Labour REFUSES to protect pensions from tax as millions of retirees 'in limbo once again'

The Government is under pressure to introduce a pension tax lock

Don't Miss

Most Read

Latest

The Labour Government has refused to implement a "pension tax lock" to protect older Britons from paying more of their retirement savings to HM Revenue and Customs (HMRC).

Ministers have turned down a petition demanding declining to guarantee protection for tax-free pension withdrawals or relief on contributions. despite over 22,400 signatories.

The petition, launched by investment platform AJ Bell, states: "The Chancellor should introduce a pension tax lock: a commitment not to reduce the amount people can withdraw from their pension tax-free or the amount of tax relief given on pension contributions.

"We believe this would help ensure retirement savings are protected and people can save with confidence."

Labour has refused to implement a pensions tax lock despite a popular petition

|GETTY

In its latest reply, the Treasury reiterated its standard position of not commenting on potential tax changes before fiscal events.

This marks the second time officials have declined to back the proposal, having previously refused to commit when first responding in October ahead of Chancellor Rachel Reeves's Budget.

A Treasury spokesperson stated: "The Government wishes to encourage pension saving, to help ensure that people have an income, or funds on which they can draw on, throughout retirement.

"The Government is committed to supporting savers at all stages of life. That is why, for the majority of savers, pension contributions made from income during working life are tax-free."

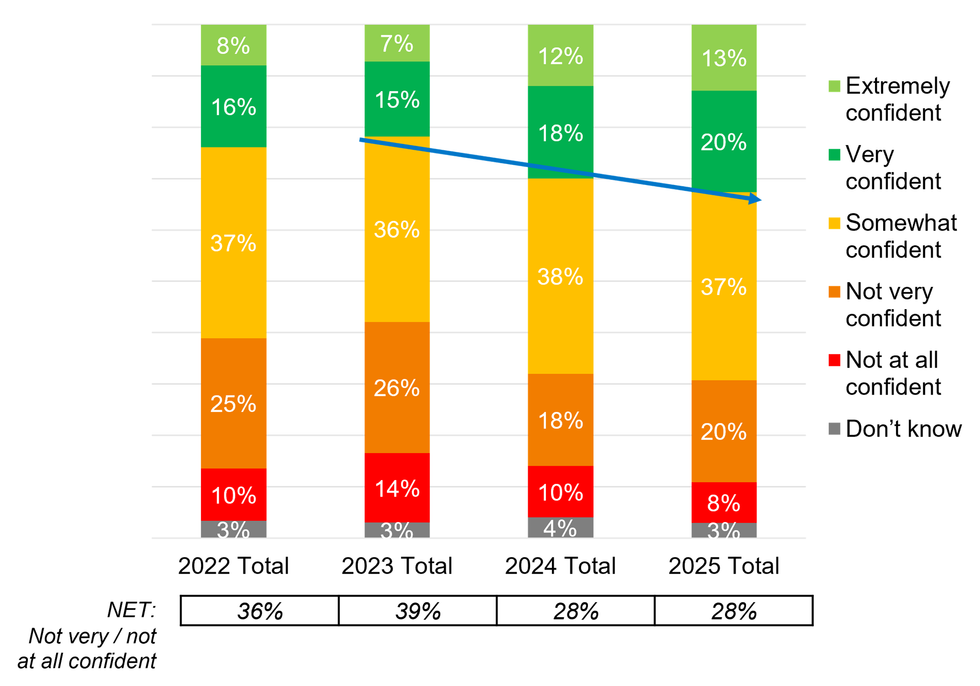

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Tom Selby, the director of public policy at AJ Bell, condemned the Government's stance, stating it has "comprehensively failed to deliver much-needed certainty for pension savers".

He accused ministers of contradicting themselves by claiming to support pension saving whilst simultaneously refusing to quash damaging speculation.

"Having overseen one of the leakiest Budgets in living memory, the Government must be well aware it has created the conditions for rampant speculation," Mr Selby said.

The decision leaves savers "in limbo once again", he warned, adding that ongoing uncertainty risks prompting more people to withdraw their pension funds prematurely based on rumours about future policy changes.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR Calls for a pension tax lock come as the full, new state pension comes close to cross the personal allowance threshold due to the impact of fiscal drag and the triple lock.

Fiscal drag is the term used to describe when tax thresholds are frozen during a period of time when incomes or inflation are on the rise, resulting in taxpayers being pulled into higher brackets.

Thanks to the triple lock, state pension payment rates are guaranteed to rise every year in line with either the rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

As it stands, the full new state pension amount for the 2025/26 tax year is £230.25 per week, or £11,973 annually, Under the triple lock, this will jump to £241.30 per week or £12,547.60 per year.

Analyst have warned this bring the retirement benefit just £22 away from crossing the personal allowance, meaning older Britons will pay tax on their state pensions alone for the first time.

John Chew, a technical specialis for Tax and Estate Planning at Canada Life, explained: "The triple lock will trigger a 4.8 per cent rise in the state pension from April 2026 to £12,548, meaning pensioners will be just £22 away from the income tax cliff edge.

"With income tax thresholds now extended until 2031, this stealth tax will continue to bite deeper into pensioners’ incomes. From April 2027, anyone receiving the full state pension will, for the first time, start paying income tax on it.

"For those who will be relying on other assets to sustain their finances in retirement - such as private pensions, annuities, or dividends - the income tax bill will rise even further. In just four months, pensioners relying on dividend income will also face a 2% increase in dividend tax, further eroding their retirement income."

More From GB News