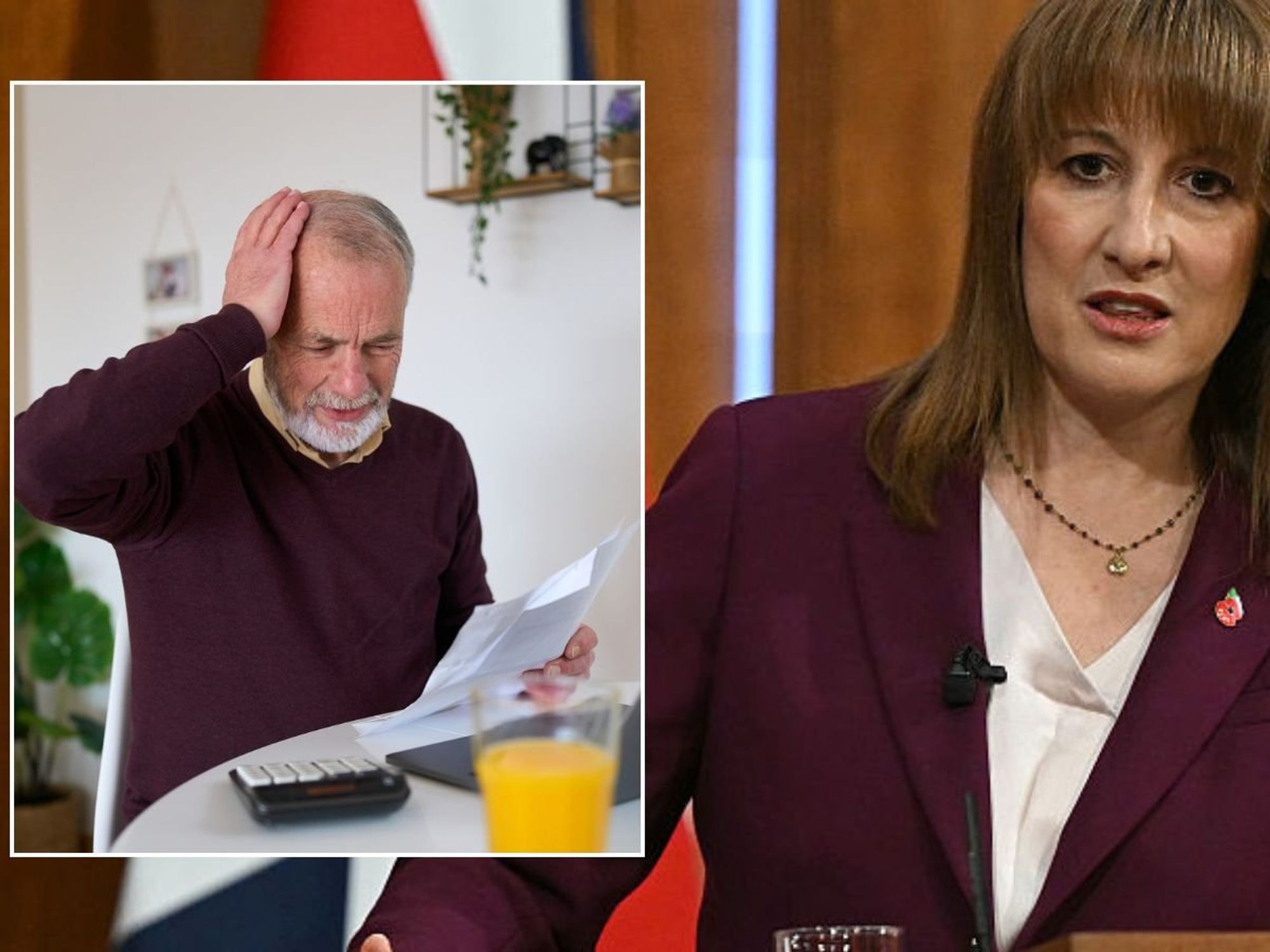

Rachel Reeves considers income tax rise - here's exactly how much more you could pay

Rachel Reeves is considering an increase to income tax, according to reports

Don't Miss

Most Read

Workers could soon see their take-home pay fall as the Government considers changes to income tax to plug a £30billion funding gap.

Treasury officials are looking at options that could leave those on average salaries paying around £224 more each year.

Treasury officials are said to be considering a 1p rise to the basic rate of income tax, which could raise more than £8billion for the public purse.

The move would break Labour’s election promise not to raise income tax, creating a political headache for the Chancellor.

According to reports, some Treasury and Downing Street advisers see an income tax increase as one of the few reliable ways to raise enough money without introducing further tax hikes later in the Parliament.

However, Rachel Reeves is understood to have concerns about the political fallout, particularly after last year’s national insurance rise already went against previous pledges.

A 1p rise in the basic rate of income tax would affect millions of workers across the country, with those on average salaries paying hundreds of pounds more each year.

Someone earning around £35,000 would see their yearly tax bill rise by £224 to £4,710, while those earning up to £50,270 would pay £7,917, an extra £377.

Treasury estimates indicate this measure would generate £6.9billion in its first year

| GETTYTreasury estimates indicate this measure would generate £6.9billion in its first year, subsequently exceeding £8billion annually according to HMRC calculations.

An alternative approach under consideration would target only higher earners by increasing the 40 per cent rate to 41 per cent, leaving those earning below £50,270 unaffected.

This option could prove less politically damaging for Labour as it would spare typical workers from additional tax burdens.

Under this scenario, someone earning £75,000 would pay an extra £247 annually, with their tax bill rising from £17,432 to £17,679.

Those earning £100,000 would face an additional £497 yearly, increasing their payments from £27,432 to £27,929.

HMRC projections suggest this approach would yield approximately £1.6billion initially, growing to exceed £2billion in subsequent years.

The Chancellor faces a difficult decision as Treasury insiders remain split on whether to proceed with any income tax rise, particularly given the political sensitivities involved.

The challenge for the Chancellor is how to close a major funding gap

| GETTY Chancellor Rachel Reeves will unveil her autumn budget on November 26 | PA

Chancellor Rachel Reeves will unveil her autumn budget on November 26 | PAMs Reeves' caution comes from Labour’s clear election promise not to raise income tax, a pledge that played a key role in winning voter support.

The challenge for the Chancellor is how to close a major funding gap without adding to the cost of living pressures already facing millions of households.

Treasury officials are still debating whether the money raised from an income tax rise would justify the political fallout of breaking another key promise so early in Labour’s time in office.

More From GB News