Stealth tax warning: 'Millions sleepwalking into unexpected bills' due Rachel Reeves's raid on state pensions

Pensioners are paying more to HMRC under fiscal drag with annual hikes to state pension payment rates pulling Britons into higher tax brackets

Don't Miss

Most Read

Analysts are warning that more and more British pensioners are finding themselves fall foul of a little-known "stealth tax", which has yet to be scrapped by Labour Chancellor Rachel Reeves.

HM Revenue and Customs (HMRC) has issued a record 1.32 million simple assessments in the 2023/24 tax year, according to new figures obtained by wealth manager Quilter under the Freedom of Information (FoI) Act.

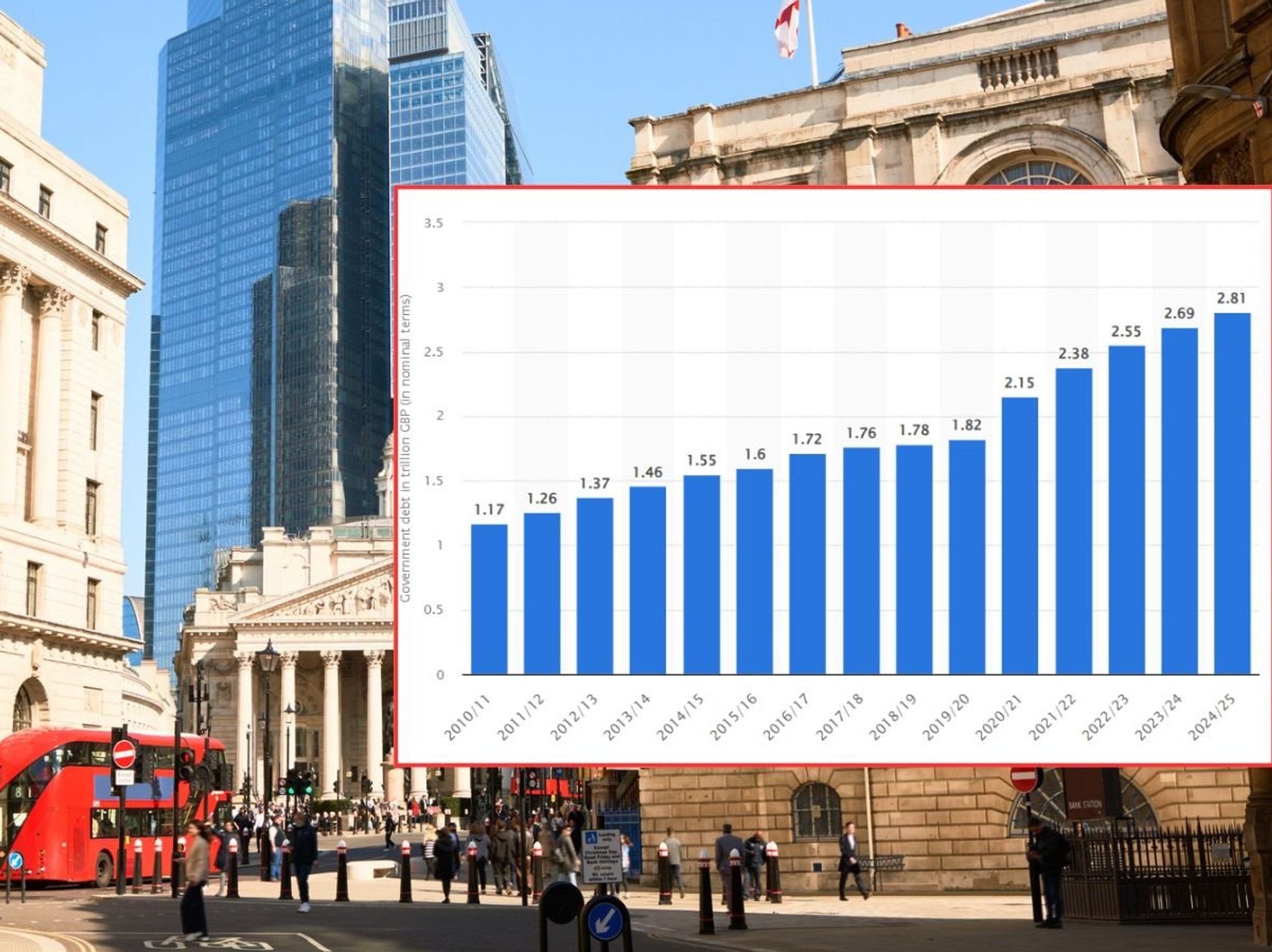

This marks a dramatic 74 per cent surge from the previous year's 757,745 and eflects the growing number of taxpayers being automatically assessed for underpaid tax, with the current figure nearly triple what it was five years ago.

The sharp increase is largely attributed to more older Britons being drawn further into the tax system as state pension rises push their income over personal allowance thresholds.

Rachel Reeves is under fire over stealth tax on state pensions as 'millions sleepwalking into unexpected bills'

| GETTYThis trend has been accelerated by frozen tax thresholds and high inflation, creating unexpected tax liabilities for many and is commonly referred to as fiscal drag. Simple assessments are a method HMRC uses to collect tax without requiring taxpayers to complete a self-assessment return.

Instead, the tax authority issues a bill directly when it believes the calculation is straightforward. These are typically used where HMRC already holds sufficient information about an individual's income, particularly for pensioners or employees who underpay tax due to income changes not fully accounted for by PAYE during the year.

While designed to streamline tax collection, Quilter notes the growing use of simple assessments reflects in part the increasing number of older households paying more into the tax system.

The data reveals a consistent upward trend in simple assessments over recent years. In 2017/18, HMRC issued 486,340 assessments, rising to 711,390 in 2018/19, before dipping slightly to 593,637 in 2019/20 and 582,211 in 2020/21.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Analysts are warning the public about HMRC little-known "stealth tax"

