Will Nigel Farage's 'Robin Hood' tax make YOU richer or poorer? We asked the six leading finance experts

'For working people!' Nigel Farage slaps down fears over tax break misuse after vowing 'lifestyle change' |

GB NEWS

Nigel Farage promises a sweeping overhaul of the tax rules applied to non-doms if Reform UK wins power

Don't Miss

Most Read

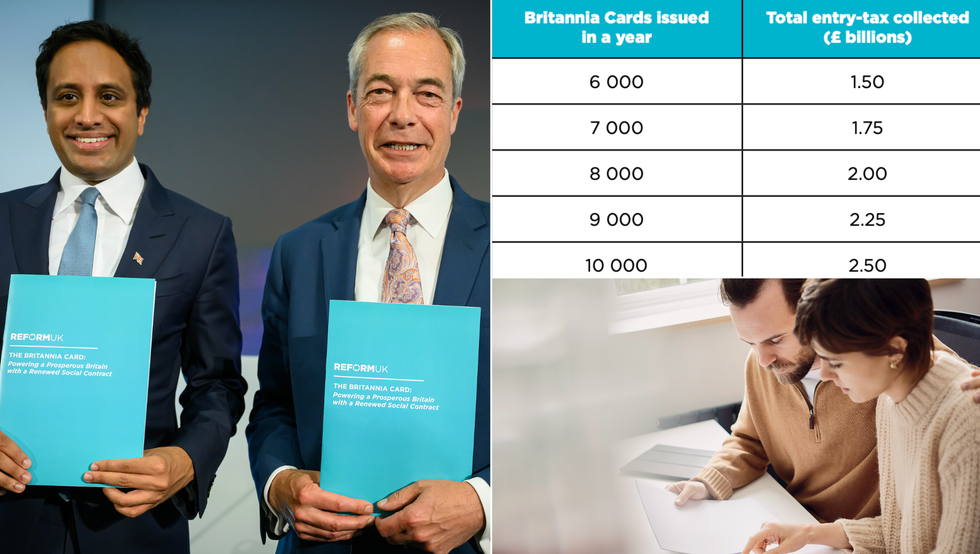

Reform UK leader Nigel Farage has unveiled one of his party's boldest policies yet in what is being described by some analysts as a "Robin Hood tax", directly taking aim at Chancellor Rachel Reeves's raid on non-domiciled individuals.

Last year, Reeves confirmed that inheritance tax (IHT) would now be levied at the foreign assets of non doms, which critics have claimed has led an exodus of wealth from the UK.

Amid rumours of a looming U-turn, Farage confirmed Reform's plan to launch a "Britannia Card" to entice wealthier foreigners to move to Britain.

This represents one of the insurgent party's audacious interventions when it comes to wider UK tax policy, but how does the "Britannia Card" hold up to scrutiny?

Will Nigel Farage's 'Robin Hood' tax make YOU richer or poorer? We asked the six leading finance experts |

Will Nigel Farage's 'Robin Hood' tax make YOU richer or poorer? We asked the six leading finance experts | Getty Images/Reform UK

What is the Britannia Card?

This initiative would see new non-doms pay a £250,00 landing fee in exchange for the card, which will allow them to only pay UK taxation on a remittance basis. Foreigners who pay the fee will not have to pay inheritance tax or any levy on international wealth incomes, or gains; therefore ruling out capital gains.

Britannia Card holders will be able to claim a 10-year renewable multi-entry residence permit to encourage long-term stays. Notably, 100 per cent of entry contributions will be distributed to the lowest earning 10 per cent of full-time workers, delivered automatically by HM Revenue and Customs (HMRC) as a cash dividend.

Based on Reform's low-uptake scenario, which is 6,000 cards a year being handed out, this would generate a £1.5billion a year fund. This would reportedly result in a tax-free annual dividend of £600 per worker. A high-up take scenario of 10,000 cards a year would deliver a £2.5billion annual fund, resulting in a £1,000 a year windfall for each eligible worker, according to Reform's figures.

