Martin Lewis shares top children’s savings accounts as grandparent asks how to save for young children

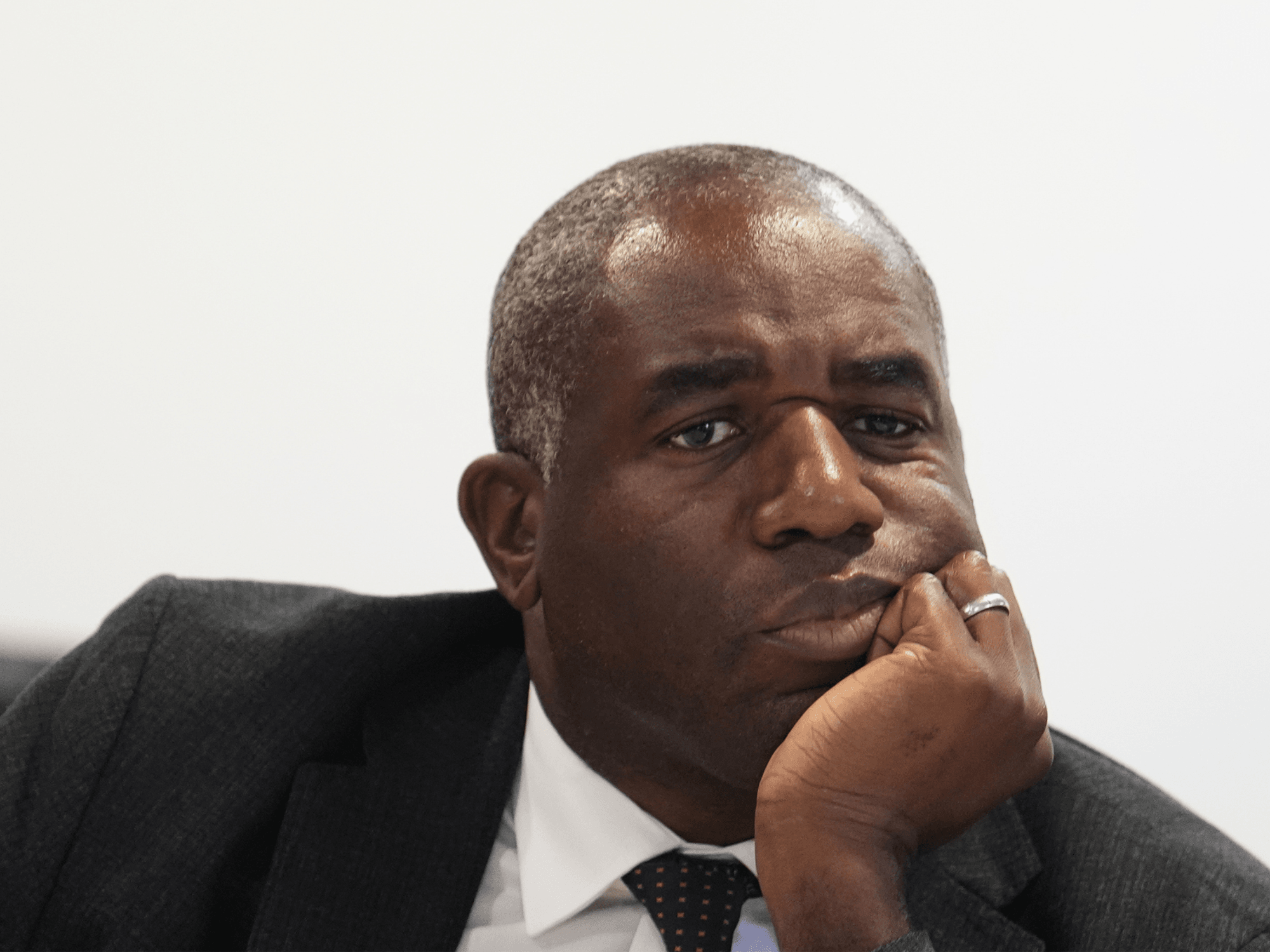

Martin Lewis spoke about savings accounts on The Martin Lewis Money Show Live

|ITV

Martin Lewis shared his savings tips in a Christmas and Black Friday special show this evening

