Mortgage lending slumps 24.2 per cent after stamp duty reforms

Mortgage analyst warns housing faces “difficult winter” despite rise in new commitments

Don't Miss

Most Read

Mortgage lending fell sharply in the second quarter as April’s stamp duty reforms hit the property market.

Financial Conduct Authority data shows gross mortgage advances dropped 24.2 per cent to £58.8billion.

The figure represents the weakest performance since early 2024 and was 2.4 per cent lower than the same period last year.

The decline followed a surge in transactions during the first quarter as buyers rushed to complete deals before the tax changes.

The combination of higher interest rates and increased stamp duty obligations created new barriers for purchasers.

The rise in transaction costs led many would-be buyers to delay or reconsider their plans.

Despite the slowdown, new mortgage commitments rose strongly in the same period.

Commitments increased 14.6 per cent to £78.2billion, the highest level since late 2022 and up nearly 17 per cent year-on-year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Financial stability among existing homeowners has improved.

| GETTYThe market also saw more borrowers with smaller deposits.

Loans with a loan-to-value ratio above 90 per cent made up 7.1 per cent of advances, the highest since 2008.

Regulators said affordability checks continue to ensure these borrowers can manage repayments.

Financial stability among existing homeowners showed further improvement.

Fresh arrears cases dropped to 8.8 per cent, their lowest since early 2022.

Outstanding arrears balances fell 1 per cent to £20.9billion, down almost 5 per cent on a year earlier.

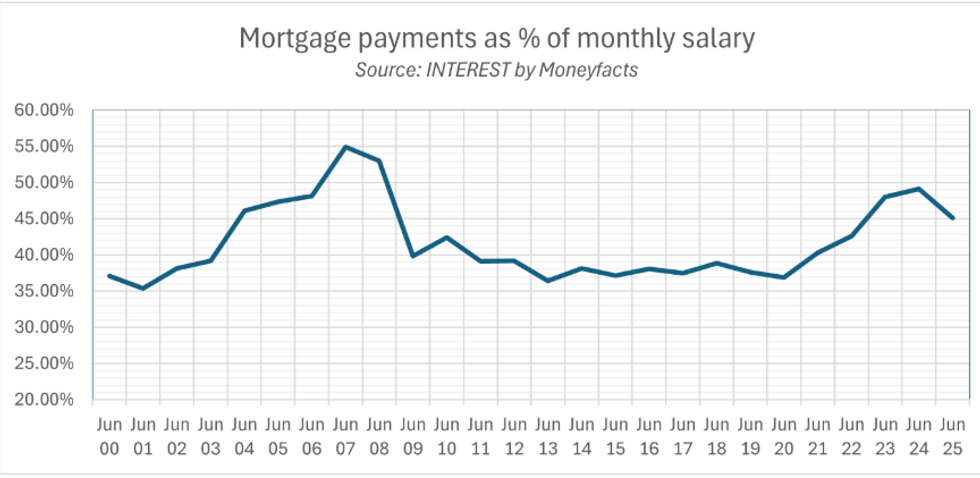

Analysis shows mortgage repayments now swallow nearly half of average earnings.

| INTEREST BY MONEYFACTSAnalysts remain cautious about the outlook despite the positive trends.

Karen Noye, mortgage expert at Quilter, told GB News: "Stamp duty changes halted sales for a while, but as prospective buyers top up their savings to cover the increased costs, we will gradually see more return to the market."

Ms Noye said: "Supply-side challenges persist, and the housing market faces a difficult winter as affordability remains such a barrier."

Concerns about future policy are adding to the uncertainty.

She continued: "Budget rumours are also adding to the uncertainty and talk of new property-related taxes could result in would-be sellers putting their plans on hold until they have a clearer picture."

Market observers said this hesitation could stall activity in the near term.

Purchasers are slowly building savings to meet higher transaction costs, pointing to some recovery potential in the coming months.

But significant obstacles remain.

Low housing supply continues to constrain the market while affordability pressures show little sign of easing.

Political uncertainty is adding further strain to fragile conditions.

Speculation over new property taxes has encouraged some vendors to delay listings.

Analysts warned this may prolong stagnation before a clear recovery can take hold.

Should stamp duty be scrapped? | GETTY

Should stamp duty be scrapped? | GETTYThe outlook through winter remains highly uncertain.

Mortgage commitments suggest pent-up demand exists, but lending volumes show the impact of April’s stamp duty reforms.

High loan-to-value lending offers some hope for first-time buyers.

Improved arrears figures indicate existing homeowners are coping, but affordability remains a hurdle for new entrants.

Experts said supply shortages and the risk of further taxation continue to destabilise the sector.

Until policy clarity improves and affordability strengthens, the housing market is expected to remain volatile.

More From GB News