Nationwide Building Society proposes takeover of Virgin Money in deal worth £2.9billion

The banking sector is continuing to change with Nationwide Building Society’s reported preliminary acquisition deal of Virgin Money continuing this trend

Don't Miss

Most Read

Virgin Money has reportedly agreed to a takeover by Nationwide Building Society in a deal worth around £2.9billion.

A preliminary agreement has been reached between the lenders which will assist the building society in challenging the Big Four banks.

Nationwide is offering a total of 220p for each Virgin Money share, which includes a 2p final dividend and 38 per cent premium to Virgin Money’s closing share price yesterday.

Combined, the banking group would have total assets estimated to be around £336billion.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

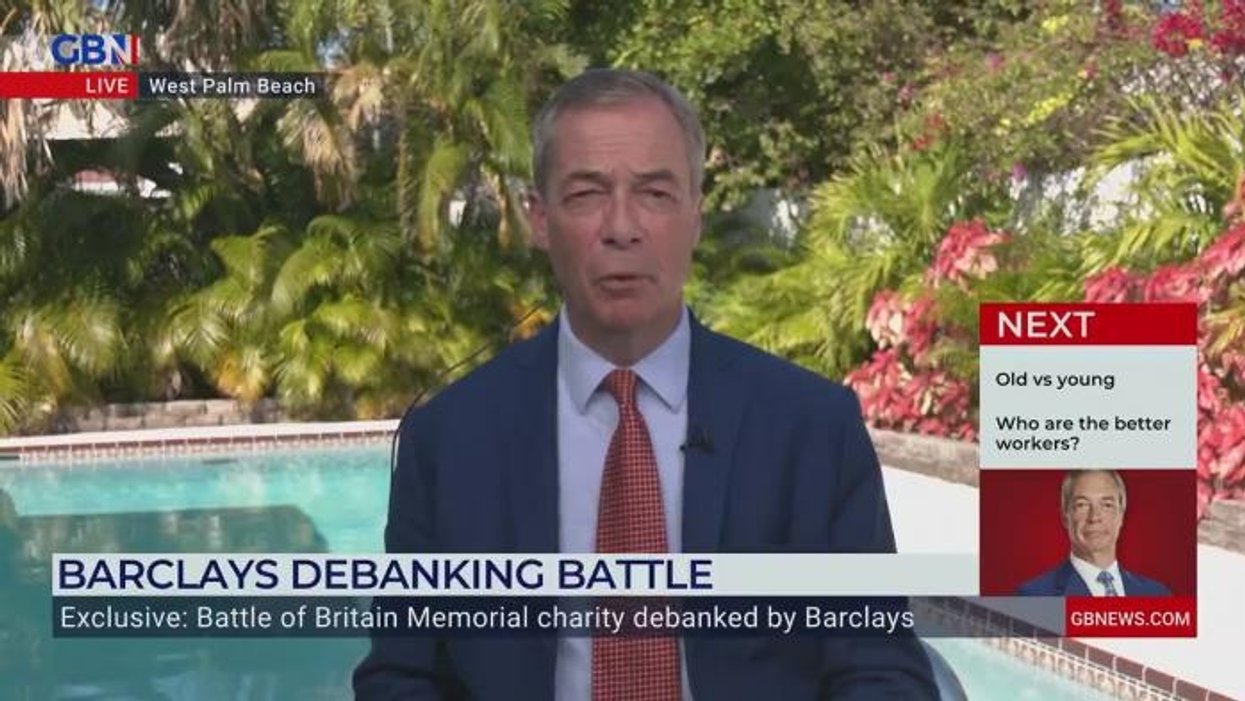

Nationwide has reportedly agreed to a takeover deal with Virgin Money

|GETTY B

The building society asserted the deal would “accelerate its strategy and broaden and deepen its products and services faster than could be achieved organically”.

Kevin Parry, the chairman of Nationwide Building Society, said: “A combination with Virgin Money would accelerate Nationwide’s strategy and create a stronger, and more diverse, modern mutual.

“The combination would increase Nationwide’s scale and financial strength, put us in a stronger position to continue to provide Fairer Share Payments to eligible Nationwide members, and offer rates for mortgages and savings that are, on average, better than the market average.”

David Bennett, Virgin Money’s chairman, added: “The Board of Virgin Money is pleased that Nationwide recognises the considerable strengths and opportunities that exist across our business, with the potential acquisition delivering attractive value for our shareholders.

“We are confident that a combination would support an exciting new chapter for Virgin Money to benefit from Nationwide’s scale and ambition.”

Furthermore, the building society confirmed it does not intend to make any material changes to the size of Virgin Money’s 7,300-strong workforce “in the near term”.

As well as this, Nationwide stressed that it would remain a mutual building society if the deal ends up going ahead.

This proposed deal comes amid ongoing volatility within the UK banking in recent years amid the cost of living crisis.

LATEST DEVELOPMENTS:

If the deal goes through, the building society said there would be no material changes to Virgin Money's workforce in the near future

| GETTYHigh streets across the UK have been hit hard by the ongoing wave of bank branch closures which has left many communities concerned about being left without access to cash.

According to data from consumer champion Which?, around 5,791 branches have closed since January 2015 which is a rate of around 54 a month and is set to continue in the 2024 with major lenders confirming multiple closures.

Virgin Money has been among the the high street banks to close locations across the country, closing 39 branches last year.

However, Nationwide has committed to not close any of its sites until at least 2026 as part of its Branch Promise to customers.