Mortgages: Could Klarna be stopping you from getting on the housing ladder — despite perfect credit score?

How to make smart purchase decisions in an unstable housing market |

GB News

Study finds major banks are turning away applicants with flawless credit histories due to buy now, pay later activity

Don't Miss

Most Read

Britons with flawless credit histories are being turned away by major banks because of their use of buy now, pay later services, new research has claimed.

A survey of 21 mortgage brokers found applicants with perfect credit scores face rejection when lenders discover transactions from platforms such as Klarna on their records.

The study, which was conducted by the Association of Mortgage Intermediaries, highlights the growing impact of BNPL (Buy Now, Pay Later) usage on home loan applications.

Despite meeting traditional lending criterias, many prospective homeowners are finding that their use of interest-free payment schemes has become a barrier to securing mortgages from high street lenders.

TRENDING

Stories

Videos

Your Say

The research revealed that 67 per cent of brokers have seen BNPL use contribute to or directly cause mortgage rejections.

Of these, 40 per cent involved clients who used such services regularly, while 21 per cent said borrowers had used them habitually.

One broker reported that a client was rejected by four major banks after using BNPL services several times, despite maintaining a perfect credit score.

Another applicant was refused when a lender found 33 deferred Klarna payments over twelve months. In addition, 27 per cent of brokers said BNPL use led to clients being offered higher interest rates than expected.

Some applicants presented credit files more than 150 pages long due to numerous Klarna transactions, complicating the review process for lenders.

Major banks rejecting applicants with flawless credit over buy now pay later use

|GETTY

How Banks and building societies treat BNPL commitments during mortgage assessments

Some major lenders disregard BNPL activity altogether. Nationwide only considers agreements lasting more than six months and reports few such cases.

Yorkshire Building Society sees occasional BNPL use as unproblematic unless combined with other signs of financial stress.

Meanwhile, Santander treats active BNPL balances as existing debt, which can reduce the maximum mortgage amount available.

Leeds Building Society factors BNPL commitments into affordability checks to ensure applicants can still meet repayments when balances are due.

NatWest classifies BNPL as committed expenditure in affordability assessments, while Coventry Building Society warns that regular use could affect first-time buyers already close to their borrowing limits.

LATEST DEVELOPMENTS

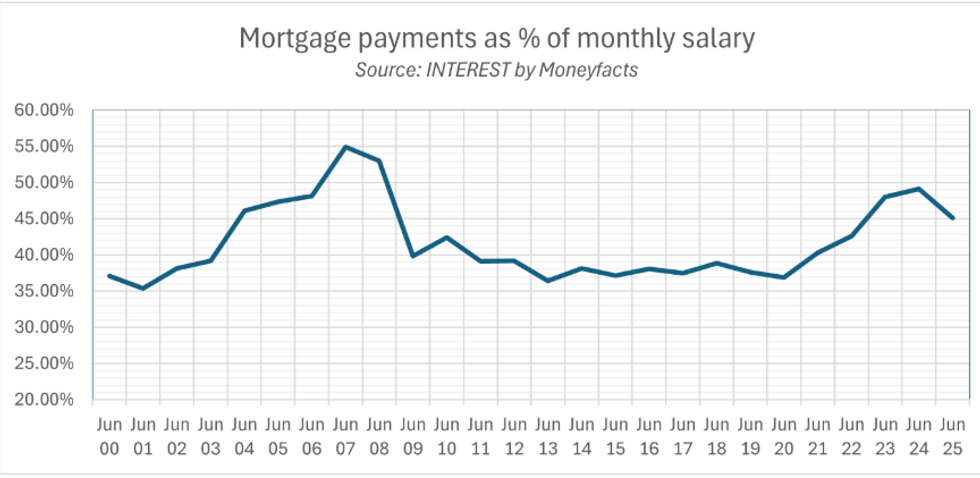

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTSKlarna argues completed purchases show good money management and can even enhance a mortgage application.

A company spokesman said: "If a mortgage broker tells you that using Klarna means you won't get a mortgage, find a different broker. Lenders have made clear they see healthy, short-term, interest-free BNPL use as a normal part of modern money management – and when used responsibly, it can help, not hinder, your chances of getting a mortgage."

Clearpay said it has received no customer concerns about mortgage impacts, describing BNPL as an "everyday payment" option for consumers seeking flexible financial tools.

The company warned parts of the financial industry misunderstand BNPL’s purpose and user behaviour.

Both firms criticised lenders for being slow to adapt to new payment habits, with Clearpay noting 95 per cent of its transactions are settled on time.

Mortgage advisers are now urging BNPL users to prepare carefully before applying for home loans.

David Hollingworth, from L&C, advised reviewing credit reports with major agencies and resolving any negative entries quickly.

He said clearing overdue payments and maintaining a clean history can significantly strengthen applications.

Banks and building societies often have differing approaches to Buy Now, Pay Later schemes

| GETTYMortgage adviser Jo Murgatroyd recommended closing dormant BNPL accounts and ensuring timely payments on active ones.

She said borrowers should be fully transparent with brokers about any BNPL commitments.

Experts also suggest reducing non-essential spending and avoiding new credit agreements before applying for a mortgage.

They argue showing consistent, responsible credit management can improve outcomes with lenders, while minimising BNPL use helps applicants appear financially stable.

A Klarna spokesperson told GB News that short-term, interest-free buy now, pay later (BNPL) products, such as its “Pay in 30” and “Pay in 3” options, typically involve small purchases and are unlikely to affect mortgage applications.

“The average transaction value for these things is about £100,” the spokesperson said. “If you split that into three, that’s going to be £33. As a one-off, most don’t think a mortgage broker is going to take account of that, because it’s just such small amounts of money.”

They added that such payments are usually cleared well before a mortgage begins: “Typically, you will have paid off those loans fully by the time your mortgage starts.”

However, the spokesperson acknowledged that regular BNPL use could be factored into affordability checks: “If you’re regularly spending £200 a month on buy now, pay later, then some brokers may take that into account in your monthly outgoings.”

They stressed that lenders treat BNPL spending like any other expense: “It’s no different from just spending that money on your debit card.

"From the perspective of the mortgage lender, they’re just looking at it saying, well, you’re spending £200 a month, so that’s part of your monthly expenses.”

The spokesperson concluded: “As long as you keep up repayments, then it's treated no differently to a debit card payment— that’s the view we understand lenders take.”

Our Standards: The GB News Editorial Charter

More From GB News