Pension disaster as 3.3 million retirement savers to be clobbered by 'worse' stealth tax on salary sacrifice

Will you be affected by Rachel Reeves's changes to pension saving rules?

Don't Miss

Most Read

Some 3.3 million pension savers are due to be clobbered by a looming stealth tax due to Chancellor Rachel Reeves changes to salary sacrifice rules, which were announced in last month's Budget.

While these reforms will not be introduced until April 2029, newly published figures from HM Revenue and Customs (HMRC) suggest millions will pay more to the tax authority.

HMRC's guidance reveals that 7.7 million workers currently utilise salary sacrifice arrangements for their pension contributions, with 3.3 million of these contributing more than £2,000 annually.

Under the measures announced in the Budget, pension contributions made through salary sacrifice exceeding the £2,000 annual threshold will lose their National Insurance exemption.

Pension disaster as 3.3 million retirement savers to be clobbered by 'worse' stealth tax

|GETTY

Any amounts above this limit will instead be treated as standard employee pension contributions within the tax system, meaning workers will face National Insurance charges on these sums.

Salary sacrifice schemes currently offer a tax-efficient method for employees to boost their retirement savings while maintaining their take-home pay through reduced National Insurance contributions.

HMRC data indicates those using these arrangements tend to be of typical working age, with workers aged 31 to 50 making up 52 per cent of participants despite representing just 44 per cent of the broader employee population.

Men are similarly overrepresented among salary sacrifice pension contributors, accounting for 59 per cent compared to their 50 per cent share of the UK adult population.

Workers have been taking advantage of workplace salary sacrifice schemes | GETTY

Workers have been taking advantage of workplace salary sacrifice schemes | GETTYWorkers frequently adjust their contribution levels throughout their careers based on financial commitments and proximity to retirement.

The administrative burden will fall on 290,000 employers operating salary sacrifice pension arrangements, who must now track relevant contribution amounts and report class one national insurance payments to HMRC where applicable.

Businesses face one-off expenses for familiarising themselves with the new rules, staff training and software updates, alongside ongoing costs for additional calculations and reporting requirements.

HMRC itself anticipates spending roughly £1.9million on IT modifications to implement the measure.

The changes come as the cost of salary sacrifice relief has grown substantially, according to the latest HMRC figures.

Salary sacrifice's expenditure has jumped from £2.8billion in forgone National Insurance contributions during 2016-17 to £5.8 billion in 2023-24, with projections suggesting this would nearly triple to £8 billion by 2030-31 without intervention.

Sir Steve Webb, a former pensions minister now working as a partner at consultants Lane Clark & Peacock, cautioned that the consequences could extend beyond those directly affected if employers respond by scaling back pension provision for all staff.

"A Budget measure that was largely seen as complex and technical could have significant real-world implications for millions of workers," Mr Webb said

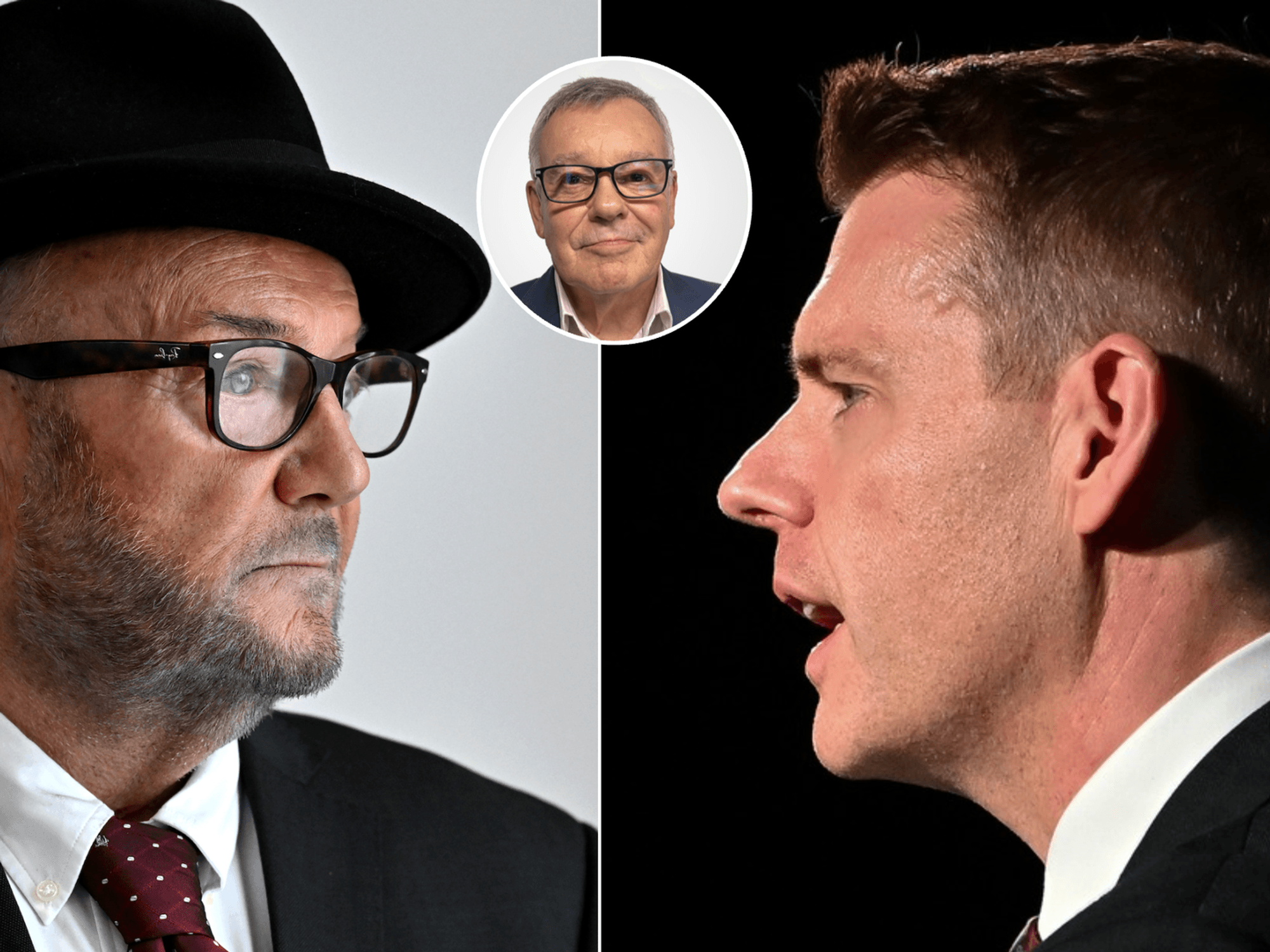

Rachel Reeves unveiled multiple reforms in her Autumn Budget

| PA“At a time when the nation as a whole has a significant ‘under-saving’ problem, this change will make matters worse.

“On the Government’s own estimates, around three in seven of the workers who use salary sacrifice to pay into their pensions will be hit by the change, while employers will face a bigger hit because of their higher rate of National Insurance contributions.

"Although employers have time between now and 2029 to consider their options, there is a risk that some will simply cut back on the generosity of their workplace pension offering, which would be a serious backward step."