State pensioners could lose up to £70,000 in retirement savings due to 'frozen' triple lock policy

Analysts are sounding the alarm over the impact "frozen" state pensions have on the retirements of Britons living abroad in certain countreis

Don't Miss

Most Read

British pensioners who choose to retire abroad could forfeit almost £70,000 in state pension payments over two decades if they relocate to countries where their entitlements become frozen, according to new analysis.

The calculations from interactive investor reveal that those moving to nations without uprating agreements with the UK face substantial financial losses.

Their state pensions remain fixed at the initial payment rate, missing out on annual increases. Over shorter periods, the financial impact remains considerable.

Pensioners could lose £37,477 over 15 years, £15,838 over a decade, or £3,666 over five years compared to those who remain in the UK.

State pensioners could lose up £70,000 if they move abroad

|GETTY

The triple lock mechanismThe triple lock mechanism, introduced in 2011, ensures the state pension rises annually by the highest of 2.5 per cent , inflation, or average earnings growth.

However, this protection doesn't extend to all British retirees living overseas due to longstanding Government policy,.

Approximately 450,000 British pensioners are currently affected by the Government's frozen pension policy, according to the All-Party Parliamentary Group on Frozen British Pensions.

Whether a pension is frozen depends entirely on the destination country. Those who retired overseas before the triple lock's introduction have experienced even greater losses.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are worried about their pension savings | GETTY

Britons are worried about their pension savings | GETTY Pensioners who moved abroad in 2010, just before the policy began, have missed out on £25,832 in payments compared to UK-based counterparts.

The financial disadvantage varies depending on when retirees relocated. Those who moved abroad ten years ago have lost £13,162, whilst pensioners who emigrated five years ago are £7,391 worse off.

Even recent emigrants face immediate impacts. Those who moved overseas just one year ago have already missed out on £471, demonstrating how quickly the gap between frozen and uprated pensions begins to widen.

Myron Jobson, a senior personal finance analyst at interactive investor, warns that whilst overseas retirement may offer lifestyle benefits, careful financial planning is essential.

Jobson noted it is "vital to consider how such a move could affect your state pension entitlement". He shared: "If you move to a country where the UK has no uprating agreement, like Australia or Canada, your state pension will be frozen at the level you first receive it.

"That means you won’t benefit from the valuable triple lock increases that pensioners in the UK enjoy each year, and over time, that can seriously erode your spending power."

LATEST DEVELOPMENTS:

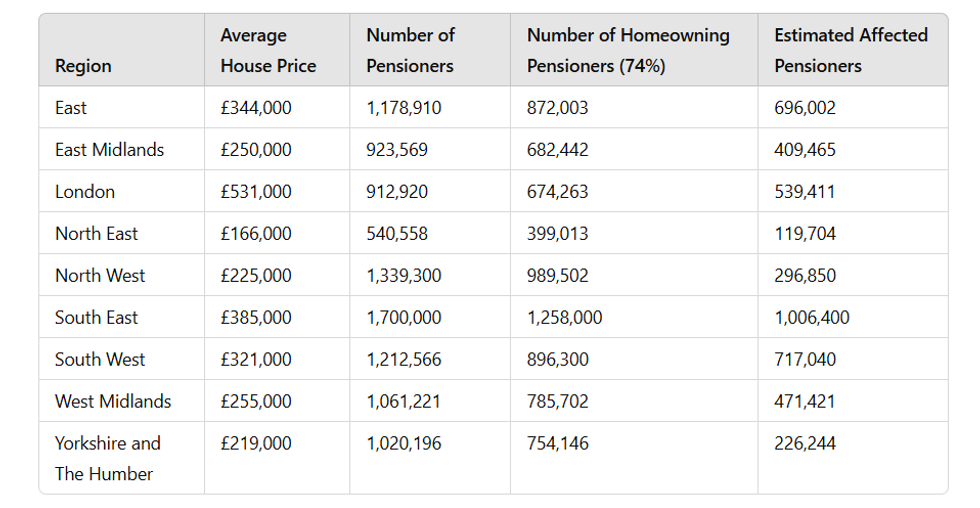

Estimated number of pensioners that would be affected by means testing the state pension on house value, broken down by region | GBN

Estimated number of pensioners that would be affected by means testing the state pension on house value, broken down by region | GBNThe retirement analyst added: "Planning ahead is key. Make sure you’ve checked whether your chosen destination is affected and consider topping up any gaps in your national insurance record to maximise what you’re entitled to.

"Deferring your state pension can boost the amount you get, though it won’t help with uprating in frozen countries.

"Most importantly, building a strong private pension pot can help provide the financial cushion you’ll need to maintain your standard of living abroad, regardless of state pension freezes. Budgeting carefully and preparing for rising living costs can go a long way in making your retirement overseas both comfortable and secure.”

"It is worth considering seeking advice from a financial adviser to fully understand the implications of retiring abroad and plan accordingly."

More From GB News