Rachel Reeves warned tax raid is 'paralysing' business as firms brace for biggest layoffs in a decade

Shopkeeper issues warning amid national insurance hike and vape ban - 'There's going to be job cuts!' |

GBNEWS

The UK's jobless rate hit 4.6 per cent in spring 2025, sparking criticism that the Government is failing to protect workers

Don't Miss

Most Read

Latest

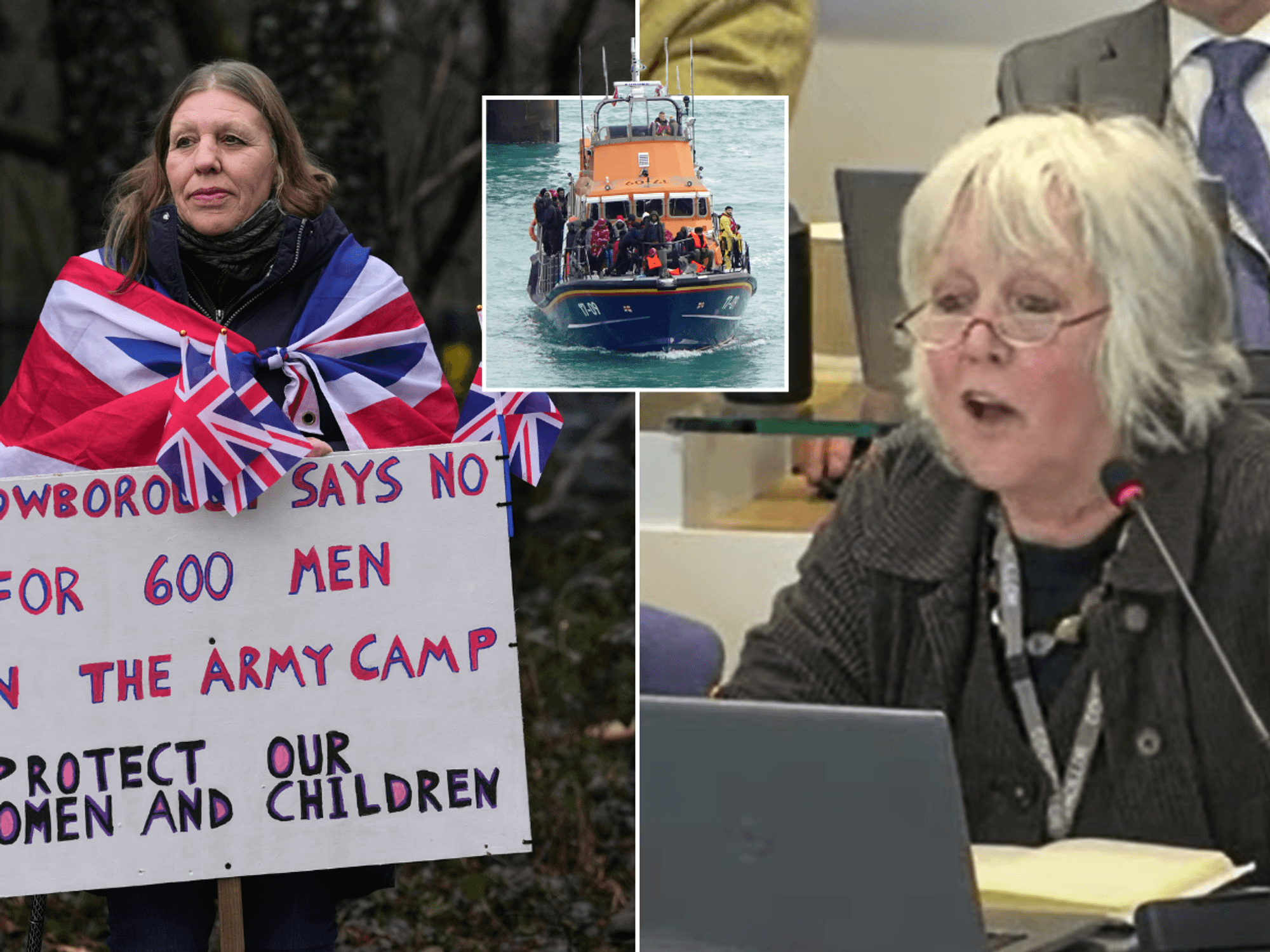

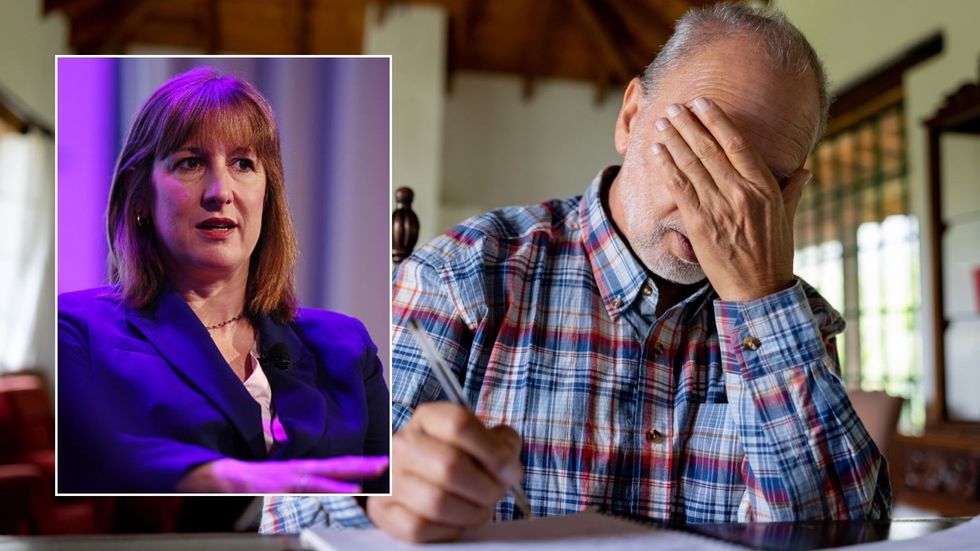

Business leaders have issued stark warnings to Chancellor Rachel Reeves that her tax increases are "paralysing" British companies, with one in three firms cutting jobs to cope with the £25 billion National Insurance raid.