Don't Miss

Most Read

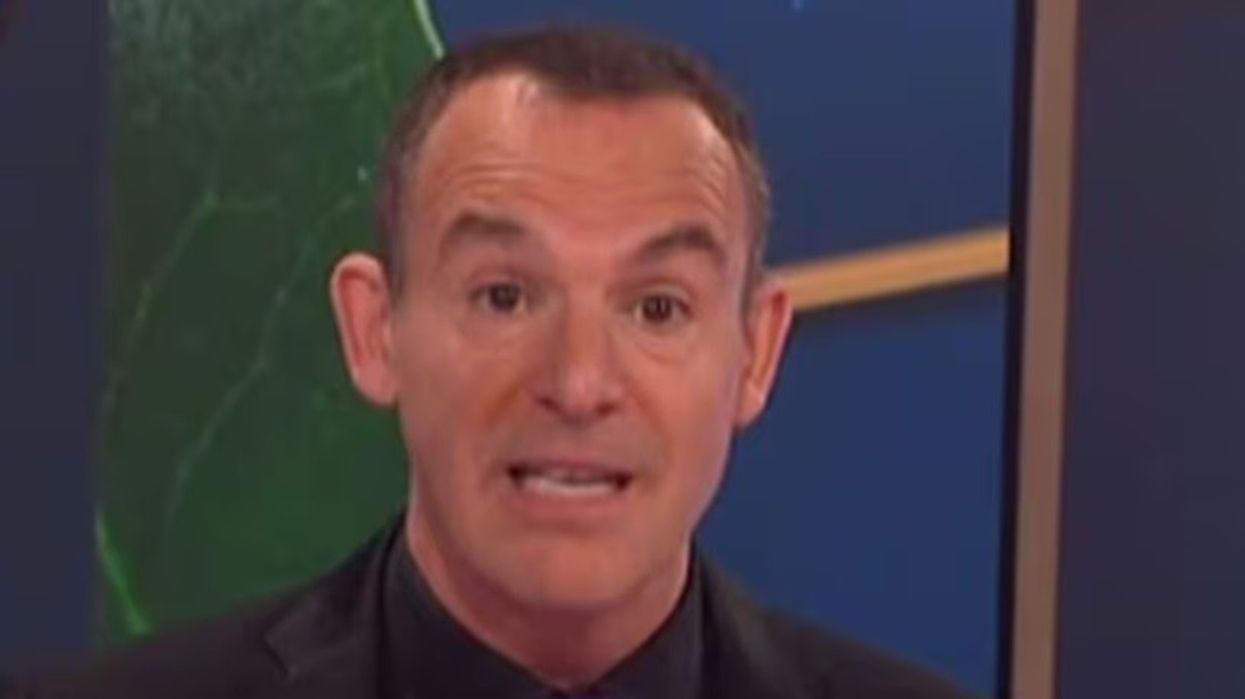

Martin Lewis has highlighted a number of savings accounts for children, paying up to 5.8 per cent interest.

Speaking on The Martin Lewis Money Show Live, a grandparent asked what was the “best way” to put money away in monthly instalments for his three grandchildren.

Another person, a parent of a one-year-old, said: “We are planning on giving him money for Christmas because he’s got all the toys he needs.

“What’s the best savings account to put money into?”

Martin Lewis highlighted regular savings and lump sum savings accounts

|PA

Mr Lewis pointed out there were several children's savings accounts to choose from, with three easy access options paying an interest rate of at least five per cent right now.

He said: “Saffron Building Society’s the top [easy access] payer. It’s a regular saver. That means you can put money in each month up to a relatively small amount – up to £100 a month.

“It’s a variable rate but it’s a pretty decent rate. It lasts the year and you can withdraw money when you want.”

The financial journalist then drew attention to Halifax’s Kids Monthly Saver – available for children aged 15 or under.

He said: “It’s also a regular saver account. 5.5 per cent – this is a fixed rate.”

Mr Lewis pointed out this was fixed for one year on a maximum of £100 per month, but no withdrawals were allowed during this period.

Then he moved to lump sum savings, highlighting HSBC UK’s My Savings account for children aged seven to 17.

This account pays five per cent interest on savings, on £10 up to the maximum of £3,000.

Addressing another option, Mr Lewis said: “Yorkshire Building Society - 4.55 per cent. Minimum £10. Maximum, if you’re lucky, £1million for your kids.”

Finally, he highlighted Halifax’s Kids’ Saver which offers an interest rate of 3.4 per cent.

There is a minimum balance of £1 and a maximum limit of £5,000.

LATEST DEVELOPMENTS:

The HSBC UK account is openable by parents or guardians, while the Halifax, Saffron Building Society and Yorkshire Building Society accounts can also be opened by grandparents.

The financial journalist was also asked about Junior ISAs, explaining that this money (up to £9,000) would be locked away until the child turns 18.

He said: “The top payer is the Beverley Building Society paying 5.5 per cent and it’s openable by post or branch.”

The Money Saving Expert founder also pointed out Coventry Building Society pays 4.95 per cent via its Junior ISA. This can be opened by phone.

Tesco Bank and NS&I both pay four per cent, with these Junior ISAs able to be opened online.

The Martin Lewis Money Show is available to watch on ITVX.