Pension warning as 'unavoidable necessity' sees Britons miss out on £38,000 savings boost

Sunak accuses Labour of hitting pensioners with tax after tax

|GB NEWS

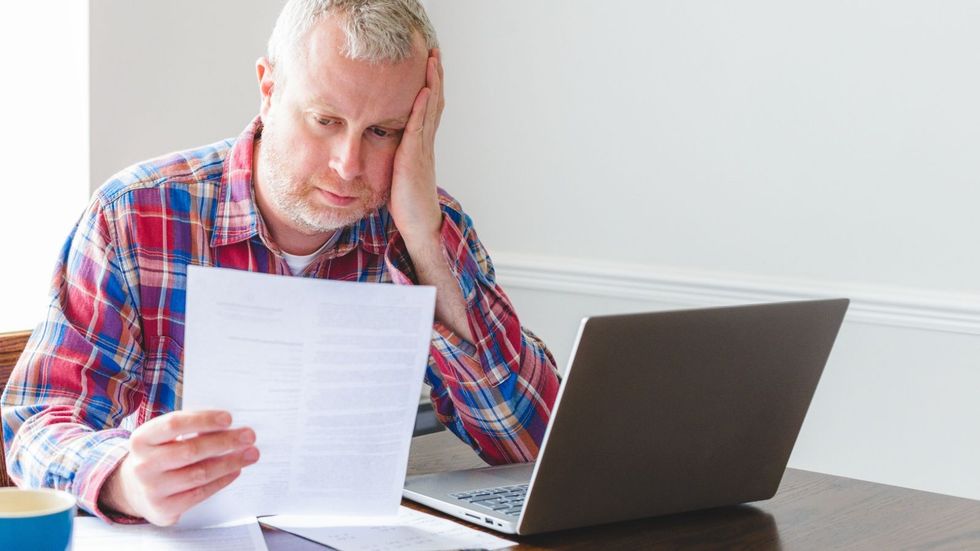

Britons are able to start withdrawing money from their pension at the age of 55 but doing so presents risks, according to Scottish Widows

Don't Miss

Most Read

An "unavoidable pension necessity" could see Britons boost their retirement savings by up to £38,000 but the majority of people are missing out on this sum, experts claim.

Pension savers withdrawing from their workplace pot before retirement are putting themselves at “risk”, according to research by Scottish Widows.

On average, the provider found that the average workplace pension withdrawal came to £47,000, based on customers’ behaviour across more than 230,000 different retirement claim transactions between 2019 and 2023.

If this amount remained invested from age 55 for an extra five years, savers would potentially have around £13,900 more on average once they hit 60, the analysis suggests.

By 55, Britons with a defined contribution (DC) pension are able to begin withdrawing money under existing rules.

The £13,900 figure could potentially increase to around £24,600 if it were to stay invested for 10 years to age 65.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are missing out a vital pension boot by choosing to withdraw from their retirement pots

|GETTY

If this money were to remain invested until someone turned 70, they would have more than £38,000 in their pension pot.

However, how much someone will eventually have saved in their workplace retirement plan is dependent on how markets perform.

More than three-quarters of people with DC pension pots have already withdrawn money from them by the time they retire, Scottish Widows found.

Out of the people taking money out early, 52 per cent withdrew funds five years before their selected retirement age (SRA).

Some 21 per cent opted to start taking out funds nine to 10 years before their retirement age.

Graeme Bold, workplace pensions director at Scottish Widows, noted that early pension withdrawals are often “an unavoidable necessity” which the majority of Britons are forced to take but urged anyone doing this be aware of the “risks”.

Bold explained: “As an industry, it’s crucial that we better understand pension holders’ behaviour, so that we can help them save enough for a comfortable retirement.

“More needs to be done to encourage people to keep their pensions invested for as long as possible.

“It’s up to pension providers to have the support in place for people through a lifetime of investment – before, during and after they reach retirement age.

“The pensions landscape is ever-changing – people are living longer which means pensions must cover longer retirements, and more people are choosing to phase into retirement with part-time work.

LATEST DEVELOPMENTS:

Pensioners face a "poorer retirement" due to withdrawing from their pots early

| GETTY“Therefore, it’s essential that pensions are flexible enough to be fit for purpose in today’s world.”

Last week, a Freedom of Information request, commissioned by Lane, Clark and Peacock (LCP), found around one million Britons are trapped in “shocking” long-term mortgage deals that lasted way past the state pension age.

Sir Steve Webb, a former pensions minister, warned that many households are “gambling their retirement” with the hope of getting on the property ladder.

In recent months, experts have urged MPs to act as future generations face a worse-off retirement than their parents and grandparents.