Premium Bonds alert: Savers face 'widespread cuts' after major NS&I rate decision

NS&I has announced more interest rate cuts, which could signal changes to Premium Bonds down the line, according to experts

Don't Miss

Most Read

Premium Bonds holders could be impacted by "widespread cuts" from National Savings and Investments (NS&I) later this year following a recent announcement from the financial institution, analysts warn.

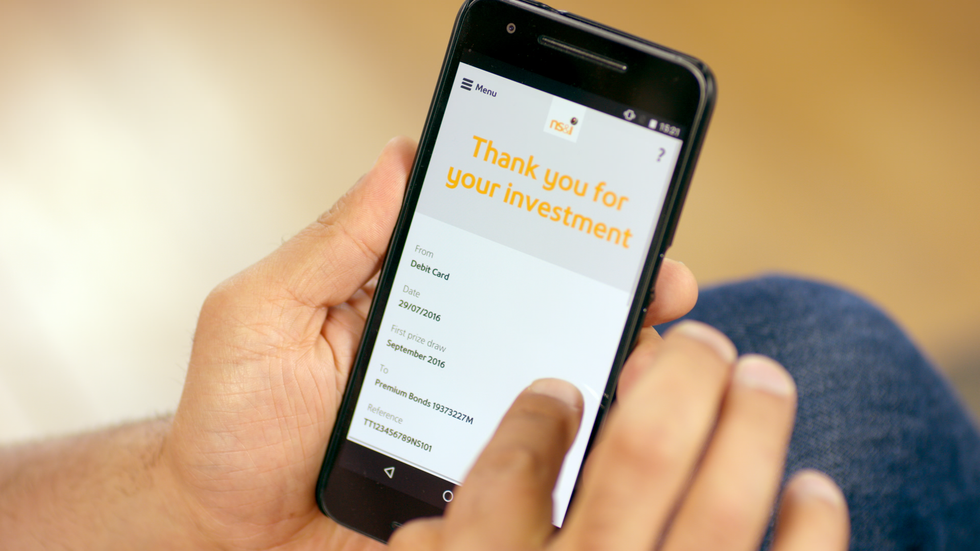

The Government-backed bank is reducing interest rates on two of its popular savings products from next month, which could impact NS&I's well-known savings product down the line.

The Direct Saver account will see its rate fall from 3.3 per cent to 3.05 per cent, while Income Bonds will also drop to the same level from their current 3.3 per cent. Both changes take effect on Thursday, February 12.

This represents the first adjustment to these particular accounts since March 5, 2025, with NS&I stating the reductions reflect shifts in the broader savings market during the intervening period.

Premium Bond savers face 'widespread cuts', analysts warn

|GETTY

Sarah Coles, the head of personal finance at Hargreaves Lansdown, said this latest move from NS&I would leave many customers feeling let down amid ongoing changes in the savings market.

"This isn't a surprise, especially given how the high street giants have taken a scythe to their easy access rates, but for loyal NS&I savers, it will be a significant disappointment," she said.

She noted that, with major high street banks having slashed their rates dramatically, some now offering below 1 per cent on easy-access accounts, NS&I was always likely to follow a similar path.

Despite the cuts, savers willing to look beyond NS&I can secure considerably better returns, according to Coles. She highlighted that online banks and savings platforms have maintained far more competitive offerings as they battle for customers.

NS&I has made changes to its account rates

| NS&I;"The contrast with the most competitive deals on the market is striking," Coles said. "The online banks and savings platforms are keen to win market share and compete for business, so as a result, they've held onto higher rates impressively."

While rates have declined from their peak, numerous providers continue to offer more than 4 per cent on easy access accounts. "It means savers can do much better elsewhere," Ms Coles added.

The savings expert also broke down the impact on Premium Bonds customers, stating: "Holders will be glad NS&I has chosen this approach, rather than cutting the Premium Bond prize rate. However, they're not out of the woods just yet.

"NS&I will have an eye on ensuring the prize rate isn't offering significantly more than the easy access market, so if we see more widespread cuts, Premium Bonds could be next for the chop."

For savers concerned about security, Coles noted that while NS&I offers full Treasury backing on deposits, the Financial Services Compensation Scheme now protects up to £120,000 per institution.

Unlike traditional savings accounts, Premium Bonds holders are enrolled in a monthly prize draw instead of accruing interest, with winners taking home up to £1million every month.

While Premium Bonds has been an option for millions of Britons, savers have taking advantage of the recent period in high interest rates following action from the Bank of England.

In response to a surge in the consumer price index (CPI) inflation rate, the central bank's Monetary Policy Committee (MPC) has voted to raise the base rate to as high as 5.25 per cent.

The Bank of England base rate has fallen | CHAT GPT

The Bank of England base rate has fallen | CHAT GPT This has been passed on to savers; however, the Bank has since reduced interest rates to 3.75 per cent as inflationary pressures have eased. This is set to impact the returns rewarded from

Andrew Westhead, NS&I's retail director, insisted the financial institution continually monitors its savings interest rates in response to market conditions, which are continuously fluctuating.

Mr Westhead said: "We keep all our savings rates under review as market conditions change.

"Today's changes will help us meet our net financing target whilst continuing to balance the interests of our savers, taxpayers and the wider financial services sector."

More From GB News