Rachel Reeves to target Britons with the 'broadest shoulders' as £50billion tax rises loom

GB News

Economists warn Labour may need £50billion in new revenue, with VAT, inheritance tax and capital gains under scrutiny in November's budget

Don't Miss

Most Read

The chancellor may need to abandon key election commitments to secure approximately £50 billion in additional revenue, tax specialists from the national consultancy Crowe have cautioned.

The firm's experts have speculated potential measures could include imposing VAT on private medical services and increasing wealth levies - in the budget which has already been touted 'the Nightmare before Christmas'.

The consultancy's senior partners have outlined scenarios where Labour might target those with "broadest shoulders" through new taxation measures.

These predictions indicate significant changes to inheritance tax arrangements and capital gains tax rates may be forthcoming.

The specialists warn that manifesto pledges protecting ordinary workers from tax increases appear increasingly difficult to maintain given the scale of revenue required.

Their analysis suggests the government faces limited options between increased borrowing, reduced spending, or breaking electoral promises.

Robert Marchant, National Head of Tax at Crowe, warns that introducing VAT on private education could establish a concerning precedent for similar charges on private medical services.

He notes: "Has the addition of VAT to private school fees started the government down a slippery slope?"

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are being warned that there may be an imminent tax raid

| GETTY / PARecent data reveals that one in eight UK residents utilises private healthcare, with total spending reaching £46.4billion in 2022.

This substantial market presents an attractive revenue target for Treasury officials seeking additional funds.

Mr Marchant highlights potential complications, observing that such a move could drive patients back to the NHS whilst allowing medical providers to reclaim more VAT, reducing net receipts.

He queried: "Fundamentally, would it be politically damaging for a government to tax health? Our government did though choose to do so with education, so perhaps nothing is off the table."

Britons are concerned about the rising tax burden | GETTY

Britons are concerned about the rising tax burden | GETTYInheritance tax reforms could particularly impact middle-aged households who depend on family bequests to supplement their financial planning, according to Laurence Field, Partner Corporate Head of Tax at Crowe.

He cautions that "many ordinary working families are relying on modest inheritances to shore up their financial futures."

The tax specialist highlights how mounting pressures from property costs, educational debt and child-rearing expenses have made wealth accumulation increasingly challenging for this demographic.

Mr Field notes that inheritance tax thresholds have remained static for over fifteen years, with fiscal drag already diminishing their real value.

He predicts immediate financial concerns will override political loyalties, stating: "In the short term, I expect the dash for cash may outweigh any potential longer-term electoral damage."

Possible reforms could extend the seven-year "survivorship" period for gifts or impose lifetime gifting caps.

Pete Fairchild, National Head of Private Clients at Crowe, anticipates the government will avoid raising income tax and national insurance rates for employees and the self-employed.

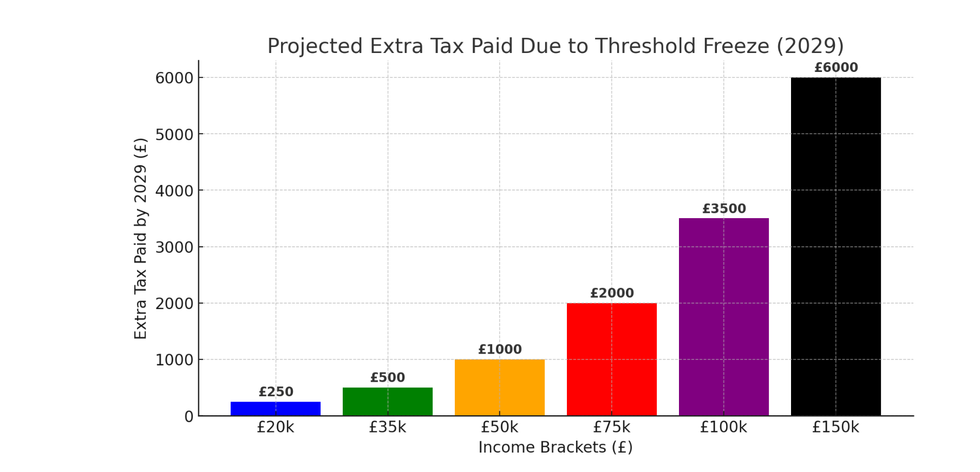

However, he warns that frozen allowances continue to drag more taxpayers into higher brackets through fiscal creep.

Mr Fairchild expects the Chancellor to target capital gains tax, where the annual exemption has plummeted by over 75% to just £3,000.

He predicts that, "many commentators predict a further 4% increase this year, or even different rates of tax being applied to gains depending on the type of asset sold."

The tax expert questions whether these wealth taxes can generate sufficient revenue, noting: "What remains unclear is just how these changes will balance the books and plug the £50billion deficit. CGT and IHT do not raise substantial amounts of tax annually."

Additional revenue streams under consideration include ending the current freeze on fuel duties and limiting salary sacrifice arrangements, according to the Crowe analysis.

LATEST DEVELOPMENTS:

Lower earners see smaller increases, while higher earners face significantly larger tax burdens as a result of stealth tax raid | ChatGPT

Lower earners see smaller increases, while higher earners face significantly larger tax burdens as a result of stealth tax raid | ChatGPT Treasury officials reportedly view with concern the practice of employees exchanging taxable salary for benefits that avoid national insurance contributions.

Mr Marchant suggests the Chancellor faces an impossible choice, noting: "Either the Chancellor borrows more, spends less, or raises more taxes."

He warns that achieving £50billion through adjustments to smaller taxes like inheritance tax alone appears unrealistic.

The consultancy emphasises that businesses and individuals urgently require clarity to avoid hasty financial decisions.

Mr Fairchild observes: "Taxpayers want certainty so they can properly think through their plans and avoid knee-jerk reactions."

With the budget imminent, speculation continues about which manifesto commitments might be sacrificed to address the substantial fiscal shortfall.