On the policy, Nigel Farage said: "The driving ambition of Reform UK is to put the lives of everyday British citizens first – and this policy does exactly that. We are the party of working people, and we’re building a Britain where wealth and opportunity are shared, not hoarded."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Rachel Reeves has came under fire for recent changes to non-dom tax rules

| GB NewsWhat are the experts saying?

While a General Election is likely four years away, financial analysts are taking Reform UK's policy output seriously in light of the party's significant polling lead. Offering a mixture of redistributive and small-state libertarian, the Britannia Card has been welcomed in some quarters and rejected in others.

James Ward, the head of Private Client at Kingsley Napley, noted that the proposal is "deliberately more generous" than the current and previous tax regime, suggesting it could be the catalyst in getting the Chancellor to reverse her crackdown on non-doms based in Britain.

He told GB News: It would certainly help to make the UK more competitive than other countries, and encouraging more wealthy individuals to base themselves in the UK again is what we need for a healthy economy. The 20-year IHT shield will be especially attractive given the punitive and unpopular changes Rachel Reeve has made on that front.

"Curiously, the Reform proposals do not cover current non-doms, who would also want to benefit from such a regime and so surely it should be extended to them. Like other advisers, we are seeing wealthy individuals leave the UK or choose not to base themselves here, and this trend should be reversed as soon as possible to prevent a permanent decline."

MEMBERSHIP

- REVEALED: The 10 Cabinet Ministers at risk of being toppled by Nigel Farage's turquoise tsunami as Reform storms into 9-point lead

- The Britain that bequeathed America our freedoms and justice is dying an agonising death - Lee Cohen

- Get FIVE free entries into The Great British Giveaway when you become a GBN member in June

- Donald Trump was right to strike Iran. Urgent questions now hang over Britain - Mark Francois

- Alastair Stewart: A life-changing diagnosis brings into sharp focus who your real friends are. It's very revealing

Miles Dean, the partner and head of International Tax at Andersen LLP, noted that the Britannia Card represents a clear break in policy from the fiscal status quo offered by the current Labour Government and the Conservative Party, which was in power over the last 14 years.

Dean explained to GB News: "At the very least, Farage has proposed an idea that sets Reform apart from the Uniparty and may resonate with the working class if they believe the funds raised will be used for their benefit.

"However, I fear that the damage has already been done and I doubt that this alone is enough to entice wealthy non-doms back, especially given that implementation is at least four years away."

Reform has come under fire over the costings attached to their policy agenda, with some analysts questioning whether the sums add up.

LATEST DEVELOPMENTS:

Nigel Farage slaps down concerns non-dom tax policy could be misused - 'This is for working people!'

Tom Gauterin, the director who specialises in Trusts, Estates and Tax at Freeths, was unsure whether this "would actually raise any review as the £250,000 fee for a decade's worth of tax-privileged residence is cheap compared to similar levies in other countries, such as Italy.

Speaking to GB News, he added: "Given the number of huge changes to non-dom taxation over the last 17 years, would wealthy non-UK people actually trust this to be delivered? What happens if, as is entirely possible, Reform were to pass this legislation then lose the next election only five years into the ten-year residence period?

"How does it work for less wealthy non-doms (e.g. doctors), who already have a complete exemption from tax on non-UK assets for four years, but who would lose that under this proposal and wouldn’t be able to afford the £250,000? This could end up reducing revenue if less wealthy non-doms chose not to come to the UK."

Concerningly, Tax Policy Associates director Dan Neidle has claimed the proposal would cost the UK economy £34billion in its current format.

In the think tank's latest report, Neidle said: "First, it would discourage highly skilled professionals from moving here – they couldn’t afford the £250,000. For the first time in the UK’s history, an expat arriving here would be immediately subject to full UK tax (and likely also tax in their home country). That’s a big tax increase: the Reform UK proposal would make the UK uncompetitive.

"Second, all the recent changes to the non-dom regime mean that any Government would struggle to persuade the very wealthy that the “Britannia card” would really provide a lifelong exemption, so take-up would be very limited.

