Bank wrongly rejects fraud refunds for more than 1,000 customers

Digital bank had the worst record among major UK lenders

Don't Miss

Most Read

Digital bank Monzo wrongly rejected refund claims from more than 1,000 customers who were victims of fraud and scams over the past year, according to Financial Ombudsman Service figures.

The challenger bank recorded the worst performance among major UK banks, with the ombudsman ruling against Monzo in 34 per cent of the 3,372 cases it reviewed.

This means the bank was found to have made incorrect decisions in more than 1,000 complaints involving authorised push payment scams, chip and pin fraud and identity theft.

Monzo, which launched in 2015 and now has more than 14 million customers, topped the list of banks most likely to have wrongly rejected fraud compensation claims.

TRENDING

Stories

Videos

Your Say

NatWest ranked second, with 33 per cent of fraud complaint decisions overturned by the ombudsman across 1,972 cases.

HSBC ranked third, with the ombudsman ruling against 32 per cent of its decisions across 2,535 fraud complaints.

The data shows a pattern of major banks refusing compensation to fraud victims before decisions are later overturned by the independent complaints body.

There is often a delay between when fraud takes place, when customers complain to their bank and when cases are reviewed by the ombudsman.

Bank wrongly rejected fraud refunds for more than 1,000 customers

|GETTY

Monzo said some of the cases included in the figures related to fraudulent activity that took place more than two years ago.

Fraud is now the most common crime type in the UK.

Fraud accounted for around 41 per cent of all offences recorded in England and Wales in the year to September 2024.

The Government introduced new rules in 2024 requiring banks to reimburse most victims of authorised push payment fraud who were tricked into sending money to criminals.

LATEST DEVELOPMENTS

Criminals stole £450.7million from victims in 2024, while banks reimbursed £267.1million

|GETTY

UK Finance reported 185,733 authorised push payment fraud cases in 2024, representing a 20 per cent fall from 232,427 cases recorded in 2023.

The Financial Ombudsman Service receives hundreds of fraud complaints each week from customers who have been unable to resolve disputes directly with their bank.

A Monzo spokesman said: "Since then, we have continued to invest in technology to stop fraud before it impacts our customers and it’s working. We prevented 2.9 times the value of fraud in 2025 compared to the year before."

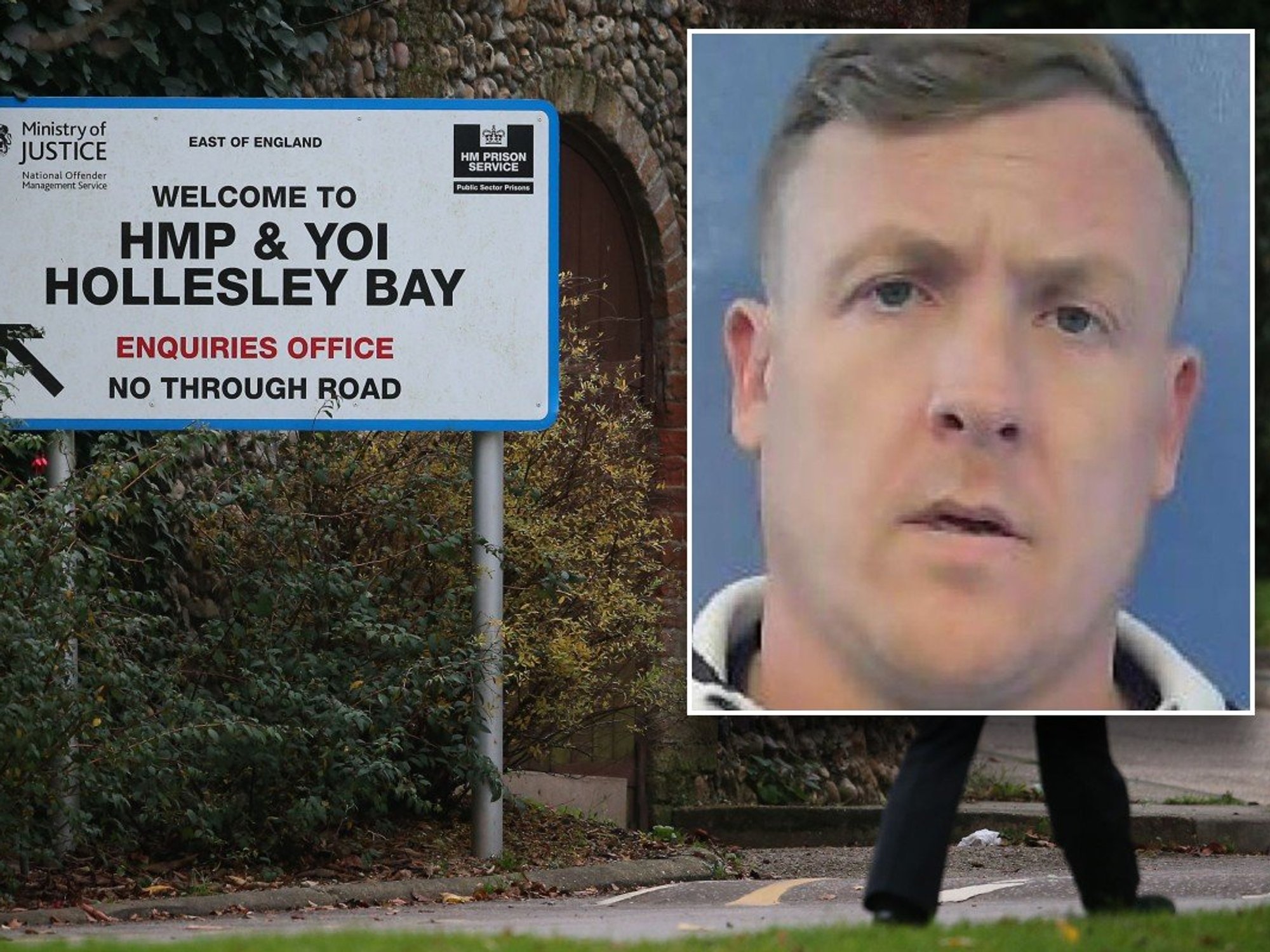

Monzo faced regulatory action last year when the financial conduct authority issued a £21million fine over weaknesses in financial crime controls.

The penalty followed findings that customers were able to open accounts using false addresses, including 10 Downing Street, Buckingham Palace and the bank’s own headquarters.

The bank later confirmed chief executive TS Anil will step down in February after nearly six years leading the company.

Former Google executive Diana Layfield is set to replace him.

Alex Neill, co-founder and co-chief executive of consumer voice, said: "People who’ve been scammed aren’t just out of pocket, they are often left feeling worried and ashamed."

NatWest said resolving customer complaints remained a priority

| GETTYShe added: "Firms need to play their part and make reimbursement fair, fast and consistent, without forcing victims into a long fight for answers."

NatWest said resolving customer complaints remained a priority and confirmed it had contacted customers involved in historic cases to help reduce the ombudsman backlog.

HSBC said it complies fully with reimbursement rules and confirmed it refunded more than 13,000 scam claims while preventing more than £130million in fraud losses last year.

The ombudsman advises fraud victims to first contact their bank before escalating complaints to its free service if they remain dissatisfied.

More From GB News