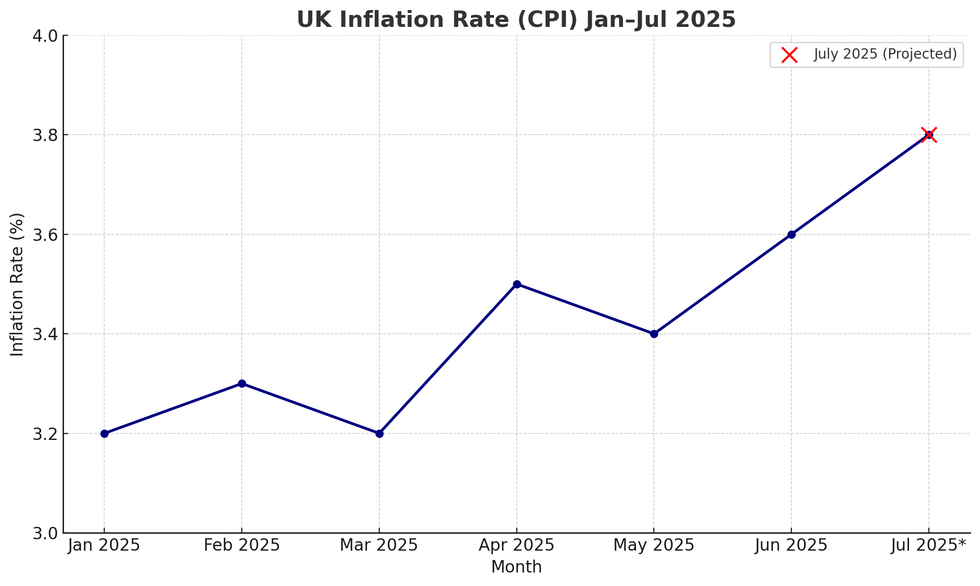

Inflation remained at 3.8 per cent in August

| CHAT GPTHe dismissed suggestions that changes such as higher national insurance payments for retailers or new packaging rules were pushing up supermarket prices.

Murray emphasised that "global commodity prices" remain the crucial element affecting food costs, expressing confidence that Britain's recent trade agreements would "help to bring down the cost of things at the supermarket checkout".

Chancellor Rachel Reeves stated her commitment to reducing expenses and assisting households struggling with elevated bills. However, retail organisations maintain that higher employer national insurance rates, increasing minimum wage requirements and fresh packaging levies have forced businesses to transfer additional costs to consumers.

Looking ahead, inflation is expected to reach four per cent in September before beginning a gradual descent, according to Rob Wood, chief UK economist at Pantheon Macroeconomics.

Aldi has secured its spot as the nation’s most affordable supermarket

| ALDIMatt Swannell from the EY Item Club concurred that September would likely represent the highest point for consumer price inflation.

"After that, the headline rate is expected to drift downwards gradually," Swannell noted. He anticipates that upward pressure on grocery costs should begin easing around the new year.

Market research firm Worldpanel by Numerator reported grocery inflation had already edged down to 4.9 per cent in September from five per cent previously.

Most analysts expect the Bank of England to maintain interest rates at four per cent when announcing their decision on Thursday, as policymakers balance concerns about persistent inflation against economic stagnation and labour market weakness.