Savings alert: Britons could miss out on £77k 'high interest' boost by not making 'simple changes'

Savers urged to be careful of tax on savings interest |

GB NEWS

Savings interest rates remain relatively high but many bank customers are not taking advantage of these completive deals, new research claims

Don't Miss

Most Read

Britons could be missing out on a savings boost worth up to £77,000 over the course of their lifetime by not taking advantage of competitive deals from high street banks and building societies.

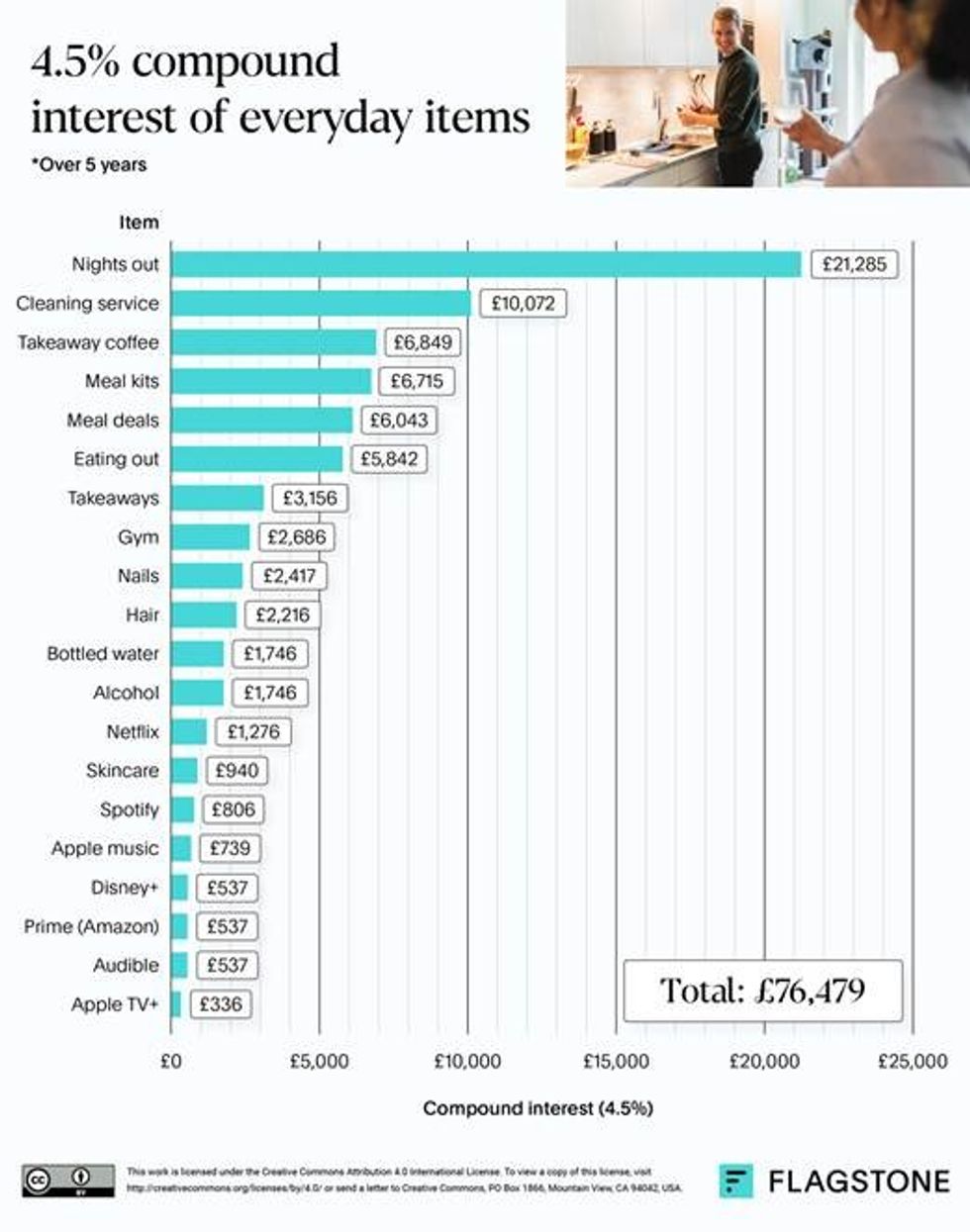

New research from high-interest savings platform Flagstone has revealed the true cost of everyday spending habits when compared to potential savings.

The study shows how common expenses like coffees, nights out and cleaning services could generate substantial wealth if that money was deposited in high-interest accounts instead.

This wealth-building potential comes from compound interest, where savers earn returns on both their initial deposits and the interest already accumulated.

Britons could be missing out on a significant savings boost due to a hidden habit

| GETTYCompound interest allows money to grow at an accelerating rate over time, with Flagstone's research demonstrating how redirecting daily spending could translate to significant savings over a five-year period.

The average monthly spend for a night out in the UK is £317, according to Flagstone's findings.

If this amount was redirected to a high-interest savings account with a 4.5 per cent, compound interest rate, it could generate a remarkable £21,285 over five years.

