State pension panic as Brits find their £6,000 top-ups get 'lost' amid HMRC and DWP backlog - 'It's a disgrace!'

‘Rubbing our noses in it!’ State pension rise will be swallowed up, retiree fears - ‘Doesn’t go anywhere’ |

GBNEWS

To get the full new state pension, Britons need 35 qualifying years on their National Insurance record

Don't Miss

Most Read

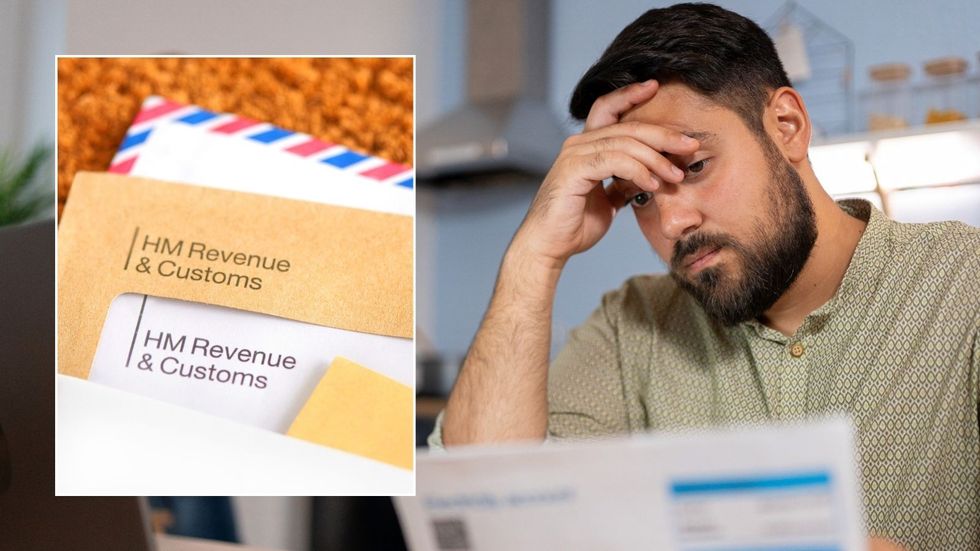

Thousands of pensioners across Britain remain in limbo months after paying to top up their National Insurance records, with some missing payments exceeding £6,000.

The delays have persisted despite Government assurances that cases involving those approaching or already at state pension age would receive priority treatment.

The backlog stems from a surge in applications ahead of an April deadline to fill historic gaps in state pension records dating back to 2006.

Affected individuals report hour-long waits when attempting to contact HMRC by telephone, only to receive promises of action that fail to materialise.

Some pensioners have been waiting since November 2024 for their payments to be processed.

This has left them without confirmation that their contributions have been allocated to their National Insurance records as they approach retirement.

Elaine Bowden, a 65-year-old retired microbiologist from Merseyside, handed over approximately £5,000 in November but has yet to see her payment processed.

With her state pension due to begin in August, she expressed frustration at the situation.

Man looking worried and HMRC letter | PA / GETTY

Man looking worried and HMRC letter | PA / GETTYBowden told This is Money: "They have still got my money somewhere. I could have had interest on the money for all that time. It's a disgrace."

David Kirkwood's experience illustrates the scale of the problem. He made two payments totalling £6,000 last November to enhance his state pension, but only one was processed before his 66th birthday this spring.

He said: "It certainly looks like they have lost my payment," he said. A separate tax payment of nearly £3,000 he made in January 2024 had also gone missing.

"To sum up, it would appear that HMRC have 'lost' £6,217.21 of my money."

David Kirkwood's experience illustrates the scale of the problem

| GETTYThe Department for Work and Pensions and HMRC, which jointly operate the system, maintain they are prioritising payments from individuals close to or over state pension age.

A Government spokesperson said: "We have allocated all of these customers' top-ups to their National Insurance records and are sorry for the delay. We're tackling response times by deploying extra staff to process payments."

Former Pensions Minister Steve Webb criticised the handling of the situation. "Whilst these sums are small to the Government, they are large to the individuals concerned. It is time that the whole system was brought into the 21st Century," he said.

Webb highlighted the communication failures plaguing the system. "Yet again we are hearing of case after case where people have found it impossible to find out what is going on.

"They struggle to get information on the phone or are promised action which never seems to happen."

The issues arise against the backdrop of significant changes to National Insurance contribution rules. Earlier this year, HMRC and the DWP launched a campaign reminding people they had until 5 April to check their National Insurance record and fill any gaps from 6 April 2006 onwards.

Earlier this year, HMRC and the DWP launched a campaign reminding people they had until 5 April to top up gaps up to 2006

| PAFrom 6 April 2025, people will only be able to make voluntary National Insurance contributions for the previous six tax years, in line with normal time limits. This represents a significant reduction from the extended period previously available.

To receive the maximum new state pension, currently £230.25 per week, individuals need at least 35 full National Insurance years. People can earn qualifying years through various means, including employment or by claiming certain benefits.

However, thousands of people lack sufficient years to claim the full state pension, prompting many to consider paying to plug the gaps in their records.

More From GB News