Pension disaster looms for Britons as half of baby boomers fall short of retirement savings goal

New research suggests retirees may not have saved enough for an adequate retirement in Britain

Don't Miss

Most Read

Latest

Only 51 per cent of Britain's baby boomer generation have adequate financial preparations for their retirement years, according to new research.

Vanguard's comprehensive Retirement Outlook study has revealed a dramatic disparity in readiness levels between different pension holders.

Those fortunate enough to possess defined benefit pension arrangements show markedly superior preparation, with 69 per cent meeting their retirement targets.

This contrasts sharply with individuals lacking such schemes, where only 28 per cent have achieved sufficient financial security.

Baby boomers are not saving enough, according to research

|GETTY

Government statistics indicate that 65 per cent of individuals in their sixties hold pension assets within DB programmes, whilst merely 25 per cent possess defined contribution savings.

For baby boomers anticipating DB pension income, these traditional schemes are projected to constitute roughly 50 per cent of their total retirement earnings, according to Vanguard's findings.

The prevalence of DB schemes amongst this age group reflects the pre-2012 pension landscape, before automatic enrolment transformed workplace savings.

This historical advantage has created a substantial divide in retirement preparedness between those with and without access to these guaranteed income streams.

Working longer or transitioning gradually into retirement represents one viable strategy for enhancing financial stability, particularly for those capable of extending their careers.

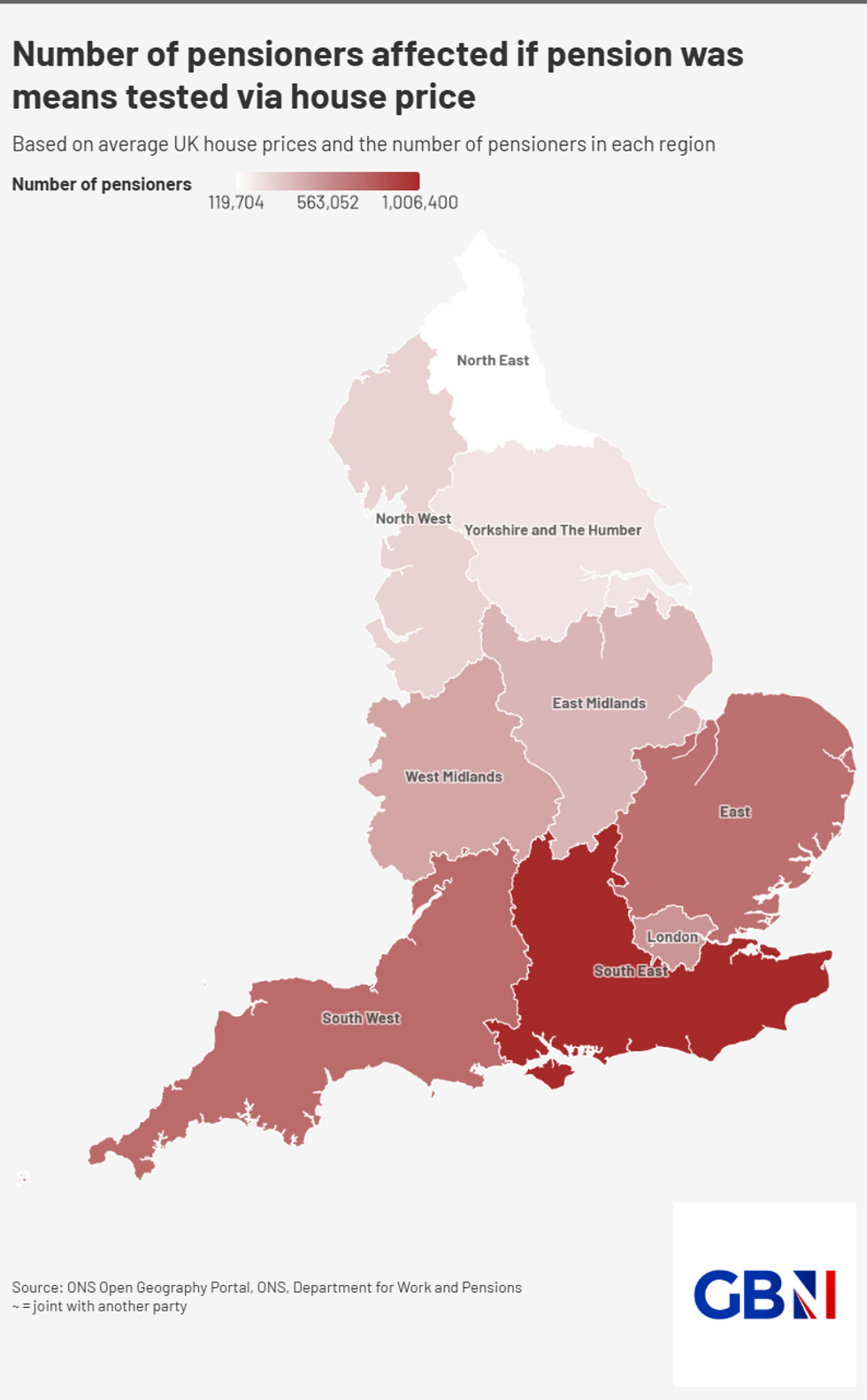

Property assets offer another avenue, with downsizing, relocation to more affordable regions, or equity release schemes providing potential solutions to funding gaps.

"Planning for retirement can feel complex and overwhelming. However, there are things people in, at or entering retirement can do that will make a difference to their financial situation," states Georgina Yarwood, senior investment strategy analyst at Vanguard Europe.

Additionally, reassessing expenditure targets could substantially boost retirement preparedness, with even a 10 per cent reduction in planned annual spending making a meaningful difference.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Looking ahead, younger workers face different challenges but can learn from current retirees' experiences.

Research indicates most people begin retirement planning merely three to five years before their intended departure date.

LATEST DEVELOPMENTS:

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBN"For younger generations, it's a good idea to start early," advises Yarwood.

"Time is an asset. By saving consistently and putting money to work in the investment markets, they can benefit from the power of compounding."

According to Yarwood, engagement with pension planning could help future retirees avoid the preparedness gap currently affecting half of baby boomers.

She notes this particularly pertinent given the shift away from defined benefit schemes towards defined contribution arrangements in modern workplaces.

More From GB News