'Surprising' blow to homebuyers as lenders raise mortgage rates above four per cent

Mortgage interest rates are on the rise once again in a blow to homeowners and prospective homebuyers

Don't Miss

Most Read

The mortgage price war between the UK’s high street lenders, including HSBC, NatWest and Santander, has cooled as the last sub-four per cent fixed product has disappeared from the market.

Banks and building societies have slashed mortgage rates in recent months ahead of the Bank of England’s expected cut to the base rate later this year.

However, this trend has been reversed with HSBC announcing it will be raising the interest rates of certain fixed rate mortgage products as of today.

This comes shortly after Santander, Coventry Building Society and TSB also increased prices on selected mortgage products in the past week.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

High street lenders are raising mortgage rates in a blow to homeowners

|GETTY

Prior to today, HSBC was offering a five-year fixed-rate of 3.99 per cent for those with a 40 per cent deposit or equity.

However, the bank is boosting the interest rates on its two-, three- and five-year fixed mortgages across loan-to-value ratios which means deals will be above four per cent.

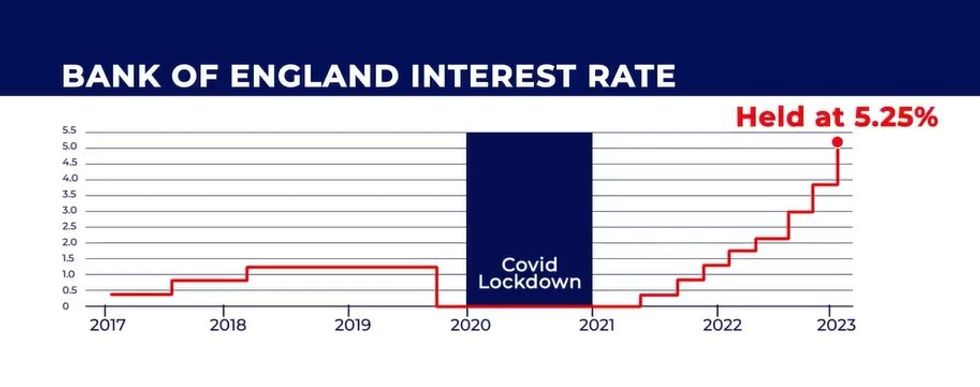

The Bank of England has raised the country’s base rate in its attempt to rein in inflation with interest rates having been stuck at 5.25 per cent since August 2023.

Analysts are betting on the base rate being reduced later in the year but lenders appear to be more cautious going into 2024.

As of today, the average two-year fixed residential mortgage rate is sitting at 5.74 per cent, according to Moneyfacts. This is up from an average rate of 5.72 per cent on the previous working day.

Furthermore, the average five-year fixed residential mortgage interest rate is at 5.31 per cent which is slight rise from 5.30 per cent yesterday.

The average two-year buy-to-let residential rate is 5.53 per cent which is a jump from 5.50 per cent the day before.

On top of this, the average five-year buy-to-let residential mortgage rate is 5.52 per cent which is a 0.01 per cent increase from February 22.

LATEST DEVELOPMENTS:

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWSRichard Carter, CEO of Lenvi, urged lenders to hold of on further hikes to mortgage rates as recent actions by HSBC and others may be “premature”.

He explained: “Rising mortgage rates is surprising news in light of slowing inflation and interest rates remaining steadfastly high for yet another month.

“This suggests that calls to cut rates may be premature. If mortgage rates and house prices continue to increase as we head into moving season, this will push back hopes for home buyers and owners that mortgage rates will fall below four per cent this year.

“Lenders need to continue to show patience and understanding to potentially vulnerable customers who are facing a remortgage or who are going through the stressful process of buying a home during this turbulent time.”