Reeves has been urged not to impose further tax rises in the autumn, cautioning that such moves would harm growth in the economy.

Shevaun Haviland, head of the British Chambers of Commerce (BCC), is set to tell the Chancellor at the organisation’s annual conference on Thursday that the Government must "incentivise growth, not kill it".

Her warning comes amid growing alarm over the impact of higher National Insurance costs. A BCC survey of over 570 firms found that a third have already cut staff or are planning to do so following the April hike in employers' National Insurance contributions.

"Business confidence has collapsed," Haviland will warn, adding: "Increased taxation is paralysing business."

She said the scale of the tax rise "took businesses by surprise", explaining: "We were unprepared for the huge burden placed upon us, and it led many of us to rethink our growth plans."

Separate research from the Chartered Institute of Personnel and Development (CIPD), which represents HR professionals, paints an equally bleak picture.

A survey of 2,000 employers shows that redundancy intentions are now at their highest level in a decade, excluding the Covid pandemic, suggesting the UK could be heading for its biggest wave of job cuts in years.

Rachel Reeves's National Insurance hike is being blamed for the recent job figures

| GETTYHaviland will add: "For the Government to achieve its Growth Mission, people need to stay in work and businesses need to invest. As always, businesses soak it up and move forward, but they feel like they are wading through treacle."

Research from The Entrepreneurs Network revealed widespread dissatisfaction among business founders, with only eight per cent believing the Labour Government understood their needs.

One in six founders was considering selling their business whilst one in 10 planned to leave the UK entirely.

The Weil European Distress Index warned that British businesses were experiencing some of the highest levels of corporate distress in Europe

| GETTYEamonn Ives, the think tank's research director, said: "The fact so few founders believe the Government understands what they require to grow is highly concerning.

"Whether it's by lowering the burden of taxation or simplifying our immigration system, the Government should be unstinting in ensuring that Britain is set up to actively support wealth creation here within our own shores."

The Weil European Distress Index warned that British businesses were experiencing some of the highest levels of corporate distress in Europe, with only German companies struggling more.

Andrew Wilkinson, of Weil's London restructuring practice, said: "Retail's position is a warning sign: rising costs and falling confidence are pushing firms to their limits."

Mounting expectations suggest the Chancellor may need to raise taxes again in autumn to meet her fiscal rules, with Capital Economics estimating she could require as much as £23 billion.

Sir Keir Starmer's winter fuel payment reversal, a potential end to the two-child benefit cap, higher government borrowing costs and a possible productivity downgrade have all increased pressure on Reeves's plans.

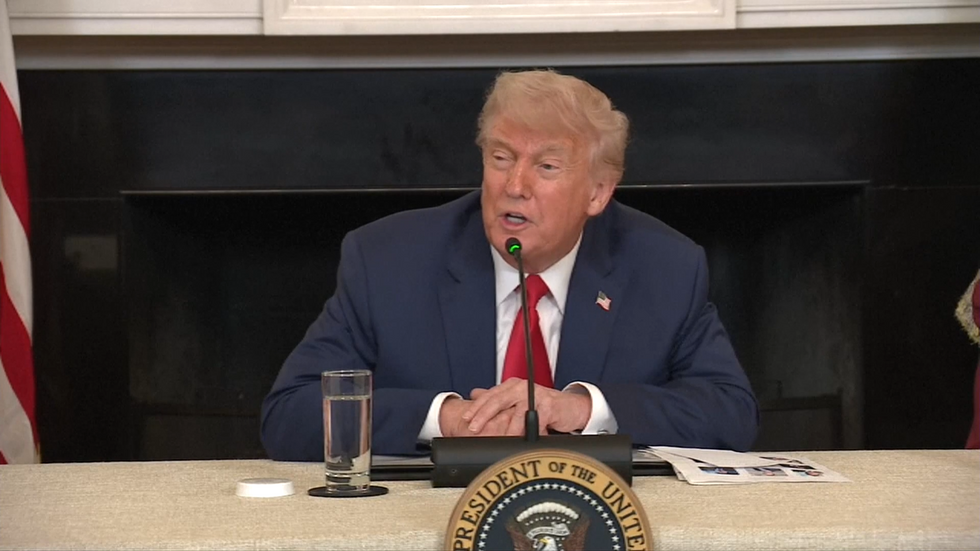

Donald Trump's trade war threats and the need to increase defence spending are adding to the Chancellor's challenges

| POOLDonald Trump's trade war threats and the need to increase defence spending are adding to the Chancellor's challenges, with companies fearing they will be targeted again due to Labour's manifesto pledges not to raise income tax, National Insurance or VAT.

A Treasury spokesman said: "We are a pro-business Government. Economic activity is at a record high with 500,000 more people in employment since we entered office.

"We are also protecting the smallest businesses from the employer National Insurance rise, shielding 250,000 retail, hospitality and leisure business properties from paying full business rates and have capped corporation tax at 25 per cent – the lowest rate in the G7.

"The tough but necessary decisions we’ve taken on tax mean we could protect working people's payslips from higher taxes, invest record amounts into the NHS, defence and other public services while keeping bus fares at £3 and expanding free school meals."

More From GB News