| PAThese numbers began climbing again with 675,442 in 2021/22 and 757,745 in 2022/23, before the dramatic jump to 1,320,755 in 2023/24. In its FOI response, HMRC cited the rising number of state pensioners with additional retirement income subject to PAYE and the continued freezing of tax thresholds until 2028 as being responsible.

One major factor driving the increase is that state pensions are paid without tax deducted at source. For pensioners with other income such as private pensions, their state pension is accounted for via tax code reductions, but errors can occur in these calculations.

The continued freezing of tax thresholds until 2028 means that as incomes rise with inflation, more people are pushed over the personal allowance threshold and become liable for income tax, even if their purchasing power hasn't improved.

This effect is amplified by the triple lock, which has delivered unusually large state pension increases in line with recent high inflation, pushing more pensioners over tax thresholds.

Jon Greer, the head of retirement policy at Quilter, describes the situation as "yet another sign of fiscal drag in action" where "millions are sleepwalking into the tax system through no fault of their own."

"The sharp rise in simple assessments reflects how frozen tax thresholds and higher state pensions are creating more tax liabilities for older people. Many of them may not even realise they owe anything until HMRC's letter arrives," he explained.

LATEST DEVELOPMENTS:

Fiscal drag is dragging Britons into higher tax brackets | GETTY

Fiscal drag is dragging Britons into higher tax brackets | GETTY Greer adds that while simple assessments are intended to simplify tax collection, "they can catch people off guard, especially pensioners who don't complete a tax return and assume their income is below the tax-free threshold."

The Labour Government's freeze on allowances is "quietly swelling the tax base," according to Greer, creating financial challenges for many who were not expecting to pay tax in old age.

For those receiving unexpected tax bills, Greer offers clear advice: "Unexpected tax bills can be scary especially if you are already struggling with your finances. If you get one and don't know what to do, the best course of action is to call HMRC to discuss your options. Do not bury your head in the sand."