Pension hack could 'boost' YOUR retirement savings by £201k and 'reduce' stealth tax

Finance expert discusses Reeves' use of 'stealth taxes'

|GB NEWS

Analysts are recommending workers invest overtime pay in pension savings to help their retirement

Don't Miss

Most Read

Latest

Britons could boost their retirement savings by up to £201,000 and avoid a stealth tax on income thanks to a little-known pension hack, analysts claim.

Workers facing the squeeze from frozen income tax thresholds have a potential solution that could save thousands in tax whilst significantly enhancing their retirement funds.

Research from Standard Life, part of Phoenix Group, demonstrates that channelling overtime earnings directly into workplace pensions offers dual benefits.

This strategy helps employees avoid being pushed into higher tax brackets as wages rise, while simultaneously building retirement savings that could exceed six figures.

A pension hack could reward Britons with a £200k retirement savings boost

|GETTY

The analysis reveals that regular pension contributions from overtime pay could transform retirement prospects, with examples showing increases ranging from £134,000 to £201,000 depending on contribution levels.

Workplace pension schemes through auto-enrolment generally calculate contributions based on basic salaries, overlooking additional earnings like bonuses and overtime payments.

Yet British workers put in substantial extra hours, averaging 215 annually according to recent surveys, Standard Life claims.

These additional hours generate approximately £4,022 in supplementary income for those receiving overtime compensation.

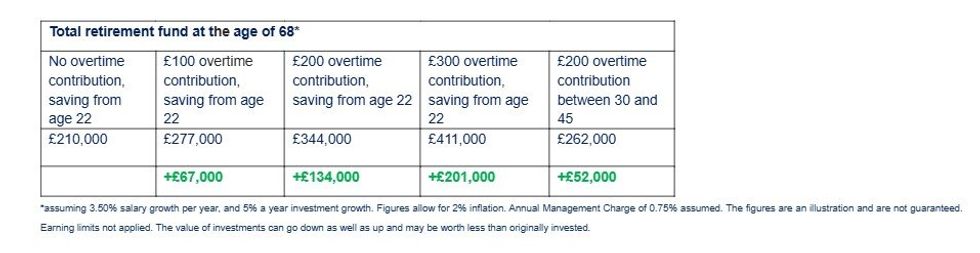

How much could you save for retirement?

|STANARD LIFE

Industries such as manufacturing and construction frequently offer premium rates for extra hours worked, often paying one and a half times standard hourly wages.

For employees earning more overtime than required for immediate expenses, these payments represent an untapped opportunity to enhance retirement provisions whilst managing tax exposure.

The figures from Standard Life's research paint a compelling picture for workers starting their careers.

An individual beginning full-time employment at 22 with a £25,000 salary would accumulate approximately £210,000 through standard auto-enrolment contributions by retirement at 68, accounting for two per cent inflation.

Adding £200 monthly from overtime payments transforms this outlook dramatically, potentially creating a retirement fund worth £344,000; an enhancement of £134,000.

Those able to redirect £300 monthly could see their pension reach £411,000 in today's money.

Even modest additional contributions prove worthwhile, with £100 monthly overtime payments potentially adding £67,000 to create a total pot of £277,000.

Pension contributions benefit from tax relief, preventing overtime earnings from being taxed at higher rates when they would otherwise push workers into upper tax brackets

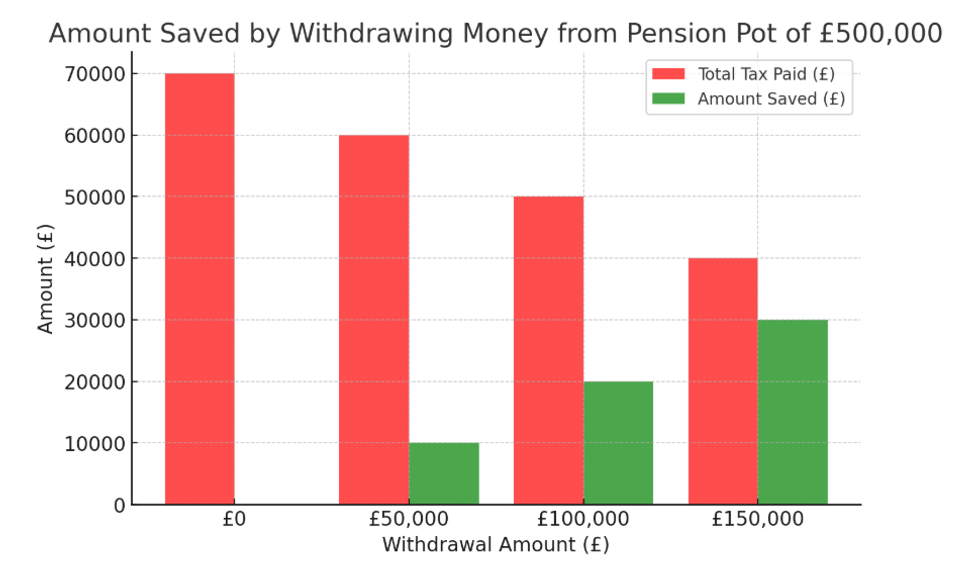

How much you could save by withdrawing money from your pension | GBN

How much you could save by withdrawing money from your pension | GBNStandard Life calculated a 22-year old saving £300 from overtime contribution could bolster their retirement savings by £201,000 once they leave the workforce.

Gail Izat, the managing director for Workplace Pensions at Standard Life, noted: "With income tax thresholds potentially being frozen for longer at the Autumn Budget, rising earnings could push many more people into higher tax bands.

"Redirecting additional pay like overtime into your pension is a smart way to reduce that impact while boosting your long-term savings. Auto-enrolment gives people a valuable start in saving for retirement, but many will need to contribute more than the minimum level to secure a comfortable retirement.

"Adding extra contributions from overtime or other additional income can be a practical, budget-friendly way to strengthen your financial future - and because pensions are tax-efficient, these contributions can help you keep more of your income."

More From GB News