For those focused on building wealth, reconsidering frequent nights out could represent the single most impactful change to spending habits.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

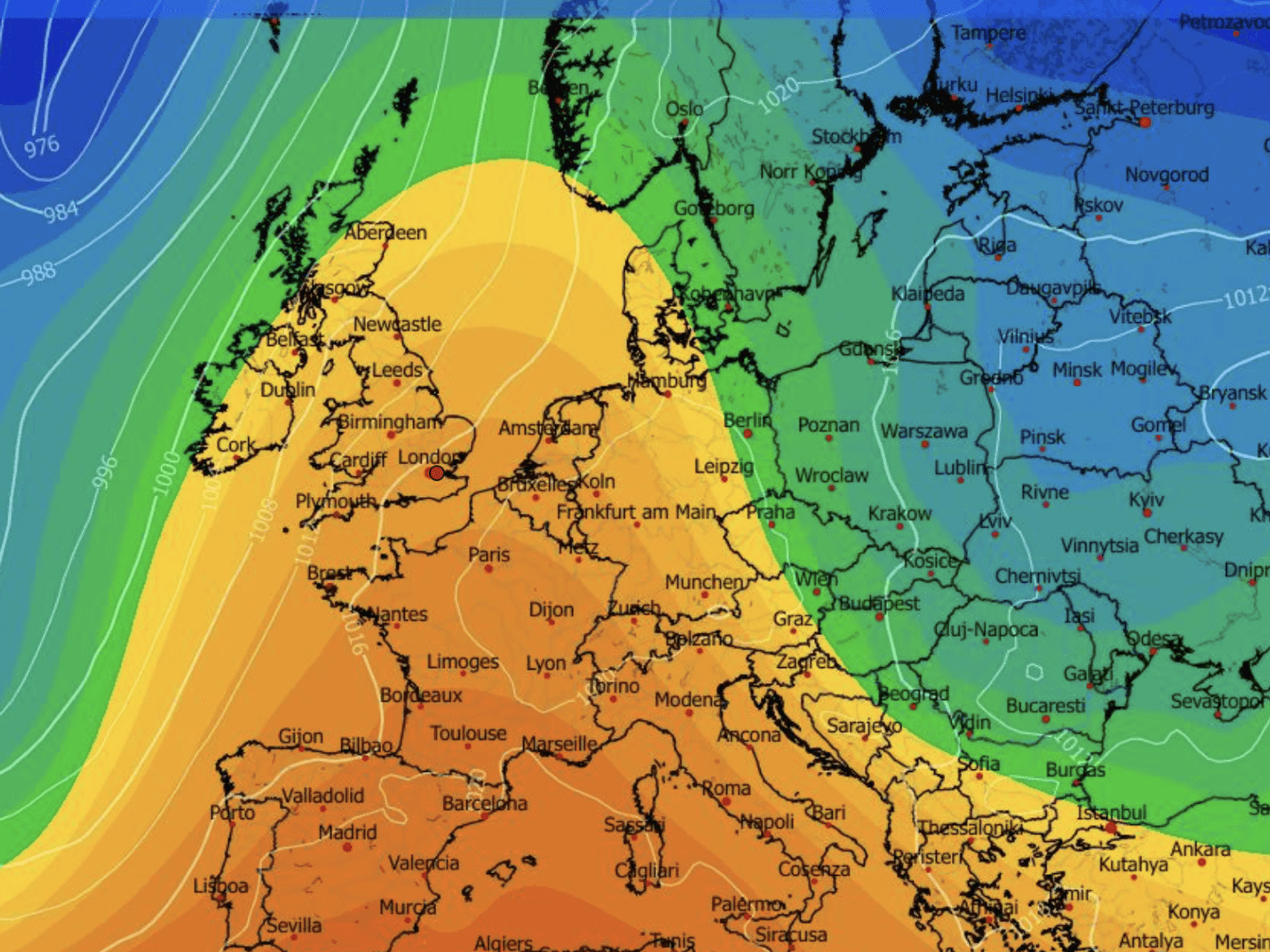

Interest rate hikes from the Bank of England have been passed down to savings products

| GETTYHousehold cleaning services represent the second-highest savings opportunity, according to Flagstone's analysis.

The average monthly cleaning cost stands at £150, with general cleaning spend having increased by 9.4 per cent last year.

This rise was primarily driven by increases to the national living wage. While having a cleaner saves time, redirecting this monthly expense to a high-interest savings account could yield substantial returns.

If this £150 monthly cleaning cost was saved instead and achieved a 4.5 per cent interest rate, it could generate an extra £10,072 after five years.

For those willing to do more housework themselves, this represents a significant wealth-building opportunity.

The daily takeaway coffee habit emerges as the third highest potential savings opportunity in Flagstone's research.

The average daily spend on a takeaway coffee is £3.40, which amounts to £102 monthly. If this money was instead deposited into an account with 4.5 per cent interest, it could generate up to £6,849 over five years.

Subscription services offer the lowest savings potential among the everyday expenses analysed.

