Graphs expose Rachel Reeves's £100bn tax bombshell - and the REAL reason a terrible raid is coming

WATCH: Head of Campaigns at the Tax Payer's Alliance Elliot Keck slams reports that Rachel Reeves plans to raise two billion pounnds a year, by taxing private pensions in the upcoming Budget

|GB NEWS

A new analysis raises serious questions about Rachel Reeves' competency as Chancellor of the Exchequer

Don't Miss

Most Read

Since taking office, Rachel Reeves has clawed back billions through taxation and social contributions, a bombshell new report has found.

A number crunch of the latest figures from the Office for National Statistics raises serious questions about the extra spending she has committed to in her first term, which has led her to further tax rises in the upcoming Budget.

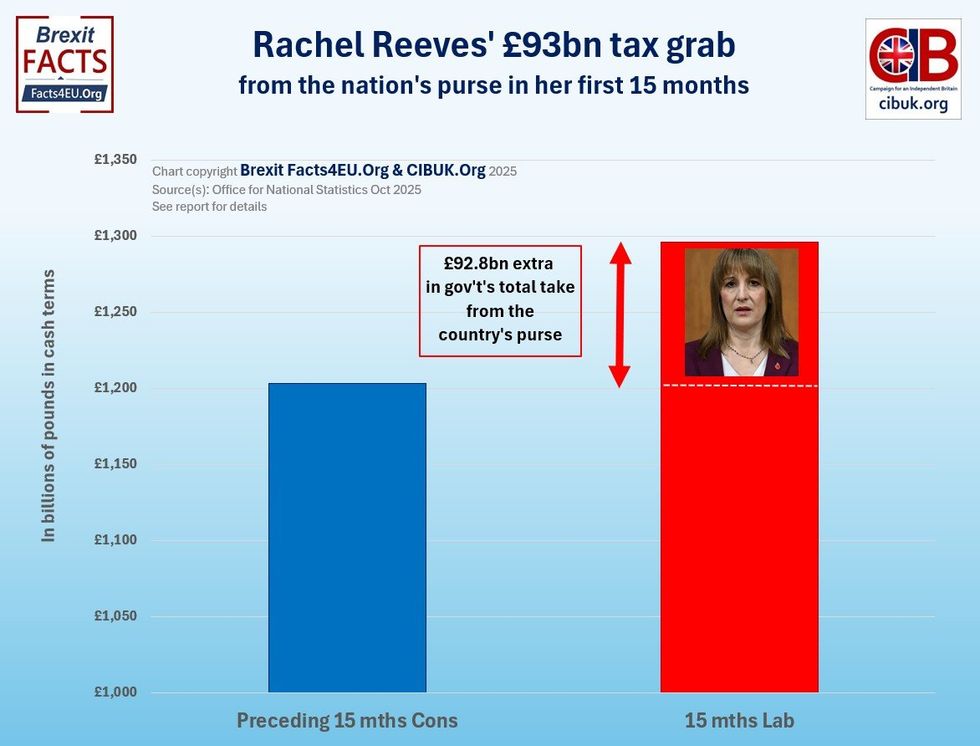

The analysis by the Brexit Facts4EU and CIBUK teams, together with Sir John Redwood and in association with GB News, found that in the first 15 months since Ms Reeves became Chancellor, the Government has taken £93billion more from the nation’s purse in total public sector taxes and social contributions than in the same 15-month period preceding it.

Below, a series of graphs detail Ms Reeves' tax hikes, which are compounded by stark unemployment statistics. Taken together, they provide a partial explanation as to how Rachel Reeves has boxed herself in, while raising concerning questions about where that extra money has been spent.

TRENDING

Stories

Videos

Your Say

Reeves terrible taxation

The graph demonstrates Rachel Reeves' huge tax grab from the nation's purse

|Brexit Facts4EU and CIBUK

In Rachel Reeves' first 15 months as Chancellor, the Government has taken tens of billions more from the nation’s purse in total public sector taxes and social contributions than in the same 15-month period preceding it (see chart above).

From July 2024, when she became Chancellor of the Exchequer, to September of this year, Ms Reeves has increased the government’s total "take" by £92.8billion.

