State pension petition to double personal tax allowance to receive Treasury response after hitting major threshold

GB News

The campaign calls for a £25,140 tax-free limit for state pensioners

Don't Miss

Most Read

Latest

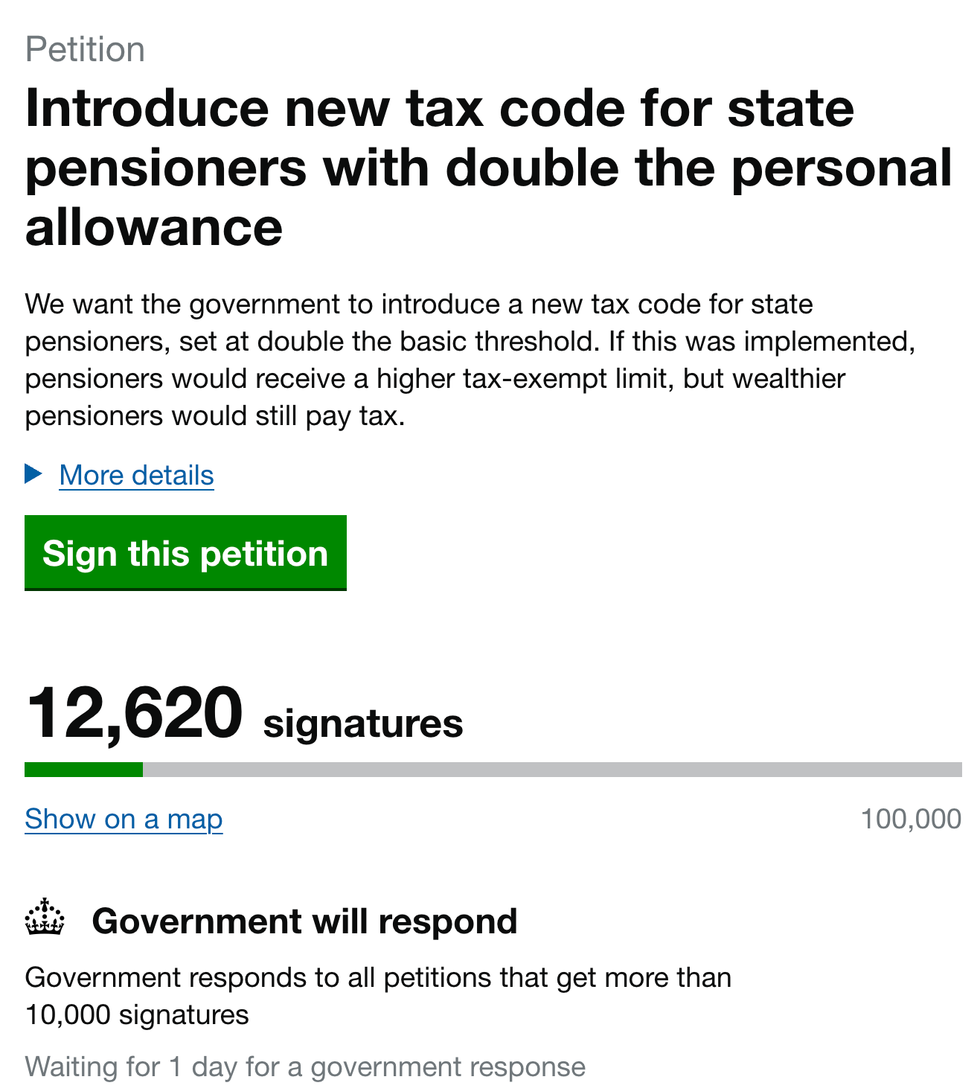

A parliamentary petition calling for state pensioners to receive double the personal tax allowance has surpassed 10,000 signatures, triggering a response from the Treasury.

The campaign seeks to create a new tax code giving pensioners £25,140 in tax-free income, double the current £12,570 threshold that applies to all taxpayers.

The petition reached 11,959 signatures on Sunday, crossing the key mark that obliges Government ministers to issue an official response outlining their view on the proposal.

The momentum behind the petition adds pressure on Chancellor Rachel Reeves over frozen tax thresholds.

Campaigners argue pensioners with modest private or workplace pensions are being pushed into paying income tax unfairly.

If the petition reaches 100,000 signatures, it will be considered for a parliamentary debate.

The personal tax allowance has been frozen at £12,570 since 2021, contributing to fiscal drag that has gradually brought more low earners into the tax system.

This threshold determines when workers begin paying the basic rate of 20 per cent, while those earning above £50,270 pay the higher rate of 40 per cent.

The freeze has particularly affected pensioners and lower-paid workers who now find themselves paying tax on incomes that would previously have fallen below the allowance.

According to new reports, Ms Reeves may extend the freeze until 2030, a move that could generate £8billion for the Treasury.

A petition to double state pensioners’ tax allowance has topped 10,000 signatures, requiring a Treasury response

|GETTY

Concerns are growing that basic state pension recipients could soon face income tax bills, as the triple lock pushes pension levels closer to the frozen threshold.

The state pension is due to rise by 4.8 per cent in April 2026 under the triple lock guarantee. This will raise the full new state pension from £230.25 to £241.30 a week.

That increase equates to £12,548 annually, placing the state pension just below the £12,570 tax-free allowance.

With the Government already committed to maintaining the freeze until 2028, pensioners could find their state pension alone triggering income tax payments in the coming years.

This has led to speculation that thousands of pensioners who rely entirely on state support may pay tax for the first time.

LATEST DEVELOPMENTS:

Rachel Reeves’ freeze until 2028 means state pensions could soon trigger income tax on their own

| PAThe petition, launched by Timothy Hugh Mason, states: "We want the Government to introduce a new tax code for state pensioners, set at double the basic threshold.

"If this were implemented, pensioners would receive a higher tax-exempt limit, but wealthier pensioners would still pay tax."

Mr Mason argues that "people with small private or workplace pensions are currently being taxed unfairly".

The proposal would create a separate tax structure for pensioners, shielding those with modest retirement incomes while ensuring that higher-income retirees remain within the tax system.

The petition reflects growing frustration among pensioners whose combined pension incomes are now subject to tax because of static thresholds.

It is one of several campaigns addressing the impact of frozen allowances.

The petition is awaiting a Government response

|GOV.UK

Another petition calling for the personal allowance to rise to £20,000 has already passed 10,000 signatures.

A previous petition demanding the same £20,000 threshold gathered 281,792 signatures before closing this summer, making it one of the most-signed petitions on the parliamentary website and leading to a full debate.

James Murray, Exchequer Secretary to the Treasury, has previously warned that raising the allowance to £20,000 would cost more than £50billion, exceeding the £45billion in unfunded tax cuts announced in Liz Truss's mini-Budget.

Helen Miller, director at the Institute for Fiscal Studies (IFS), has said the Chancellor’s reported decision to step back from income tax rises shows reluctance to take difficult political decisions, cautioning that smaller alternative tax measures could risk harming economic growth.

The petition can be accessed here.

Our Standards: The GB News Editorial Charter