Cancelling subscriptions to platforms like Disney+, Amazon Prime, Audible and Apple TV would save between just £336-£537 per item over five years when deposited in high-interest accounts.

LATEST DEVELOPMENTS:

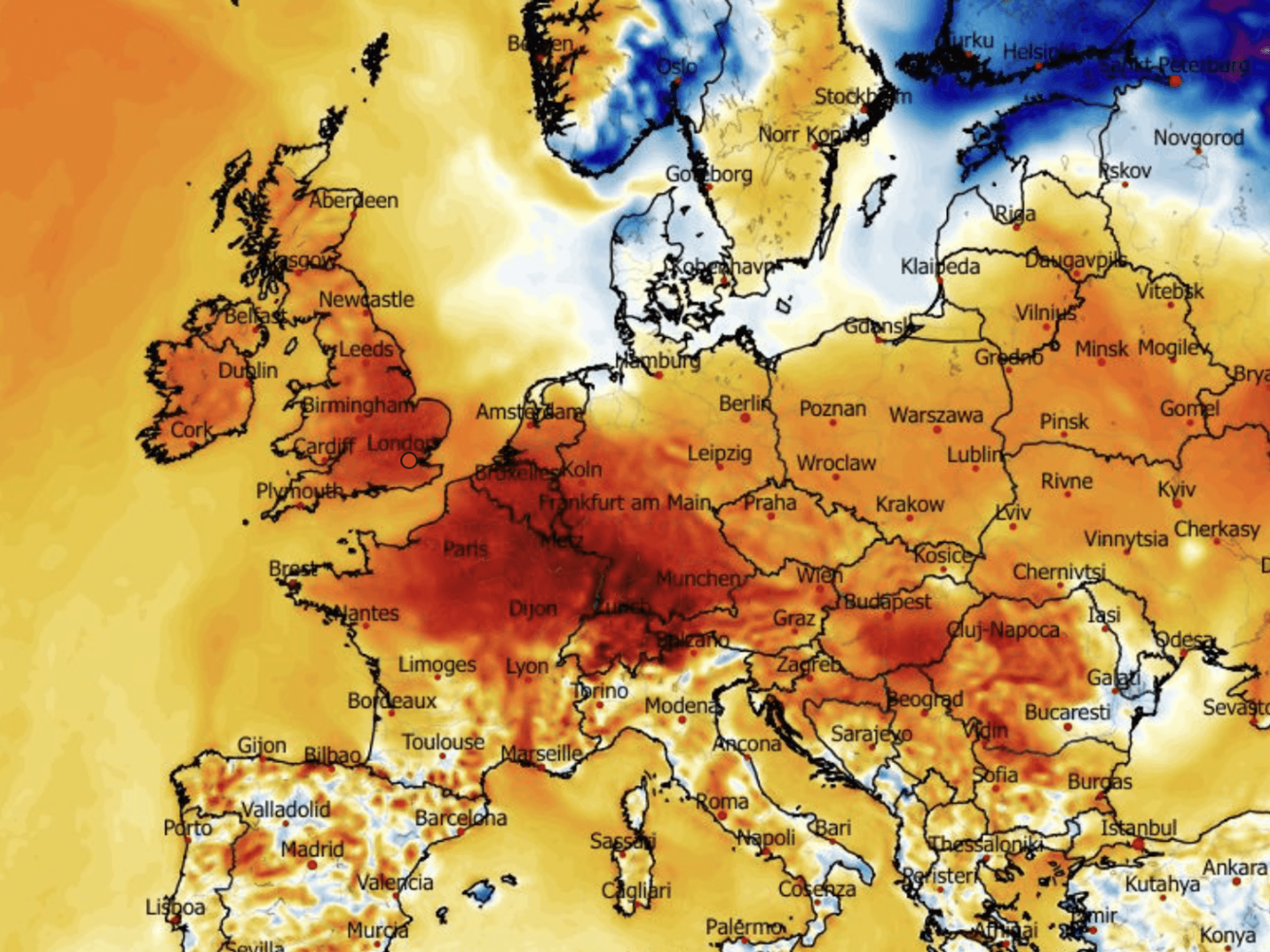

How much could you save by cutting spending?

|FLAGSTONE

However, Flagstone's research emphasises that no wealth-building opportunity should be overlooked.

By eliminating all the mentioned expenses, individuals could save between £71,575-£76,479 over five years, depending on whether they choose accounts offering 2.5 per cent or 4.5 per cent interest.

This sum significantly exceeds the average deposit on a new home, which currently stands at approximately £53,414.

The savings would even leave additional funds for value-increasing home renovations.

Claire Jones, the head of Strategic Relationships and New Business at Flagstone, commented on the study's findings.

"Spending on common items like nights out and coffees might not seem to have a huge impact on your bank balance.

"But overlooking where we can make simple changes to our spending habits can have a huge impact on future wealth," she said.

"Little indulgences are what makes life worth living. But reducing outgoings and redirecting that money to high-interest savings accounts could prove lucrative for individuals keen to focus on their wealth goals."