Millions of workers to fall into £100k 'tax trap' under HMRC rules - will you be targeted?

Expert Steve Bish explains ways to reduce inheritance tax |

GB NEWS

Analysts are urging middle class Britons to be aware of a potential 'stealth tax'

Don't Miss

Most Read

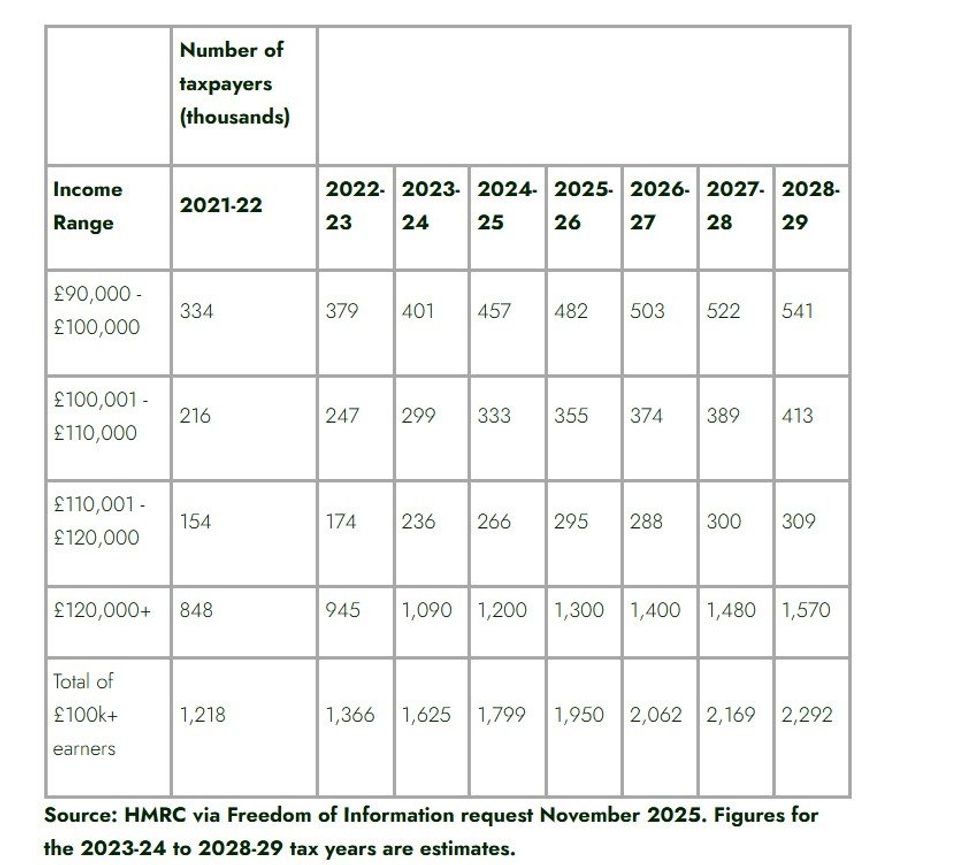

Fresh data secured through a Freedom of Information request reveals that approximately 2.3 million UK taxpayers will breach the £100,000 earnings barrier by the 2028-29 tax year.

This "tax trap" represents a surge of almost 500,000 individuals from the current figure of 1.8 million who exceeded this personal allowance in the 2024-25 financial year.

The findings, obtained by wealth management company Rathbones from HM Revenue and Customs (HMRC), highlight how increasing numbers of workers face exposure to one of Britain's harshest tax penalties.

Workers crossing this income boundary face marginal tax rates reaching 60 per cent, or 62 per cent when National Insurance contributions are included, on earnings between £100,000 and £125,140.

Are you are risk of falling into HMRC's £100 'tax trap'?

|GETTY

This occurs because the personal allowance, which currently sits at £12,570, gradually disappears for those earning above £100,000 annually.

Ahead of Chancellor Rachel Reeves's Autumn Budget on November 26, analysts are warning the impact of this "tax trap" extends past general taxation.

Stephanie Ebner, a financial planning Lead at Rathbones, warned: "For parents with two children under five, earning just £1 over £100,000 can mean losing childcare support worth almost £20,000.

These childcare costs must then be paid from already-taxed income, creating what Ebner describes as "one of the most baffling quirks in our tax system".

How many people will be pulled into higher tax brackets?

|RATHBONDES / HMRC

The £100,000 limit has stayed fixed since its implementation in April 2010, despite over 15 years of wage growth and inflation in the UK.

Ms Ebner notes that the measure was "originally designed to target the very highest earners" but now captures "thousands of professionals who were never meant to be caught".

The freeze on income tax bands, introduced by former Conservative Jeremy Hunt in April 2021, has intensified this fiscal drag phenomenon.

This occurs when tax thresholds remain at the same level during a period of time when inflation or wages are on the rise, resulting in taxpayers being pulled into higher brackets.

HMRC projections indicate an 88 per cent increase in individuals losing part or all of their personal allowance between 2021-22 and 2028-29, rising from 1.22 million to 2.29 million people.

In light of this, Ms Ebner characterised this as having "increasingly become a stealth tax on the middle class".

Workers currently employ pension contributions to maintain their taxable income beneath the £100,000 mark, preserving access to childcare support.

Salary sacrifice schemes provided through employers have become a popular method for achieving this goal.

Fiscal drag is dragging Britons into higher tax brackets | GETTY

Fiscal drag is dragging Britons into higher tax brackets | GETTY However, proposed restrictions could limit salary sacrifice arrangements to £2,000, potentially eliminating this avenue for many families.

Ms Ebner explained: "While making a personal pension contribution can achieve a similar effect, it often requires completing a tax return and potentially negotiating with HMRC to keep childcare benefits."

She added that "for parents of young children, spending a weekend updating tax details online is rarely the best use of time".

The Chancellor will reveal if the tax threshold freeze will be extended or any changes to salary sacrifice rules during the Budget on November 26.

More From GB News