Homebuyers offered 100% mortgage deal: Who is eligible and what are the risks?

Jasmine Britles shares how households can save in this economy

|GB NEWS

Britons are struggling to get on the property ladder due to rising mortgage rates and prices

Don't Miss

Most Read

Latest

Homebuyers now have the opportunity to purchase a property without a deposit, as April Mortgages launches a new 100 per cent mortgage deal.

The lender, already known for offering up to seven times annual income on some mortgages, has created this no-deposit product to help those struggling to save for a down payment.

Buyers taking advantage of this new mortgage option will be limited to borrowing no more than 4.49 times their annual income.

This means someone earning £40,000 could potentially buy a home worth £179,600 without any savings, though they would still need funds for legal fees, surveys and possibly stamp duty.

Homebuyers could borrowing 100 per cent thanks to a new mortgage deal

|GETTY

April Mortgages requires a minimum income of £24,000 to qualify for the 100 per cent mortgage, ensuring borrowers can meet the higher repayments that come with no-deposit products.

Borrowers must commit to either a 10 or 15-year fixed term, which is significantly longer than the typical two or five-year fixed products most mortgage customers choose.

Despite not needing a deposit, applicants will still need to pass full credit and affordability checks to ensure they can manage the repayments.

The longer fixed terms provide certainty for borrowers but also represent a longer commitment than most standard mortgage products on the market.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Homebuyers have struggled to navigate the property market

| GETTYThe interest rate for the no-deposit mortgage starts at 5.99 per cent. On a £200,000 mortgage being repaid over 25 years, monthly payments would be £1,288.

By comparison, someone with a five per cent deposit could secure a rate as low as 4.79 per cent with Nationwide Building Society, resulting in monthly payments of £1,145 on the same loan amount.

To offset the higher rate, April offers automatic rate reductions over time as borrowers pay down their debt and build equity in their property.

The lender also confirms there are no early repayment charges when moving home or repaying in full using personal funds.

James Pagan, director of product at April Mortgages, said the no-deposit deal was designed for credit-worthy buyers who can afford monthly repayments but lack the cash upfront.

"Saving for a deposit remains one of the biggest barriers to home ownership, even for those with strong incomes and a solid credit profile," he said.

LATEST DEVELOPMENTS:

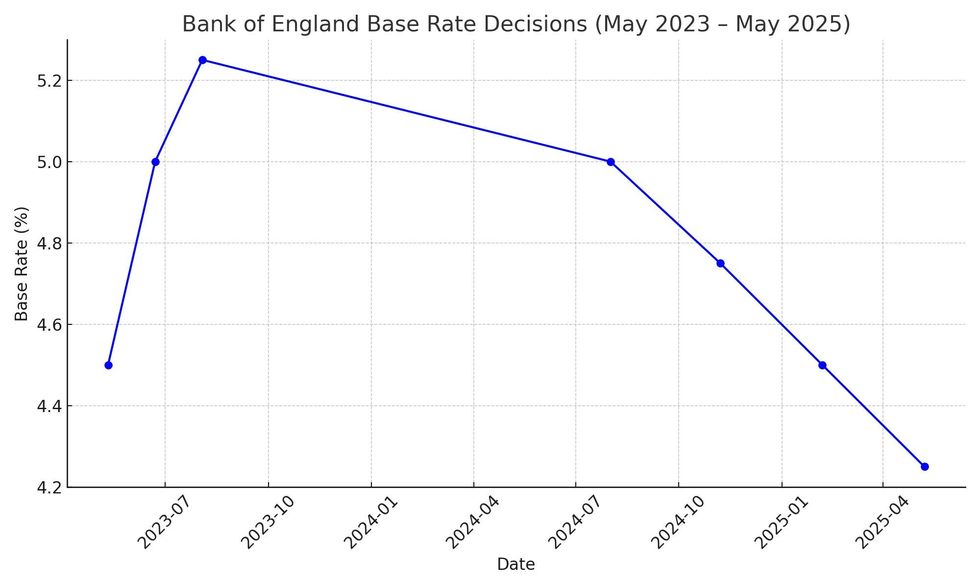

Full list of base rate changes from the Bank of England over the last two years | CHAT GPT

Full list of base rate changes from the Bank of England over the last two years | CHAT GPT "We believe the answer lies not in loosening standards, but in designing products that better reflect the realities of today's housing market."

He added that the product combines 'full credit and affordability checks with the longer-term certainty of a 10 or 15-year fixed rate'.

Pagan described the product as "a responsible option for borrowers with strong financial track records who are excluded by traditional deposit requirements".

However, potential borrowers should carefully consider whether this type of mortgage is right for them. Analysts suggest that waiting to save even a small deposit could save money in the long run and provide greater security.

David Hollingworth, associate director at the broker L&C Mortgages, said to Newspage: "Borrowers will need to evidence their ability to meet mortgage payments. In addition, they should think about the higher potential for negative equity if property prices were to fall."

More From GB News