Rachel Reeves's inheritance tax raid could hit UK economy as 'staggering 200,000 jobs at risk'

During her Autumn Budget last year, Rachel Reeves confirmed farmers will become liable to pay inheritance tax in the near future

Don't Miss

Most Read

Latest

More than 200,000 jobs could be at risk over the next five years thanks to the Government's inheritance tax raid, new research suggests.

A study from CBI Economics, commissioned by the lobby group Family Business UK, found 208,500 full-time jobs could be lost by April 2030 as a result of Chancellor Rachel Reeves' sweeping changes to business and agricultural property relief.

Research from CBI Economics also found the tax changes would result in a GVA loss of £14.8billion to the economy.

The policy change is expected to raise around £1.8billion in tax revenue over the next five years, but at a net fiscal cost of £1.9billion.

Reeves's inheritance tax plans could lead to 200,000 jobs being lost

| GETTYRachel Reeves introduced the changes to business and agricultural property relief in the Autumn Budget last year, impacting family-owned businesses and farms across the UK.

Changes to BPR and APR in the Autumn Budget limited 100 per cent relief from inheritance tax to the first £1million of claims, with a 50 per cent tax rate applied above this threshold.

Responding to the research, shadow business secretary Andrew Griffith said Labour's proposals were built on "hooky treasury maths and a blatant breach of election promises".

He added: "This survey shows just how little this government understand or care about business."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

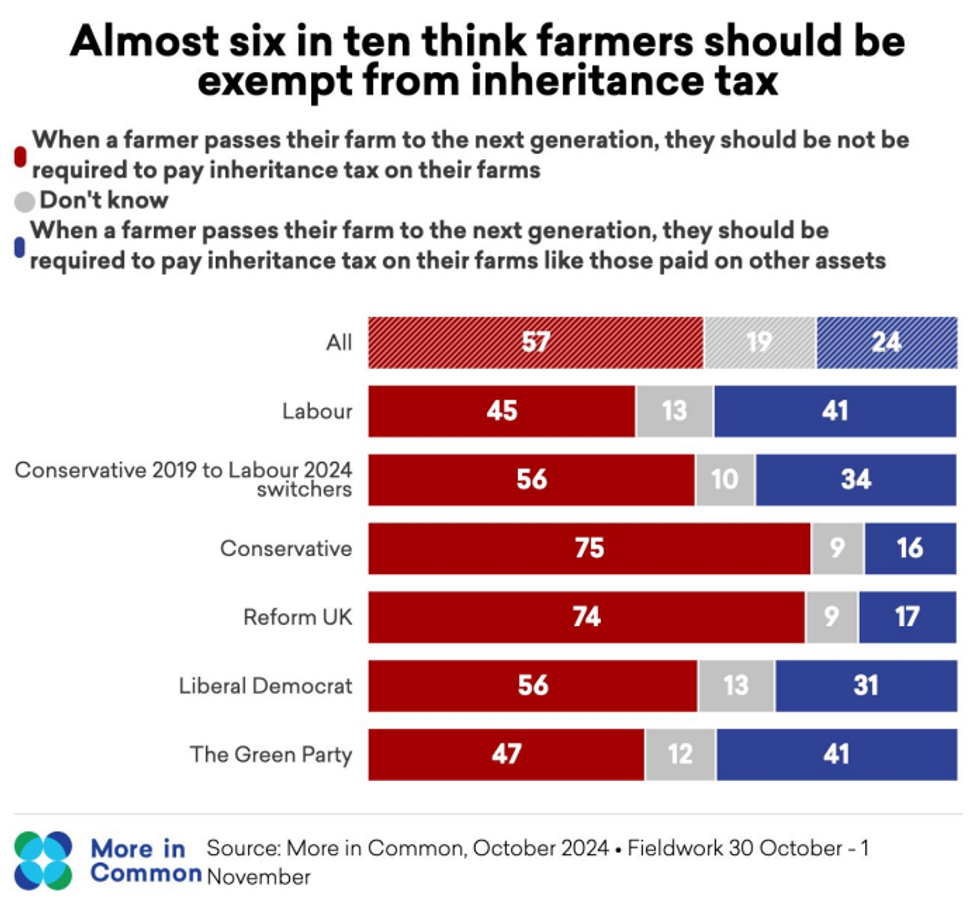

A poll last year found that nearly six in 10 think farmers should be exempt from inheritance tax

| More in CommonIn total, nearly half of family businesses anticipated reducing headcount, with an average decline of nine per cent in employment.

Around 50 per cent expect to pause or cancel planned investments, with a total decrease of 16 per cent in investment.

The agriculture sector is expected to see the steepest drop in investment, averaging a 17 per cent decline, according to CBI Economics.

Shadow business secretary Andrew Griffith said the impact on family-owned businesses was "many times" that on farms, describing it as "a staggering 200,000 jobs at risk."

LATEST DEVELOPMENTS:

Farmers have been protesting against the inheritance tax raid | PA

Farmers have been protesting against the inheritance tax raid | PAA Treasury spokesperson said: "Our reforms to Agricultural and Business Property Reliefs will mean three quarters of estates will continue to pay no inheritance tax at all, while the remaining quarter will pay half the inheritance tax that most estates pay, and payments can be spread over 10 years, interest-free."

The spokesperson described this as "a fair and balanced approach which helps fix the public services we all rely on".

The Treasury added that "capping the rate of corporation tax, reforming planning, establishing a National Wealth Fund and creating pension megafunds is part of our Plan for Change to get Britain building, unlock investment and support business so we can raise living standards and make all parts of the country better off".