"Third, and most seriously, the card would provide a very large and expensive tax windfall to a small number of very wealthy people who are already here. Office for Budget Responsibility data shows that this would amount to £34billion of lost Government revenue over five years. That would have to be funded by either tax increases or spending cuts."

What are others saying?

On the one hand, it's "clever policy engineering", but on the other, it's fraught with risk, says Oliver Chapman, Group CEO of OCI, a procurement company.

He explained: “I understand the appeal of attracting global wealth to stimulate a domestic economy. At OCI, we tackle this challenge on behalf of governments and emerging economies daily. Reform UK’s proposed Britannia Card taps into that logic, promising a fast revenue boost through high upfront fees from wealthy foreign nationals in exchange for UK residency and generous tax exemptions.

"In theory, it’s clever policy engineering. It could channel immediate capital into subsidies for low-income workers, boost VATs from high-net-worth individuals (HNWI) and reverse the post-Brexit 'wealth exodus' exacerbated by Labour's crackdown on non-doms. Done well, it positions the UK as a pro-growth, low-tax destination, rivalling international “golden visa” schemes.

"But the long-term arithmetic doesn’t favour the Exchequer. Waiving tax on global income for just 10,000 cardholders could cost the UK £7billion annually, which is nearly triple the policy’s maximum one-off yield. That’s a recurring, compounding revenue hole.

"For businesses reliant on strong public infrastructure, policy stability, and workforce support, that’s a major concern. Redistribution requires sustainable public funding. Losing billions in tax revenue may force either cuts to vital services (like the NHS) or tax hikes elsewhere, both politically and economically damaging.

"Moreover, this scheme risks reputational fallout. The UK could be viewed as a tax haven for foreign billionaires, undermining global tax transparency efforts and aggravating domestic resentment during a cost-of-living crisis. It also invites distortions such as housing inflation, skills-imbalanced immigration, and loophole exploitation unless this can be rigorously regulated.

"If implemented, success hinges on stringent guardrails: transparent eligibility, tight residency and income-source controls, and robust enforcement to prevent abuse. Without that, we risk short-term optics over long-term value.

"Reform UK may position this as a fiscal silver bullet. But business and policy leaders must weigh whether fast capital today is worth the structural deficits, political backlash, and fairness concerns of tomorrow. For now, the Britannia Card looks more like a gamble than a guarantee to me.”

Harry Fenner, former CEO of Navana Property Group and multi-millionaire entrepreneur, is broadly in favour of the radical policy, claiming that it could revive Britain's sluggish economy and lead to wealth creation.

He said: "As CEO of Navana Property Group, I’ve seen first-hand how international investment can revitalise entire neighbourhoods, fund infrastructure, and drive sustainable growth."

Reform UK’s Britannia Card proposal - charging a £250,000 landing fee in exchange for a 10-year multi-entry residence permit, with UK tax applied only on a remittance basis - has the potential to transform the UK’s appeal to global wealth creators."

According to Fenner, this isn’t about selling passports.

"It’s about creating a premium, rules-based gateway for global entrepreneurs, investors, and high-net-worth individuals who are looking for stability, opportunity, and a world-class legal and financial system," he told GB News, adding: "By exempting overseas income from UK tax unless remitted, the Britannia Card aligns with tried-and-tested models in the UAE, for example, while still generating substantial up-front revenue through the landing fee and subsequent indirect contributions."

He continued: "If just 4,000 applicants were approved annually, that’s £1 billion in immediate receipts before considering their spending, investment in UK property, job creation, and consumption taxes. This is not just economic theory; we’ve seen in London’s prime property market how inward investment creates ripple effects across supply chains and local economies.

"That said, the policy must be implemented with care. There’s a risk of public perception turning negative if it's seen as favouring the wealthy while ordinary taxpayers struggle.

"Safeguards would be essential to ensure applicants meet transparency and probity checks. It also shouldn’t undermine broader reforms aimed at tackling inequality and improving social mobility."

"But in a post-Brexit, capital-hungry Britain, bold ideas like the Britannia Card deserve serious consideration. We must position the UK as a destination not just for capital, but for commitment - where global talent is welcomed and wealth is mobilised for national renewal."

More From GB News