Santander announces more cuts to mortgage interest rates – full list

British public react to interest rates being kept at 5.25 per cent

|GB NEWS

Banks, including Santander, have been slashing mortgage rates once again amid an increasingly competitive market

Don't Miss

Most Read

Santander has announced it is reducing interest rates again across its line of mortgage products.

The high street lender confirmed earlier today it has slashed mortgage and additional loan rates by between 0.17 per cent and 0.82 per cent.

This comes after similar recent announcements from other banks and building societies, such as HSBC.

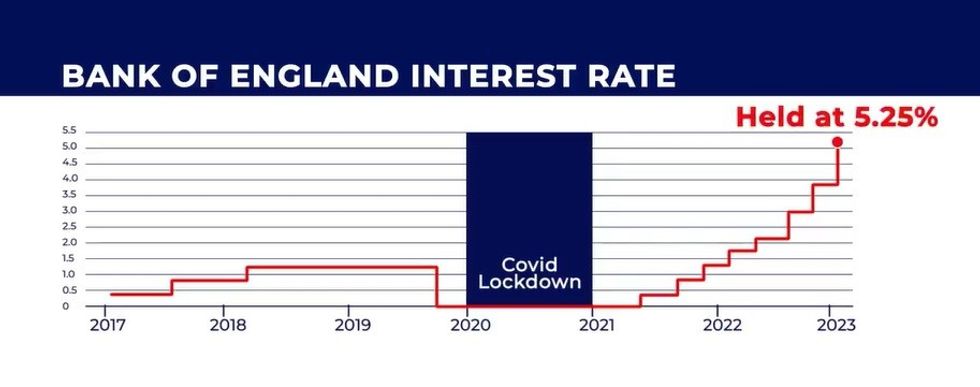

Interest rates have been on the rise over the past year-and-a-half thanks to the Bank of England’s decision over the UK’s base rate.

Banks, including Santander, have been slashing mortgage rates once again amid an increasingly competitive market

|GETTY

A breakdown of the full list of Santander’s new mortgage rates can be found by visiting the lender’s website.

These include:

- 60 per cent LTV five year fixed rate residential remortgage with a £999 product fee is now priced at 3.89 per cent, down from 4.71 per cent

- 75 per cent LTV five year fixed rate residential remortgage with a £999 product fee is now priced at 4.34 per cent, down from 4.82 per cent

- 85 per cent LTV five year fixed rate residential purchase mortgage with a £999 product fee is now priced at 4.39 per cent, down from 4.76 per cent

- 90 per cent LTV five fixed rate residential purchase mortgage with a £999 product fee is now priced at 4.49 per cent, down from 4.89 per cent.

Here are some examples of the two-year fixes customers can get following this latest round of reductions:

- 60 per cent LTV two year fixed rate residential remortgage with a £999 product fee is now priced at 4.44 per cent, down from 4.92 per cent.

- 75 per cent LTV two year fixed rate residential remortgage with a £999 product fee is now priced at 4.69 per cent, down from 5.06 per cent.

- 85 per cent LTV two year fixed rate residential purchase mortgage with a £999 product fee is now priced at 4.79 per cent, down from 5.25 per cent.

- 90 per cent LTV two year fixed rate residential purchase mortgage with a £999 product fee is now priced at 4.94 per cent, down from 5.39 per cent.

LATEST DEVELOPMENTS:

The Bank of England's MPC has voted to keep the base rate at 5.25 percent | GB NEWS

The Bank of England's MPC has voted to keep the base rate at 5.25 percent | GB NEWSCurrently, the base rate is sitting at 5.25 per cent and has remained at this level as inflation has eased in the UK.

As such, lenders like Santander are cutting mortgage rates with an expectation of further reductions later in the year.

Graham Sellar, the bank’s head of business development, explained: “We are delighted to help borrowers access cheaper loans with major reductions across our fixed mortgage rates.

“Customers can apply for our latest deals through their mortgage broker or directly with us on the Santander website or over phone.”