State pension age could rise to 68 'ASAP' under new proposal despite 'real burden' on Britons

The state pension age could be changed under new proposal

|GETTY

A new report from the London School of Economics has suggested raising the state pension age to help the Government balance the books

Don't Miss

Most Read

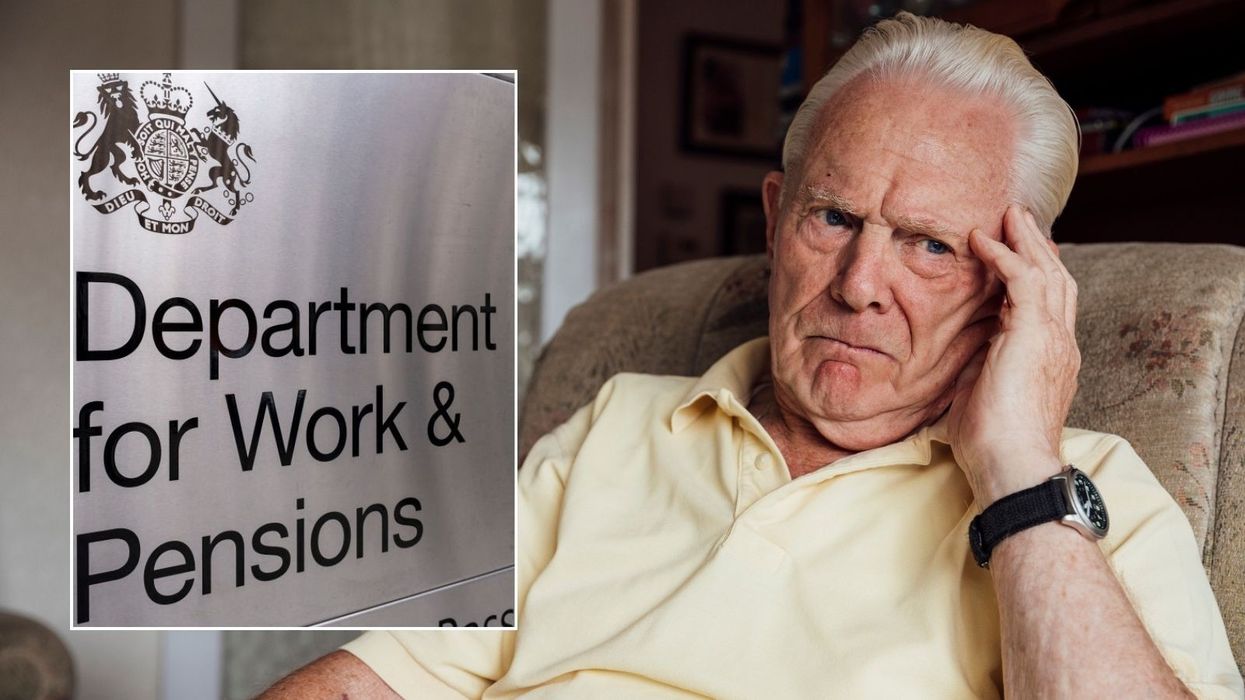

A proposal to raise the state pension age earlier than expected has been floated despite the fact older Britons will lose payments for a year.

The London School of Economics (LSE) which recently published the proposal, recommended increasing the retirement benefit's age threshold to 68 “as soon as possible”.

As it stands, the state pension is 66 years old and is expected to jump to 67 by 2028.

Under current Department for Work and Pensions (DWP) plans, the age threshold will rise once again to 68 in 2044-46.

However, LSE's report warned that this will result in further pressure on budgetary spending.

The university cited the last Government's consideration to bring forward the age hike to offset the expense.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Pensioners may have to wait longer for payments

| GETTYThe LSE report stated: "An ageing population is one of the greatest economic challenges of our time.

"The number of people aged over 65 is growing rapidly relative to those aged 15-64. The size of the older group is now 30 per cent of the younger group; by 2070 they are expected to be 50 per cent.

"104 Pension benefits already cost five per cent of GDP, and growing numbers of people over 65 cannot be sustained at a reasonable standard of living unless more of them work."

Concerns have been raised about the long-term viability of the triple lock which is the metric used to determine the annual rate rise to pension payments.

LATEST DEVELOPMENTS:

Under the triple lock, the state pension goes up by either rate of inflation, average earnings or 2.5 per cent; whichever is highest.

Raising the state pension age could keep the triple lock in place for the foreseeable future, analysts have claimed.

Based on LSE's research, a one-year increase to the pension age to 68 would lead to a £6.1billion savings boost for the Exchequer.

However, the report came to the conclusion that such a decision would lead to "serious hardship" for thousands of elderly people.

Notably, everyone aged 67 "would lose their state pension for that year" when the threshold takes place.

Furthermore, many people who would have opted to retire by 67 could remain in the workforce for a longer period of time.

As it stands, pensioners receive their state pension once they reach 66

| GETTYAccording to the university, remaining in employment to this point could be a "real burden".

LSE stated: "We already have direct evidence on the effect of raising the pension age upon the wellbeing of all those affected. The evidence comes from what happened when the pension age was raised to 66 in 2018-20.

"By comparing those who got no pension at 66 with previous cohorts who got the pension, we can find the loss of wellbeing caused by the loss of the pension. The answer is an average loss of 0.12 points of wellbeing (out of 10) for a year.

"The loss of wellbeing is of course connected not only with the loss of income, but with the fact that some people now work who would not have otherwise done so."