In Part II of this GB News special series, we showed how the Chancellor's for the year 2024/25 reached £1.27trillion, all while claiming she inherited a 'black hole' from the previous government.

“Rachel Reeves made a big tax grab last year, promising it would be a single, necessary raid, setting her up for no more rises. She lied. Instead of creating the stability she promised, she put spending up by much more than the large tax rise. Now she needs to mug taxpayers again to pay for her runaway spending," Sir John Redwood said.

“The problem is her spending addiction. What maddens voters is that the spending does not buy us controlled borders, safe prisons or better access to healthcare. It disappears into her black holes to pay for surging unemployment, more illegal migrants and low productivity in public services.

“More tax rises run the risk of damaging growth more. That puts us back in a doom loop, with lower growth cutting revenues and leaving a bigger deficit all over again.”

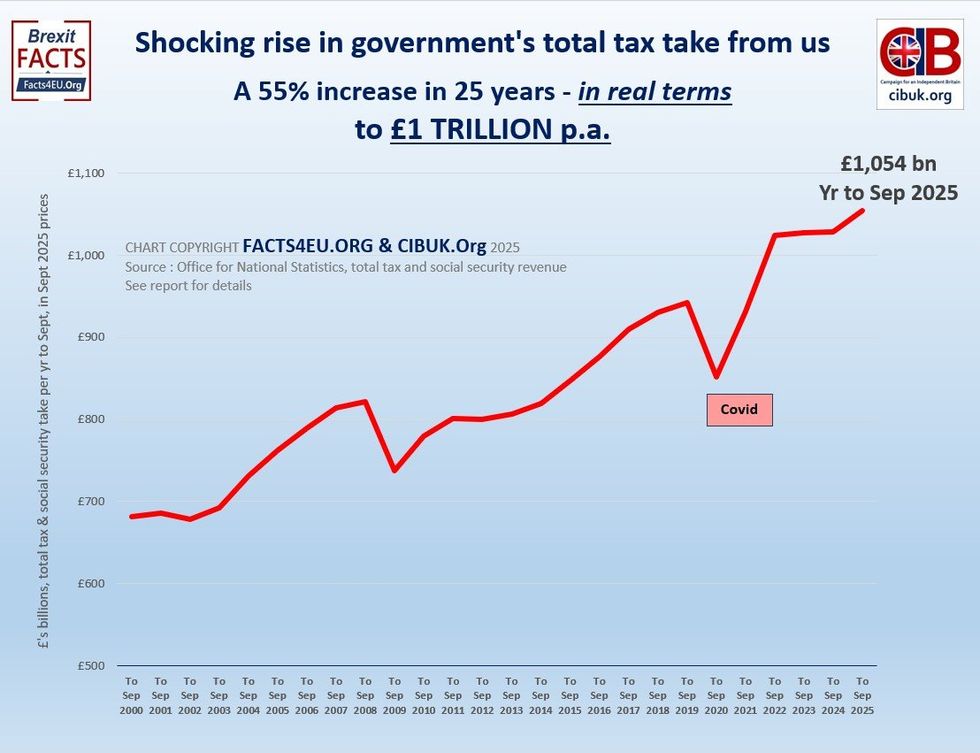

The Government is now taking £1TRILLION in all its various taxes from us each year

The graph shows the shocking rise in government's total tax take from the public: a 55% increase in 25 years - in real terms

|Brexit Facts4EU and CIBUK

In the last 25 years, successive governments have steadily increased the amount of tax and social contributions from the public and businesses.

These payments fell sharply during the Covid pandemic, when so many people were prevented from working. But then the amount jumped and has kept increasing ever since.

The chart above illustrates just how quickly the government has tried to balance the books since. These are the official figures from the Office for National Statistics, converted by the Brexit Facts4EU team into today’s money, (Sept 2025 prices).

The difference between this figure of £1trillion and the £1.27trillion the government spent is explained by the amount the government borrowed plus some non-tax incomes.

This massive jump in spending is not explained by the population increase - this is only 17.6 per cent over the 25 years, far less than the increase in the tax take.

The graph shows that the total tax income in the year to Sept 2000 was £681billion. By the year ending September 2025, this had soared to over £1trillion - an increase of 54.7 per cent in real terms.

