Lloyds Bank announces £300 cash rule in major payment overhaul this month - what you need to know

Kate Garraway interviews Yvette Cooper on Good Morning Britain |

GB NEWS

Banks, including Lloyds, are introducing new features to their online banking services

Don't Miss

Most Read

Lloyds Bank has announced a major overhaul to its banking services, which is set to allow its customers to have better access to cash.

The high street financial institution has unveiled a new mobile banking feature that enables customers to deposit cash at more than 30,000 PayPoint outlets throughout Britain by scanning a barcode generated through their smartphone app.

This new offering, which is launching on August 26, marks the first time a major British bank has offered this type of cash deposit service through retail locations.

The innovation provides customers with an alternative to traditional branch visits, allowing them to pay in money at convenient neighbourhood shops and stores.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Lloyds Bank is introducing a new feature to online banking app

|GETTY

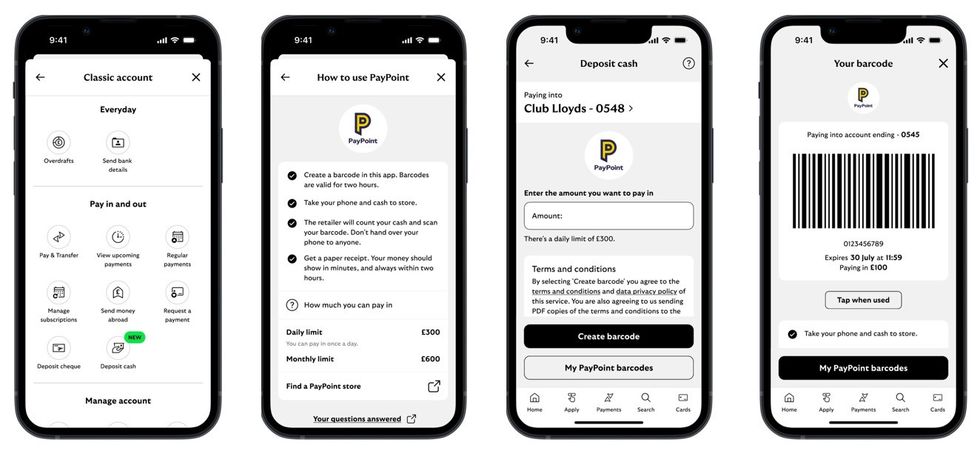

PayPoint outlets, which already handle services like parcel collection and bill payments, will accept deposits of up to £300 daily in both notes and coins.

Customers can access the service through the "Everyday" section of their banking app, where they can create a barcode that remains active for two hours.

The system permits deposits of up to £300 each day, however this is offset by a monthly cap of £600 .

More than 94 per cent of PayPoint stores operate throughout the week, including Sundays, offering exceptional accessibility for banking customers.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The bank has shared what the feature will look like in the Lloyds app

|LLOYDS BANK

With 99.5 per cent of the population residing within one mile of a PayPoint outlet, the service ensures widespread coverage across the country.

The locations already serve multiple purposes, from mobile phone top-ups to gift card purchases, making them familiar destinations for many consumers.

Gabby Collins, Payments Director at Lloyds, emphasised the bank's commitment to flexible banking solutions: "We're always looking for smart ways to make banking more flexible and give customers more choice.

"Our latest app feature now allows customers to pay in cash at their local PayPoint in just a few minutes ideal if they are popping in for milk or dropping off a parcel. With this new innovation, no other UK bank offers as many ways to manage money as Lloyds."

PayPoint's chief executive Nick Wiles highlighted his company's extensive network: "Our leading retail network provides a vast range of essential services at the heart of communities across the UK, for everything from banking, utility, parcel, cash and government services.

"The ability of Lloyds customers to make cash deposits into their accounts at over 30,000 PayPoint locations will deliver more convenience and access for customers close to where they live."

LATEST DEVELOPMENTS:

Britons are concerned about cash access amid recent bank branch closures

| GETTYAs well as this looming feature, the bank continues to offer multiple channels for cash deposits beyond this new digital option.

Traditional branches of Lloyds, Halifax and Bank of Scotland remain available for in-person transactions, alongside dedicated cash machines that accept deposits.

Banking Hubs, which feature Post Office-operated counter services, provide another avenue for cash handling across the nation.

Additionally, 11,500 Post Office branches throughout the UK offer comprehensive banking services, including cash deposits and withdrawals.

More From GB News