Jumps in joblessness

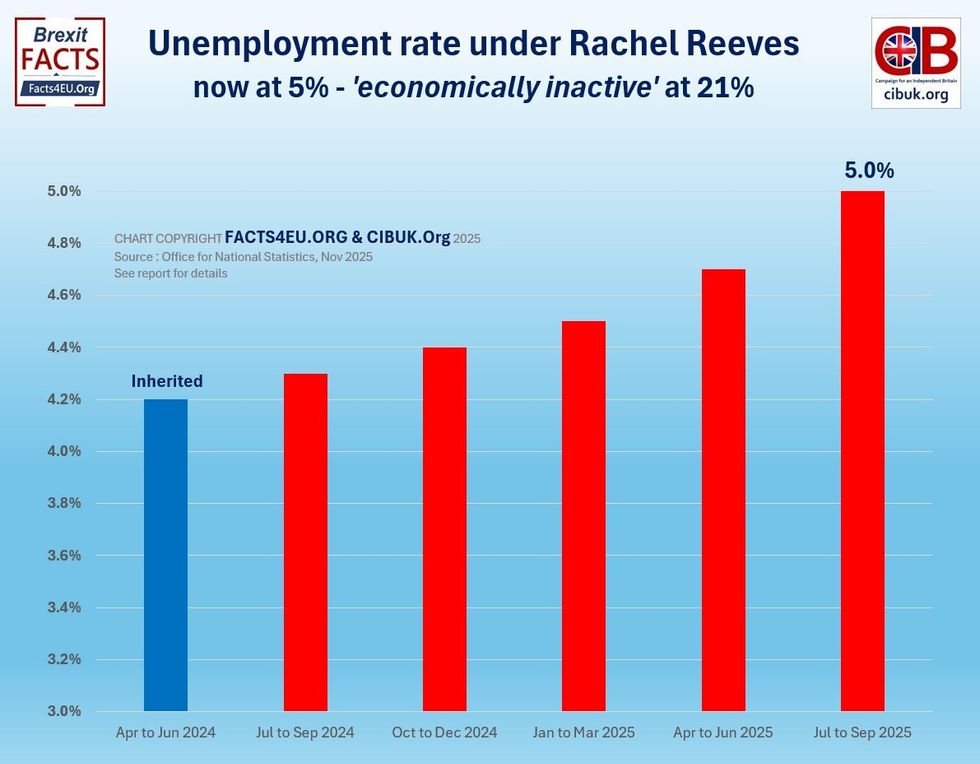

The chart above demonstrates the unemployment rate under Rachel Reeves is now at 5.0%

|Brexit Facts4EU and CIBUK

As the graph above shows, in July to September 2025, the UK unemployment rate increased again, reaching 5.0 per cent.

Over this same period, the estimated UK employment rate decreased 0.2 percentage points. An astonishing 21.0 per cent of those of working age were ‘economically inactive’.

Excluding the Covid period, this is the first time this has happened since June 2016 - nearly 10 years ago. Brexit Facts4EU and CIBUK can also reveal exclusively that male unemployment exceeded 5.0 per cent in the latest figures to August, and in the latest quarterly results, it has risen to 5.4 per cent.

Excluding Covid, the last time this happened was a year before the EU Referendum. And all this has occurred under a Labour Chancellor.

When Ms Reeves took office, overall unemployment was still high after Covid, but had dropped to 4.2 per cent. Since then, as the chart shows, the quarterly figures have only gone one way: up.

By the end of the year (2024), this figure had risen to 4.4 per cent, by June 2025, this became 4.7 per cent, and, as of September 2025, this figure reached its current level of 5.0 per cent.

Sir Redwood said: “Many of us warned the Chancellor at the time of her first budget that imposing a big additional tax on jobs would mean fewer vacancies and more people out of work. We cautioned that increasing taxes on businesses and farms would cut investment, knock confidence and put employers off hiring staff. So it proved.

“The Chancellor found out the hard way that higher taxes can hit jobs and undermine confidence. So why do it again? Why put up income tax so it is less worthwhile working extra or at all? Does she want another year of rising unemployment many more people on benefits and another failure to bring borrowing down? Please Chancellor, change your mind and get us out of the high tax high borrowing doom loop.”

Blunt instrument

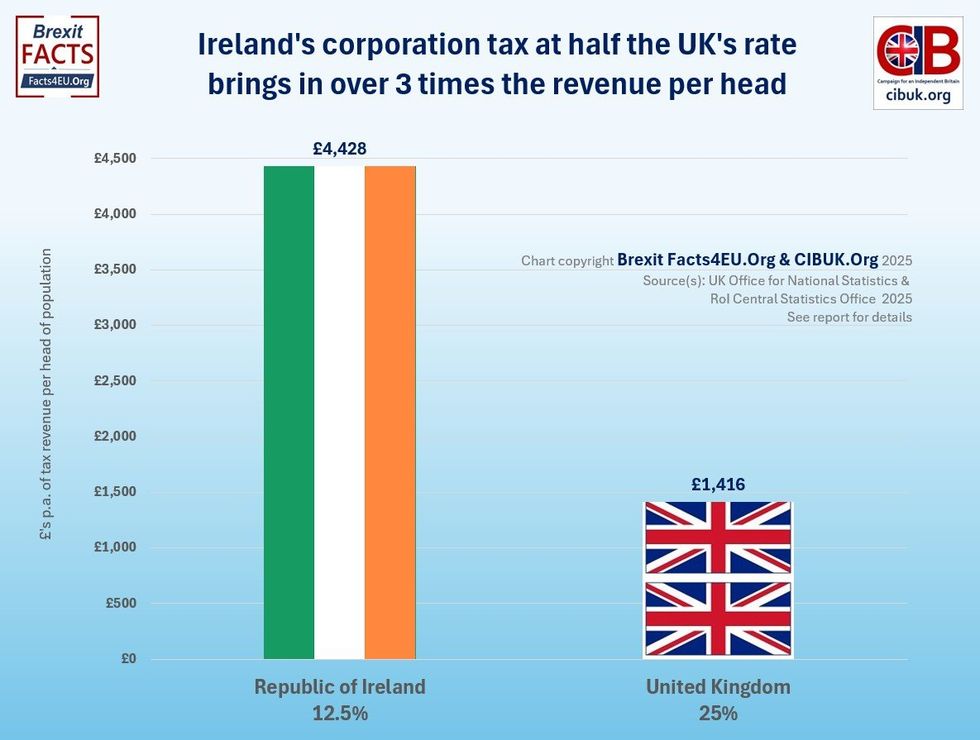

The chart shows that Ireland's corporation tax, which sits at half the UK's rate, brings in over three times the revenue per head

|Brexit Facts4EU and CIBUK

It is well-known in economists’ circles that tax revenues rise as the tax rate rises, but only up to a point. If tax rates rise beyond a certain limit, which depends on the tax and who it is affecting, then revenues from the tax actually start falling.

Probably the best example of the way in which the total tax received can actually be higher with a lower tax rate is when comparing corporation tax between the UK and the Republic of Ireland.

The UK’s main corporation tax rate is double that of Ireland – 25 per cent versus 12.5 per cent. Despite this, the Republic collects more than three times the tax revenue per head of population than the UK.

“Rachel Reeves has taxed us so much that she will now find putting taxes up will, in some cases, lead to less revenue. Her high levels of Spirits Duty last year led to a fall in the amount collected, as people could not afford the drinks with the new super tax.

"Changes to toughen Capital Gains Tax meant revenues from that very avoidable tax also fell. Under Jeremy Hunt and now Rachel Reeves, the UK has lost out massively on business taxes. By charging 25% to Ireland's 12.5%, the Treasury collect so much less revenue per head," Sir Redwood said.

The former Conservative MP continued: “Ireland has attracted more and more big investors and projects to Dublin, which could well have come to the UK if we offered the same lower Corporation tax rate. As Facts4EU show vividly, the UK collects so much less tax per head from business than Ireland because so many of the successful US corporations now choose to base much of their activity in Ireland, not here. To get out of our current fiscal black hole, we need more revenue from more growth. We would get both if only the government had the common sense to charge a rate of business tax that firms would stay to pay, and other firms would come to help them flourish.

“Just as Rachel Reeves' higher taxes are killing jobs and the employment market, so are her business taxes killing investment. They put off new companies from coming to the UK in the first place. No wonder the UK is in the slow lane with the EU and not in the fast lane with the USA.”

More From GB News